Before we get into the list of most popular tax haven countries for US citizens to pay their (or lack thereof) startup business taxes, we need to understand what a tax haven is and why certain countries fit the bill of a “tax haven country”. But if you must know, the most popular tax haven countries for US entities are in no order: Ireland, Netherlands, Luxembourg, Panama, Singapore, Cayman Islands, Bermuda, and much more!

15 Most Popular Tax Haven Countries for American Businesses and Startup Companies

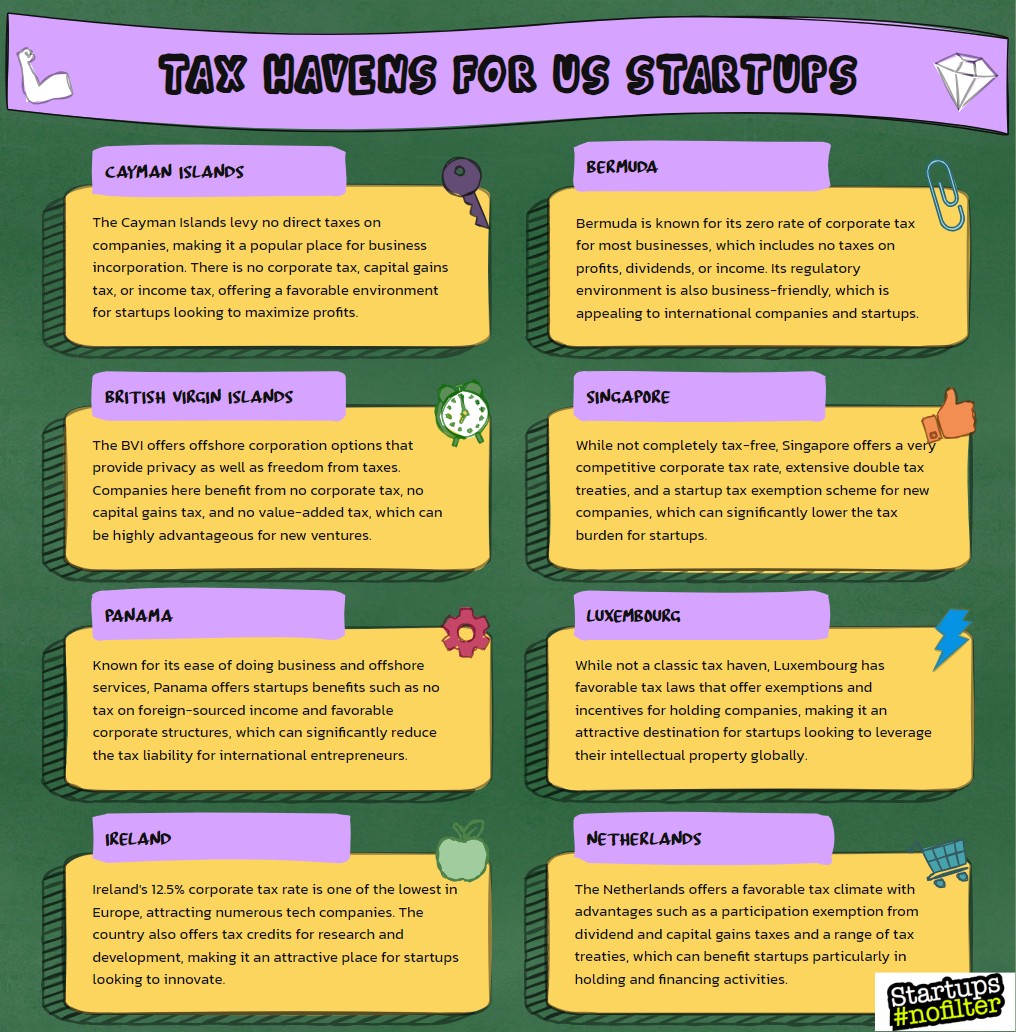

- Bermuda: Known for its zero corporate income tax rate and strong legal framework, Bermuda is a favored destination for American businesses, particularly those in the insurance and reinsurance industries. Bermuda is home to over 13,000 registered offshore companies, making it one of the largest offshore financial centers globally!

- Cayman Islands: Renowned for its tax-neutral environment and sophisticated financial infrastructure, the Cayman Islands attract many American businesses, especially in the banking, investment funds, and asset management sectors. The Cayman Islands is the world’s leading domicile for hedge funds, with over 11,000 hedge funds registered as of 2021.

- Switzerland: While not traditionally considered a tax haven, Switzerland offers favorable tax rates for certain types of businesses, along with political and economic stability. It’s particularly popular among American multinational corporations for its banking and financial services sector. Zurich and Geneva, two major cities in Switzerland, consistently rank among the top global financial centers according to the Global Financial Centers Index (GFCI).

- Singapore: With its competitive tax rates, business-friendly environment, and strategic location in Asia, Singapore is a top choice for American businesses looking to expand into the Asia-Pacific region, especially in sectors like technology, finance, and logistics. Singapore has signed over 80 comprehensive double taxation agreements (DTAs) with other countries to prevent double taxation and provide tax certainty for businesses operating internationally.

- Ireland: Known for its low corporate tax rate of 12.5% and favorable tax incentives for research and development, Ireland is a preferred location for American tech companies and multinational corporations seeking a European base. Multinational corporations headquartered in Ireland account for over 80% of global pharmaceutical sales and over 40% of global software sales.

- Luxembourg: Known for its favorable tax regime, including low corporate tax rates and extensive tax treaties, Luxembourg is a preferred destination for American multinational corporations, particularly in finance, investment funds, and holding companies. Luxembourg is one of the largest investment fund centers globally, with assets under management exceeding €5 trillion as of 2021.

- Netherlands: With its beneficial tax treaties, participation exemption regime, and favorable intellectual property tax regime, the Netherlands is attractive to American businesses seeking to establish European headquarters or expand their operations in Europe. The Netherlands is the fourth-largest recipient of foreign direct investment (FDI) globally, with Amsterdam being a prominent financial hub and startup ecosystem in Europe.

- British Virgin Islands (BVI): Offering a tax-neutral environment with no corporate income tax, no capital gains tax, and strict financial privacy laws, the BVI is a popular choice for American businesses, particularly those involved in offshore investment funds, asset holding, and international trading. The BVI is home to more than 400,000 registered companies, making it one of the most popular offshore jurisdictions for startup and corporate company formation.

- Bahamas: Known for its zero corporate income tax, no capital gains tax, and strict financial privacy laws, the Bahamas is a favored jurisdiction for American businesses, especially those in banking, tourism, and offshore financial services. The financial services industry accounts for approximately 15% of the Bahamas‘ GDP and employs over 5,000 people.

- Jersey: As a Crown Dependency of the United Kingdom, Jersey offers a stable legal and regulatory environment, along with favorable tax rates for certain types of businesses, making it an attractive option for American companies, particularly in finance, wealth management, and corporate services. Jersey’s finance industry manages assets worth over £1.5 trillion, making it one of the largest wealth management centers globally.

- Panama: Known for its territorial tax system, which means income earned outside Panama is tax-exempt, Panama offers a favorable tax environment for American businesses. It’s particularly attractive for offshore banking, shipping, and international trade. Panama’s Panama Canal generates over $2 billion in annual revenue and is a vital artery for global maritime trade.

- Malta: With its participation exemption regime, attractive tax incentives for holding companies, and extensive network of double tax treaties, Malta is a preferred destination for American businesses looking to establish a European base, especially in finance, gaming, and digital services. Malta’s online gaming sector contributes around 12% to the country’s GDP and is a significant driver of economic growth.

- Belize: Offering a territorial tax system with no taxation on income earned outside Belize, along with confidentiality and asset protection laws, Belize is popular among American businesses for offshore banking, international trade, and asset holding.

- Cyprus: Known for its low corporate tax rate, extensive network of double tax treaties, and EU membership benefits, Cyprus is favored by American businesses for investment holding, finance, shipping, and digital services. Cyprus has one of the lowest corporate tax rates in the European Union, at 12.5%, making it an attractive destination for international businesses.

- Barbados: With its favorable tax regime, including low corporate tax rates and tax treaties with numerous countries, Barbados is attractive to American businesses, especially in finance, insurance, and international business services. Barbados offers a highly skilled workforce with a literacy rate of over 99%, providing a conducive environment for startup business growth and development.

- Hong Kong: Hong Kong is a great tax haven for US startup companies due to its territorial tax system, no capital gains tax, and low corporate tax rates, making it an attractive destination for international business operations.

- Anguilla: Anguilla offers a favorable tax environment for US startups with no corporate, income, or capital gains taxes, along with strong confidentiality laws, making it an ideal jurisdiction for tax optimization and asset protection.

- Costa Rica: Costa Rica provides US startups with tax incentives such as a territorial tax system, tax exemptions on foreign-sourced income, and a stable political environment, making it an appealing choice for establishing offshore operations.

- Belgium: Belgium is a great tax haven for US startup companies due to its participation exemption regime, offering tax benefits on qualifying dividends and capital gains, along with various incentives for research and development activities, fostering innovation and growth.

First Things First: What Exactly is a Tax Haven?

Choosing the best tax haven countries in 2024 involves considering various factors to ensure alignment with the specific needs and goals of the company or individual. Here are some key factors to consider:

- Tax Rates: Assess the corporate income tax rates, capital gains tax rates, and other applicable taxes in the tax haven country. Low or zero tax rates can significantly impact tax liabilities.

- Legal and Regulatory Environment: Evaluate the legal framework and regulatory environment of the tax haven country to ensure it provides stability, transparency, and protection of assets. Consider factors such as legal system quality, rule of law, and financial regulations.

- Financial Privacy: Examine the level of financial privacy offered by the tax haven country. Consider whether the jurisdiction has strict banking secrecy laws or information exchange agreements that may impact financial confidentiality.

- Economic and Political Stability: Consider the economic and political stability of the tax haven country. Stability is crucial to mitigate risks associated with investing or conducting business in the jurisdiction.

- Infrastructure and Business Environment: Assess the quality of infrastructure, availability of skilled labor, and overall business environment in the tax haven country. A conducive business environment can facilitate operations and growth.

- Tax Treaties and Agreements: Consider whether the tax haven country has double taxation avoidance agreements (DTAAs) or tax treaties with other jurisdictions. These agreements can provide clarity on tax matters and prevent double taxation.

- Reputation and Compliance: Evaluate the reputation of the tax haven country and its compliance with international tax standards and regulations. Choose jurisdictions that adhere to international norms and demonstrate commitment to combating tax evasion and money laundering.

- Industry Focus: Consider whether the tax haven country specializes in specific industries or sectors. Certain jurisdictions may be more suitable for particular industries, such as finance, technology, or shipping.

- Exchange Controls: Assess whether the tax haven country imposes exchange controls or restrictions on the movement of capital. Flexible exchange controls can facilitate capital repatriation and international transactions.

- Professional Services Availability: Consider the availability of professional services, such as legal, accounting, and banking services, in the tax haven country. Access to reliable professional advice is essential for compliance and strategic planning.

Taxation Policies of Various Tax Haven Countries Across the Globe

The taxation policies you adhere to will play a crucial role in determining your overall tax burden and financial advantages. By closely monitoring and strategically aligning with these policies, you can tailor your financial approach to maximize wealth preservation and growth.

Low or Zero Income Taxes

Among the most critical elements of taxation policies is the level of income taxes imposed by the jurisdiction. Opting for a haven that imposes low or zero-income taxes offers a significant advantage, allowing individuals and businesses to retain a more substantial portion of their earnings. This strengthens your financial footing and provides opportunities for reinvestment, fostering wealth accumulation.

Capital Gains and Inheritance Taxes

In addition to income taxes, the treatment of capital gains and inheritance taxes holds paramount importance. A favorable jurisdiction often imposes minimal or zero taxes on capital gains, enabling investors to realize the full value of their investments. Likewise, the absence of inheritance taxes ensures the preservation of assets, facilitating smooth transitions for future generations with minimal tax implications.

Tax Treaties and Agreements

Attention should also be directed towards existing tax treaties or agreements between the chosen tax haven and the United States. These agreements can significantly influence your overall tax obligations and delineate how income earned in one jurisdiction is treated in another. Being cognizant of and leveraging these treaties can further refine and optimize your tax planning strategy.

Estate Planning and Wealth Transfer

Effective estate planning holds paramount importance for US citizens as part of any comprehensive tax strategy. Opting for a jurisdiction that facilitates smooth wealth transfer through favorable inheritance tax policies ensures the preservation of your legacy for future generations. This may entail establishing trusts, leveraging exemptions, and utilizing the legal framework of the chosen jurisdiction to efficiently safeguard and distribute assets.

Ensuring Compliance and Transparency

While pursuing advantageous tax policies, it’s crucial to prioritize jurisdictions that uphold high standards of compliance and transparency. A well-regulated tax haven not only offers tax benefits but also adheres to international norms, mitigating the risk of legal complexities or regulatory challenges.

Accessibility and Lifestyle

When considering the best tax haven countries for US citizens, practical aspects such as accessibility and lifestyle play pivotal roles. Ensuring seamless transitions and aligning with your financial objectives necessitates assessing factors like ease of living and conducting business in the chosen jurisdiction.

Ease of Travel and Connectivity

Accessibility is a key factor in any tax haven choice. Evaluating the ease of travel to and from the jurisdiction, along with proximity to major transportation hubs, simplifies logistical considerations. This ensures efficient management of global interests and connections.

Residency Requirements and Options

Different jurisdictions impose varying residency criteria. Exploring available residency options, such as investor visas or residency-by-investment programs, helps determine the most suitable path based on individual circumstances.

Standard of Living and Quality of Life

The standard of living offered by a tax haven significantly impacts lifestyle satisfaction. Access to quality healthcare, education, and cultural amenities contributes to a fulfilling life, aligning with financial goals without compromising personal well-being.

Business Environment and Opportunities

Beyond personal considerations, evaluating the business environment is essential. A conducive ecosystem with opportunities for entrepreneurship and investment enhances financial prospects, fostering growth and innovation.

Cultural Compatibility and Language Considerations

Cultural compatibility plays a crucial role, particularly for residence or business establishment. Understanding local customs, language, and business practices facilitates seamless integration and effective communication.

Asset Protection and Privacy

Robust asset protection and financial privacy are paramount considerations. Opting for a jurisdiction with stringent laws shields assets from potential risks and ensures confidentiality, safeguarding wealth from unforeseen circumstances.

Stringent Asset Protection Laws

The enforcement of stringent asset protection laws is fundamental in safeguarding wealth. These laws shield assets from creditors and legal disputes, offering peace of mind and financial security.

Confidentiality and Financial Privacy

Privacy remains a top priority in selecting a tax haven. Jurisdictions prioritizing confidentiality of financial information uphold discretion and security, enhancing trust and peace of mind.

Continuous Monitoring and Compliance

High regulatory compliance and oversight standards are indicative of a secure financial environment. Opting for a jurisdiction with active monitoring and enforcement demonstrates commitment to maintaining stability and integrity in financial dealings.

Editor of Startups #nofilter