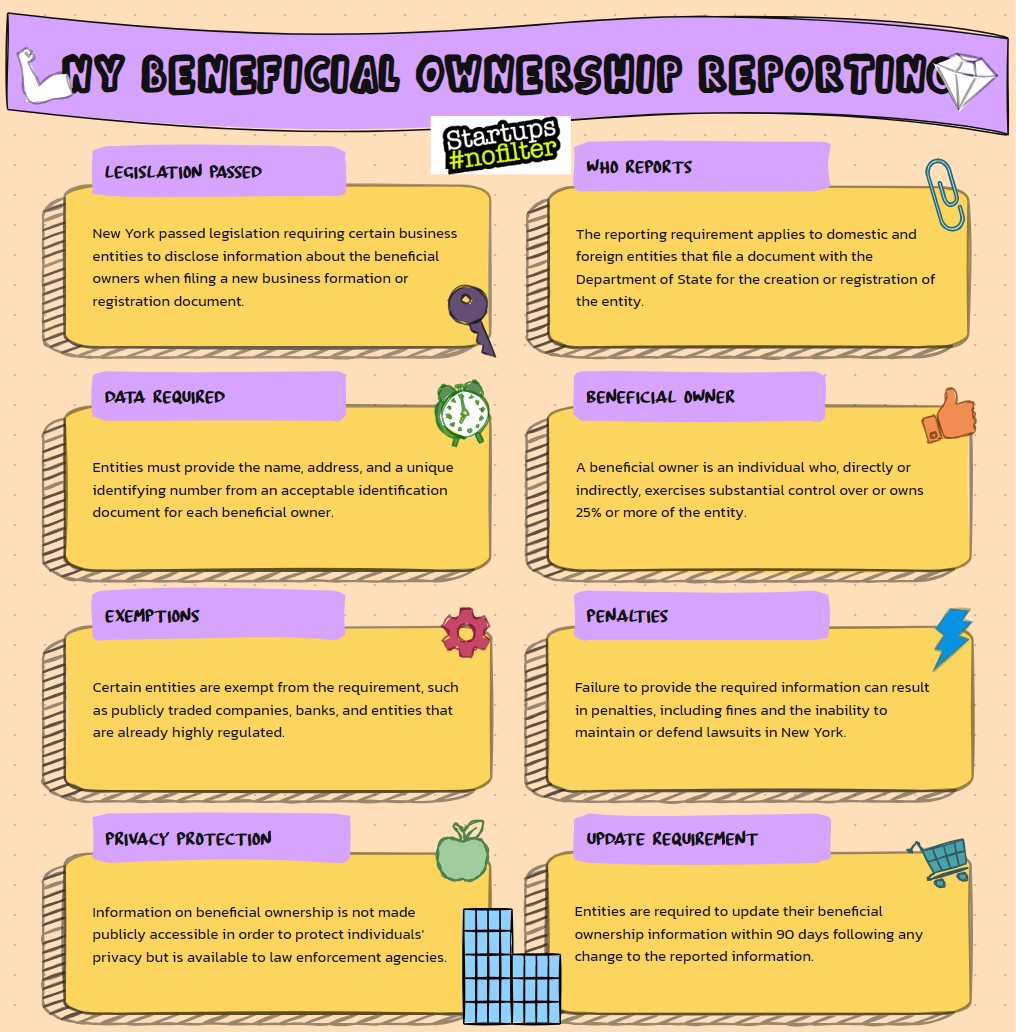

New York State has been taking significant strides towards enhancing transparency in business operations and financial transactions. A huge part of these NY state efforts is the implementation of Beneficial Ownership Information Reporting requirements.

This interesting framework aims to combat money laundering in NY, financial fraud, and other illicit activities by ensuring that the actual individuals who own, control, and benefit from companies and other entities are accurately and transparently documented. Below, we outline the guidelines for reporting beneficial ownership as per the entity type and certain transactions.

Guidelines for Reporting Beneficial Ownership as Per the Entity Type and Certain Transactions in the State of New York in 2024:

Corporations

For corporations operating within New York, it is essential to disclose information about beneficial owners, those who hold significant control or ownership. A beneficial owner in this context is defined as any individual who directly or indirectly owns 25% or more of the equity interests in the corporation or exercises substantial control over the corporation’s management decisions.

Corporations must maintain updated information on all such persons and submit this data to the appropriate New York state authorities annually. This includes full legal names, addresses, and an identification number such as a Social Security number or a passport number, ensuring compliance with state regulations.

Limited Liability Companies (LLCs)

Limited Liability Companies (LLCs) must adhere to similar beneficial ownership reporting requirements as corporations. Each LLC must provide details of all members and managers who either own more than 25% of the company or have significant influence over the company’s strategic direction and financial management. This information aids in creating a transparent business environment where financial activities can be traced back to real individuals, thereby reducing the anonymity that can facilitate unlawful activities.

Partnerships

Partnerships, including limited partnerships (LPs) and limited liability partnerships (LLPs), are also required to report beneficial ownership information. For these entities, any partner who has a 25% or greater interest in the partnership or who holds a position of significant control must be reported. The reporting must include personal identifying information, the extent of the interest or control, and any changes in the beneficial ownership that may occur over time.

Trusts

Trusts operating in New York must disclose the identities of all trustees, protectors, and beneficiaries who have significant control over the trust’s assets or decisions. This requirement ensures that individuals who ultimately own or benefit from the trust are made known to regulatory bodies, helping to prevent misuse of trusts for hiding assets or evading taxes.

Real Estate Transactions

Real estate transactions in New York now require more comprehensive disclosure of beneficial ownership information to prevent the real estate market from being used for money laundering. Any entity participating in a real estate transaction must disclose the beneficial owners who hold a significant interest in the entity at the time of the transaction. This includes providing information about individuals who directly or indirectly influence the transaction decisions or hold substantial equity stakes.

Financial Institutions

Financial institutions in New York play a crucial role in enforcing beneficial ownership reporting. Especially because NYC is known for its bad credit loans! These NY financial institutions are required to collect, verify, and record the beneficial ownership information of their corporate clients when opening accounts or conducting high-value transactions. This responsibility helps ensure that the financial system is not used for transferring or hiding illicit funds.

10 Things to Consider When Filing the BOIR in New York

Continuing with the practical aspects of complying with New York’s Beneficial Ownership Information Reporting (BOIR) requirements, there are several important considerations to keep in mind. Here are 10 critical factors that entities should consider when preparing to file their beneficial ownership information:

1. Know the Reporting Thresholds

Entities should be fully aware of the thresholds that trigger reporting requirements. For most entities, this includes any individual with more than a 25% ownership interest or who exercises substantial control over the entity.

2. Accurate Identification of Beneficial Owners

Accurately identifying who qualifies as a beneficial owner is crucial. Entities must investigate their ownership structure thoroughly to ensure that all individuals who meet the criteria are reported.

3. Gathering Sufficient Documentation

Documentation such as identification documents, ownership agreements, and organizational charts will be necessary to substantiate the information reported. Ensuring these documents are current and accessible is essential for compliance.

4. Understanding the Forms and Submission Process

Familiarize yourself with the specific forms required for submission and the details that must be filled out. Understanding the submission process, whether it’s digital or requires hard copies, is also critical.

5. Deadline Compliance

Adhering to deadlines for filing BOIR is critical to avoid penalties. Marking calendar reminders and preparing the documentation well in advance can prevent last-minute rushes and errors.

6. Data Privacy Concerns

Given the sensitive nature of the information involved, entities must handle beneficial ownership data with high confidentiality and in compliance with data protection laws to prevent unauthorized access.

7. Changes in Ownership or Control

Entities need to maintain an ongoing awareness of any changes in ownership or control that might affect their reporting responsibilities. Prompt updating of the BOIR following such changes is required.

8. Integration with Other Regulatory Requirements

Beneficial ownership reporting should be integrated with other regulatory filings to ensure consistency across all documents submitted to various government bodies.

9. Consulting with Legal Professionals

Given the complexities and legal implications of the BOIR, consulting with legal professionals who specialize in corporate and financial law can provide crucial guidance and help avoid non-compliance issues.

10. Training and Compliance Programs

Establishing training programs for staff involved in the BOIR process is beneficial. These programs can help ensure that everyone understands the importance of the requirements and knows how to handle the associated tasks effectively.

Steps to File a Beneficial Ownership Information Report in New York

To effectively comply with the Beneficial Ownership Information Reporting (BOIR) requirements in New York, entities must understand the specific steps involved in filing a report. Additionally, addressing common frequently asked questions (FAQ) can help clarify doubts and ensure a smoother compliance process.

Filing a Beneficial Ownership Information Report requires careful attention to detail and an understanding of the process. Here’s how to proceed:

- Identify the Beneficial Owners: Determine who the beneficial owners are according to the defined thresholds (e.g., those with more than 25% ownership or significant control).

- Collect Necessary Information: Gather personal information for each beneficial owner, including full name, address, date of birth, and an identification number.

- Prepare Documentation: Compile the necessary supporting documentation, such as organizational charts, operating agreements, or trust documents that verify the ownership structure.

- Complete the Reporting Form: Fill out the required reporting form, which can typically be found on the New York State Department’s website. Ensure that all information is accurate and complete.

- Submit the Report: Submit the form to the designated state agency. This could be through an online submission portal or via mail, depending on the specific instructions provided.

- Keep Records: Maintain copies of what was submitted along with all supporting documents. New York may require entities to keep these records for a number of years after filing.

- Update as Necessary: If there are any changes in beneficial ownership, update the information promptly, according to the requirements.

Common FAQ for Beneficial Ownership in NY:

Q1: What qualifies someone as a beneficial owner? A: A beneficial owner is typically someone who owns more than 25% of an entity or has significant control over the entity’s decisions.

Q2: Are all businesses required to file a BOIR? A: Most corporations, LLCs, partnerships, and trusts engaging in business or financial transactions in New York need to file a BOIR, but there are exceptions. It’s best to consult legal advice to understand specific obligations.

Q3: How often must the BOIR be filed? A: The BOIR must be filed annually or more frequently if there are significant changes in beneficial ownership.

Q4: What are the penalties for non-compliance? A: Failing to file a BOIR or filing incomplete or false information can result in penalties, including fines or legal action.

Q5: Can beneficial ownership information be kept confidential? A: Yes, New York State generally safeguards this information. However, it may be accessible to law enforcement or other governmental authorities under specific circumstances.

Q6: Where can I find the forms for filing a BOIR? A: Forms are usually available on the website of the relevant New York State department or agency overseeing the business and financial regulations.

Editor of Startups #nofilter