Getting a guaranteed approval for a startup business loan with bad credit in 2023 and 2024 can be really tough! Most traditional lenders have strict credit requirements and may not be willing to lend to individuals with a poor credit history.

Based in NYC? No problem! Check out our guide for securing a guaranteed bad credit startup business loan in New York City, updated for 2024! Or how about Miami? Or Vegas? How about Houston? Or Manitoba?

It’s important to keep in mind that no lender can guarantee approval for a loan, as they always assess the risk of lending to you based on your credit history, income, and other factors. However, these options can provide you with more opportunities to secure financing for your business, no matter the niche, including gaming, SaaS, fintech and more.

25 Companies That May Offer Guaranteed Loans to Startup Clients Despite Really Bad Credit:

Make sure to check with each lender before relying on them to guarantee you a loan offer, especially with bad credit – check the terms and conditions carefully and make sure the interest rates are manageable!

- Avant: Avant offers personal loans to customers with bad credit and can help you get the funds you need to cover unexpected expenses or make big purchases.

- OppLoans: OppLoans provides personal loans to customers with bad credit and offers flexible repayment terms and lower interest rates compared to payday loans.

- OneMain Financial: OneMain Financial offers personal loans to customers with bad credit and can help you get the funds you need for a variety of expenses, including home improvements, medical bills, and debt consolidation.

- Rise Credit: Rise Credit provides personal loans to customers with bad credit and offers flexible repayment options and fast funding.

- BadCreditLoans.com: BadCreditLoans.com is a marketplace that connects customers with lenders who are willing to provide loans to people with bad credit.

- LendUp: LendUp offers short-term loans to customers with bad credit and can help you get the funds you need in an emergency.

- CashUSA.com: CashUSA.com is a marketplace that connects customers with lenders who are willing to provide personal loans to people with bad credit.

- CashAdvance.com: CashAdvance.com provides short-term loans to customers with bad credit and can help you get the funds you need in an emergency.

- PersonalLoans.com: PersonalLoans.com is a marketplace that connects customers with lenders who are willing to provide personal loans to people with bad credit.

- NetCredit: NetCredit provides personal loans to customers with bad credit and offers flexible repayment terms and fast funding.

- Blue Trust Loans: Blue Trust Loans provides short-term loans to customers with bad credit and offers fast funding and flexible repayment options.

- Check Into Cash: Check Into Cash offers short-term loans to customers with bad credit and can help you get the funds you need in an emergency.

- MaxLend: MaxLend provides personal loans to customers with bad credit and offers flexible repayment terms and fast funding.

- Fast5kLoans: Fast5kLoans is a marketplace that connects customers with lenders who are willing to provide personal loans to people with bad credit.

- CreditLoan.com: CreditLoan.com is a marketplace that connects customers with lenders who are willing to provide personal loans to people with bad credit.

- LendYou: LendYou is a marketplace that connects customers with lenders who are willing to provide personal loans to people with bad credit.

- CashNetUSA: CashNetUSA provides short-term loans to customers with bad credit and can help you get the funds you need in an emergency.

- MoneyMutual: MoneyMutual is a marketplace that connects customers with lenders who are willing to provide short-term loans to people with bad credit.

- FlexLoans: FlexLoans provides personal loans to customers with bad credit and offers flexible repayment terms and fast funding.

- Payday Loans Online: Payday Loans Online is a marketplace that connects customers with lenders who are willing to provide short-term loans to people with bad credit.

- LoanMart: LoanMart provides personal loans to customers with bad credit and offers flexible repayment terms and fast funding.

- QuickQuid: QuickQuid provides short-term loans to customers with bad credit and can help you get the funds you need in an emergency.

- Pounds to Pocket: Pounds to Pocket provides personal loans to customers with bad credit and offers flexible repayment terms and fast funding.

- Mr. Amazing Loans: Mr. Amazing Loans provides personal loans to customers with bad credit and offers flexible repayment terms and fast funding.

- Spotloan: Spotloan provides short-term loans to customers with bad credit and can help you get the funds you need in an emergency.

It’s important to keep in mind that these companies may have higher interest rates and fees compared to traditional lenders, so it’s important to carefully review the terms and conditions of any loan before accepting it.

Also, it’s always a good idea to compare multiple lenders and compare the terms and rates to find the best loan for your needs – also make sure to compare rates between 2023 and 2024 as they can change rapidly!

A commercial loan is a type of loan specifically designed for businesses, as opposed to individuals. Commercial loans can be used to finance a variety of business expenses, including capital expenditures, operating expenses, and working capital.

Commercial loans are typically provided by banks and other financial institutions and are usually secured by the assets of the business. This means that if the business is unable to repay the loan, the lender can seize the assets used as collateral to repay the debt. Check out no collateral loans here.

Bad credit loans, on the other hand, are no doc loans that are specifically designed for individuals with poor credit. These loans are often offered by alternative lenders, such as online lenders or payday lenders, and may have higher interest rates and fees compared to traditional loans.

The relationship between commercial loans and bad credit loans for startups is that individuals with bad credit may find it more difficult to secure a commercial loan from a traditional lender due to their poor credit history. In these cases, they may consider alternative lending options, such as bad credit loans, to finance their business.

Business Credit Scores and their Impact on Landing a Guaranteed Small Business Startup Loan

Business credit scores are numerical representations of a startup business’s creditworthiness, similar to personal credit scores. Business credit scores are used by lenders to assess the risk of lending money to a business and to determine the terms and interest rates of a loan.

Business credit scores are based on a variety of factors, including payment history, credit utilization, and the length of time the business has been in operation. They are calculated by credit bureaus, such as Experian, Equifax, and Dun & Bradstreet, and are typically updated regularly based on the business’s credit activity.

The impact of business credit scores on landing a business loan can be significant. Lenders use business credit scores as a quick and easy way to assess the risk of lending money to a business, and a high business credit score can increase the chances of getting approved for a loan and potentially improve the terms and interest rate of the loan.

On the other hand, a low business credit score can make it more difficult to get approved for a loan and may result in higher interest rates and fees. Lenders may also require additional collateral or a personal guarantee from the business owner to secure the loan.

Should I seek a bad credit startup business loan that will accept me?

The decision to seek a bad credit business loan will depend on your specific financial needs and situation. While bad credit business loans may be easier to get approved for than traditional loans, they often come with higher interest rates and fees, which can be costly in the long run. Private lenders are another viable option for startup business loans.

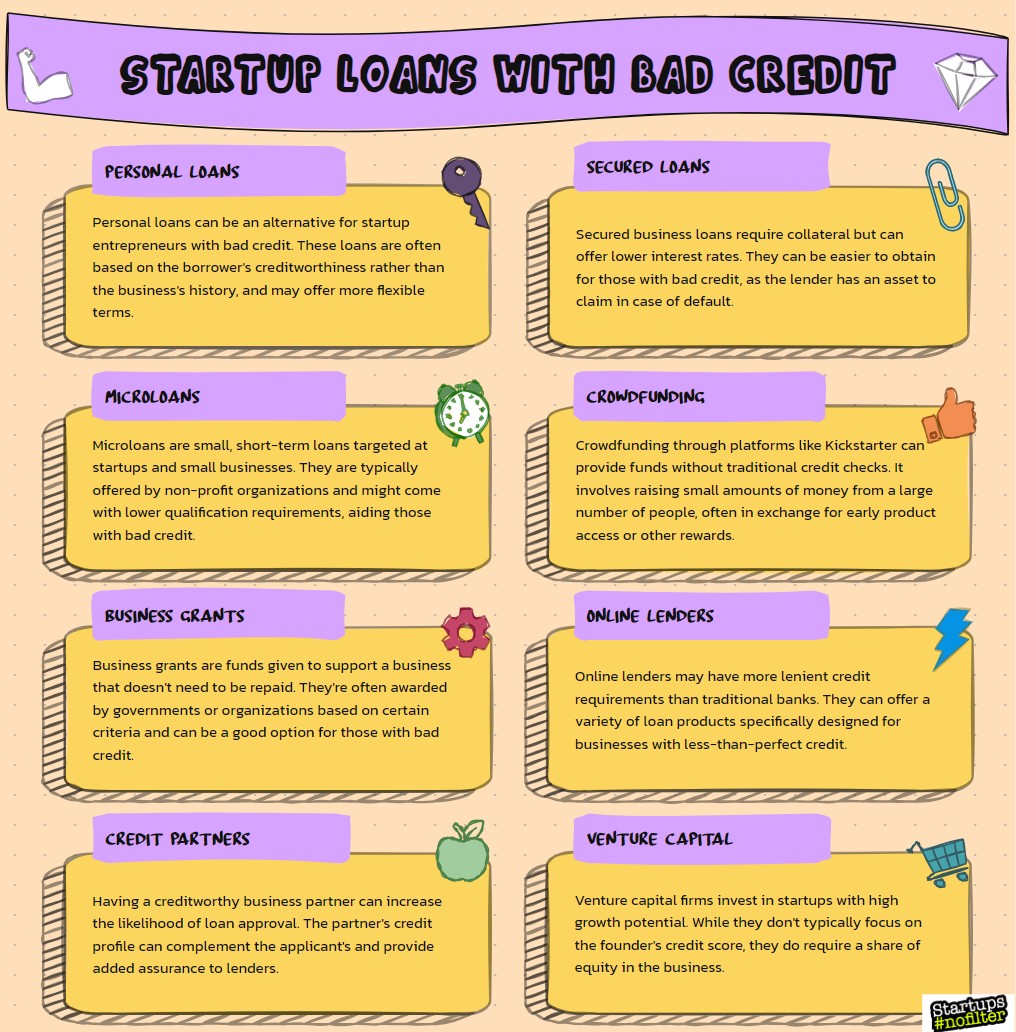

Before seeking a bad credit business loan in 2024 for your startup, it’s important to consider alternative lending options, such as crowdfunding, microloans, or peer-to-peer lending, and compare the terms and interest rates of each option to find the best loan for your needs.

Additionally, it’s important to work on improving your credit score before applying for a loan, as this can increase your chances of getting approved for a loan with better terms and interest rates. This may include paying bills on time, keeping balances low on credit cards, avoiding applying for new credit, and disputing errors on your credit report.

Ultimately, the decision to seek a bad credit business loan will depend on your specific financial needs and goals, and it’s important to carefully consider the terms and conditions of any loan before accepting it. It may also be helpful to consult with a financial advisor or business mentor to help you make the best decision for your business.

Can I get a Startup Business Loan With Credit Score 600?

One option to consider is alternative lending options, such as online lenders or peer-to-peer lending platforms. Some alternative lenders specialize in providing loans to businesses with fair or poor credit, and they may be more willing to lend to you even with a credit score of 600.

Another option to consider is a secured loan, where you put up collateral, such as real estate or equipment, in exchange for the loan. Secured loans may be easier to get approved for, even with a credit score of 600, as the collateral provides the lender with security in the event that you are unable to repay the loan.

It’s important to keep in mind that even with alternative lending options or a secured loan, you may still face higher interest rates and fees compared to traditional business loans. Additionally, it’s always a good idea to compare multiple lenders and compare the terms and rates to find the best loan for your needs.

Finally, improving your credit score and demonstrating strong financials, such as positive cash flow and a solid business plan, can increase your chances of getting approved for a loan and potentially improve the terms and interest rate of the loan you receive.

Can I get a Startup Business Loan With Credit Score 500?

Can I get a Startup Business Loan With Credit Score 400?

A credit score of 400 is considered to be very poor credit and can make it challenging to get approved for a traditional business loan from a bank or credit union. However, it is still possible to get approved for a business loan with a credit score of 400.

Wait, Can I just get a Guaranteed Small Business Startup Loan With no Credit?

It’s also important to start building a credit history for your business by getting a business credit card, applying for small business loans, and paying bills on time. This can help you establish a credit history and improve your chances of getting approved for a loan in the future.

It’s always a good idea to compare multiple lenders and compare the terms and rates to find the best loan for your needs.

There are 5 well known business loans available for borrowers with bad credit, including:

- Alternative business loans: Alternative business loans, such as online loans and peer-to-peer lending, may be more willing to lend to startup businesses with bad credit. These loans may have higher interest rates and fees compared to traditional business loans, but they can provide a quick and easy way to access funding.

- Merchant cash advances: Merchant cash advances provide businesses with a lump sum of funding in exchange for a portion of future sales. This type of loan may be easier to get approved for, even with bad credit for a startup loan, but it can be more expensive compared to other loan options.

- Secured business loans: Secured business loans require the borrower to put up collateral, such as real estate or equipment, in exchange for the loan. These loans may be easier to get approved for, even with bad credit, as the collateral provides the lender with security in the event that the borrower is unable to repay the loan.

- Microloans: Microloans are small startup business loans typically provided by non-profit organizations and can be a good option for businesses with bad credit. These loans typically have lower interest rates and fees compared to alternative business loans and can provide a way to access funding for small business expenses.

- Invoice financing: Invoice financing allows businesses to access funding by selling their outstanding invoices to a lender at a discount. This type of loan may be easier to get approved for, even with bad credit, and can provide a way to access funding quickly.

Are you a startup founder and need money? No problem; below are 9 awesome tips on how to get a guaranteed startup business loan for your startup company even with bad credit!

- Improve your credit score: Before applying for a loan, it’s important to take steps to improve your credit score for your startup business! This may include paying bills on time, keeping balances low on credit cards, avoiding applying for new credit, and disputing errors on your credit report. Improving your credit score can increase your chances of getting approved for a startup business loan and potentially improve the terms and interest rate of the loan you receive.

- Put together a comprehensive business plan: A comprehensive business plan can help you convince lenders that your startup business will be successful, even if you have bad credit. This should include detailed information about your startup products or services, target market, marketing strategy, and financial projections.

- Consider alternative lending options: Alternative lending options, such as online startup loans, peer-to-peer lending, and microloans, may be more willing to lend to startup founders and individuals with bad credit. These startup business loans specifically for bad credit and guaranteed approval may have higher interest rates and fees compared to traditional loans, so it’s important to compare multiple lenders and compare the terms and rates to find the best loan for your needs.

- Offer collateral: Offering collateral, such as SAAS access products, real estate or equipment, can increase your chances of getting approved for a startup business loan and may improve the terms and interest rate of the loan you receive.

- Find a co-signer: Having a co-signer with good credit can increase your chances of getting approved for a startup business loan and may improve the terms and interest rate of the loan you receive.

- Show proof of income: Providing proof of income, such as bank statements or tax returns from your fledgling startup company, can help you demonstrate to lenders that you have the ability to repay the startup business loan.

- Be transparent about your credit history: Being transparent about your startup business’ credit history and explaining why you have bad credit can help you build trust with lenders and increase your chances of getting approved for a loan.

- Consider a secured loan: A secured guaranteed startup loan, where you put up collateral in exchange for the loan, can be easier to get approved for and may have a lower interest rate compared to an unsecured loan.

- Shop around: Shopping around and comparing multiple lenders can help you find the best loan for your needs and increase your chances of getting approved for a startup business loan with bad credit – though a guarantee for this startup loan approval will be tough to get! Additionally, it’s important to carefully review the terms and conditions of any loan before accepting it to ensure that it’s the right loan for your needs.

Remember, there is no such thing as a guaranteed loan, but by following these tips, you can increase your chances of securing the financing you need for your startup business.