A virtual data room (VDR) is an online repository of documents and data used for securely storing and sharing sensitive information with authorized users. It’s commonly used during mergers and acquisitions, fundraising, due diligence, legal proceedings, and other business activities that involve the exchange of confidential documents. This is high level cloud operational activity and requires only the best virtual data room that a startup will need.

Startups need virtual data rooms for several reasons:

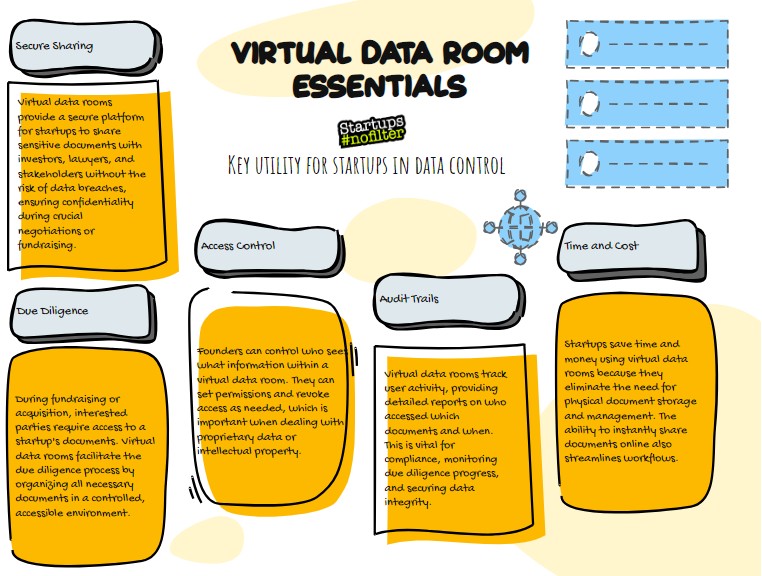

- Secure Document Storage: Startups deal with sensitive information like business plans, financial records, intellectual property, and legal documents. VDRs provide a secure environment to store these documents, protecting them from unauthorized access, data breaches, and theft.

- Streamlined Due Diligence: During fundraising rounds or potential acquisitions, startups undergo due diligence where investors or buyers scrutinize their operations and financials. VDRs streamline this process by organizing and centralizing documents, making it easier for investors to review critical information efficiently.

- Facilitate Fundraising: Startups often raise capital from investors to fuel their growth. VDRs play a crucial role in this process by enabling startups to share financial projections, business plans, and other key documents with potential investors securely and efficiently.

- Legal Compliance: Startups must comply with various regulatory requirements, especially as they grow and expand into new markets. VDRs help startups stay compliant by securely storing and managing regulatory documents, contracts, and other legal records.

- Enhanced Collaboration: Startups frequently collaborate with investors, advisors, legal counsel, and other stakeholders who may be located in different geographic locations. VDRs facilitate collaboration by providing a centralized platform for sharing, reviewing, and commenting on documents in real-time.

Overall, virtual data rooms are essential tools for startups to protect their sensitive information, streamline business processes, and facilitate growth opportunities while maintaining security and compliance standards.

16 Top Virtual Data Room Providers Affordable for Startup Companies:

Here is a listicle of some of the top virtual data room (VDR) providers, including the year founded, links to their websites, industry focus, and additional statistics:

- iDeals Solutions

- Year Founded: 2008

- Website: iDeals Solutions

- Industry: Mergers & Acquisitions, Real Estate, Biotechnology, Law Firms

- Additional Statistics: Over 1,000,000 users worldwide, 24/7 support, over 90% customer satisfaction rate

- Intralinks

- Year Founded: 1996

- Website: Intralinks

- Industry: Mergers & Acquisitions, Banking, Private Equity

- Additional Statistics: Used by 99% of Fortune 1000 companies, over $34 trillion worth of transactions completed

- Merrill Datasite

- Year Founded: 1968

- Website: Datasite

- Industry: Mergers & Acquisitions, Capital Raising, Restructuring

- Additional Statistics: Facilitated over 6,000 projects annually, operates in 170 countries

- Citrix ShareFile

- Year Founded: 2005

- Website: Citrix ShareFile

- Industry: Legal, Accounting, Real Estate, Financial Services

- Additional Statistics: Used by over 65,000 organizations, 24/7 customer support

- Ansarada

- Year Founded: 2005

- Website: Ansarada

- Industry: Mergers & Acquisitions, Legal, Financial Services

- Additional Statistics: Over 23,000 transactions facilitated, AI-powered insights and reporting

- Box

- Year Founded: 2005

- Website: Box

- Industry: Healthcare, Financial Services, Legal, Media & Entertainment

- Additional Statistics: Over 97,000 businesses using Box, integrates with over 1,400 apps

- iDeals

- Year Founded: 2008

- Website: iDeals

- Industry: Mergers & Acquisitions, Real Estate, Life Sciences

- Additional Statistics: Used by over 4,000 companies in 90+ countries

- Merrill DatasiteOne

- Year Founded: 1968

- Website: Merrill DatasiteOne

- Industry: Financial Services, Legal, Life Sciences

- Additional Statistics: Trusted by 90 of the top 100 global investment banks

- Intralinks

- Year Founded: 1996

- Website: Intralinks

- Industry: Financial Services, Life Sciences, Alternative Investments

- Additional Statistics: Facilitated $35 trillion worth of transactions

- Firmex

- Year Founded: 2006

- Website: Firmex

- Industry: Financial Services, Legal, Energy

- Additional Statistics: Supports over 15,000 new data rooms annually

- Box

- Year Founded: 2005

- Website: Box

- Industry: Technology, Healthcare, Government

- Additional Statistics: Used by 70% of Fortune 500 companies

- Ansarada

- Year Founded: 2005

- Website: Ansarada

- Industry: Mergers & Acquisitions, Legal, Financial Services

- Additional Statistics: Helped facilitate over 24,000 deals globally

- SmartRoom

- Year Founded: 2005

- Website: SmartRoom

- Industry: Financial Services, Legal, Corporate

- Additional Statistics: Trusted by over 250,000 professionals worldwide

- SecureDocs

- Year Founded: 2012

- Website: SecureDocs

- Industry: Technology, Life Sciences, Financial Services

- Additional Statistics: Deployed in over 55 countries

- OneHub

- Year Founded: 2007

- Website: OneHub

- Industry: Real Estate, Marketing, Legal

- Additional Statistics: Serves over 1 million users

- ShareVault

- Year Founded: 2003

- Website: ShareVault

- Industry: Life Sciences, Investment Banking, Legal

- Additional Statistics: Over 2 billion pages of documents managed

- DealRoom

- Year Founded: 2013

- Website: DealRoom

- Industry: Mergers & Acquisitions, Corporate Development

- Additional Statistics: Reduces deal times by up to 40%

- EthosData

- Year Founded: 2007

- Website: EthosData

- Industry: Financial Services, Legal, Corporate

- Additional Statistics: Used in over 70 countries with more than 10,000 transactions

- Brainloop

- Year Founded: 2000

- Website: Brainloop

- Industry: Board Portals, Secure Collaboration

- Additional Statistics: Trusted by over 2,000 clients worldwide

- SecureDocs

- Year Founded: 2012

- Website: SecureDocs

- Industry: Technology, Life Sciences, Financial Services

- Additional Statistics: Deployed in over 55 countries

- OneHub

- Year Founded: 2007

- Website: OneHub

- Industry: Real Estate, Marketing, Legal

- Additional Statistics: Serves over 1 million users

- WatchDox by BlackBerry

- Year Founded: 2008

- Website: WatchDox

- Industry: Government, Healthcare, Financial Services

- Additional Statistics: Over 95% of the Fortune 100 use WatchDox

- Drooms

- Year Founded: 2001

- Website: Drooms

- Industry: Real Estate, Mergers & Acquisitions, Legal

- Additional Statistics: Processed over 25,000 transactions globally

- CapLinked

- Year Founded: 2010

- Website: CapLinked

- Industry: Mergers & Acquisitions, Real Estate, Private Equity

- Additional Statistics: Used by over 250,000 professionals, supports transactions in 110 countries

- Box

- Year Founded: 2005

- Website: Box

- Industry: Technology, Healthcare, Government

- Additional Statistics: Used by 97,000 businesses, integrates with over 1,400 apps

- Ansarada

- Year Founded: 2005

- Website: Ansarada

- Industry: Mergers & Acquisitions, Legal, Financial Services

- Additional Statistics: Facilitated over 24,000 deals globally

- Firmex

- Year Founded: 2006

- Website: Firmex

- Industry: Financial Services, Legal, Energy

- Additional Statistics: Supports over 15,000 new data rooms annually

- HighQ (acquired by Thomson Reuters)

- Year Founded: 2001

- Website: HighQ

- Industry: Legal, Banking, Corporate

- Additional Statistics: Used by over 400,000 users in 50+ countries

- SmartRoom

- Year Founded: 2005

- Website: SmartRoom

- Industry: Financial Services, Legal, Corporate

- Additional Statistics: Trusted by over 250,000 professionals worldwide

- SecureDocs

- Year Founded: 2012

- Website: SecureDocs

- Industry: Technology, Life Sciences, Financial Services

- Additional Statistics: Deployed in over 55 countries

- OneHub

- Year Founded: 2007

- Website: OneHub

- Industry: Real Estate, Marketing, Legal

- Additional Statistics: Serves over 1 million users

- WatchDox by BlackBerry

- Year Founded: 2008

- Website: WatchDox

- Industry: Government, Healthcare, Financial Services

- Additional Statistics: Over 95% of the Fortune 100 use WatchDox

- Drooms

- Year Founded: 2001

- Website: Drooms

- Industry: Real Estate, Mergers & Acquisitions, Legal

- Additional Statistics: Processed over 25,000 transactions globally

These virtual data rooms cater to various industries including financial services, legal, life sciences, and more. They provide secure and efficient solutions for managing sensitive information, facilitating due diligence, and ensuring compliance with industry regulations.

These VDR providers offer robust solutions tailored to different industries, helping organizations securely manage and share confidential information. For more detailed information and a full comparison, you can refer to the original list on StartupGeek.

Bonus: Check out these low-cost or even free virtual data rooms for startups (VDRs) that can level up your file sharing game:

- Ftopia: Based in Paris, Ftopia offers a robust package for free, including custom branding and advanced security features, although it’s not tailor-made for M&A deals.

- FirmRoom: A rising star in the industry, FirmRoom offers essential VDR functions with acclaimed M&A solutions, trusted by big names like Pfizer and J.P. Morgan.

- Koofr: With headquarters in Slovenia, Koofr provides up to 2 GB of free storage and seamless integration with other cloud storage sites, but lacks M&A-specific features.

- Box: A budget-friendly option similar to Dropbox, Box is decent for smaller budgets but falls short on security for large-scale transactions.

- Dotloop: While affordable, Dotloop is better suited for agents and real estate brokers due to its lack of M&A-specific features.

- Clinked: Offering 24/7 customer service and data protection, Clinked is not ideal for M&A due to missing role-based permissions and data management features.

What are 7 Risks that Startup Companies Should Avoid When it Comes to Paying for Virtual Data Rooms?

When using virtual data rooms (VDRs), startup companies should be mindful of several risks to ensure data security and operational efficiency:

- Data Security and Breaches:

- Risk: Unauthorized access to sensitive information can lead to data breaches, financial loss, and reputational damage.

- Avoidance: Choose VDRs with robust security features like end-to-end encryption, multi-factor authentication, and regular security audits. Ensure the VDR provider complies with relevant data protection regulations like GDPR and HIPAA (Startup Geek) .

- Compliance Issues:

- Risk: Non-compliance with industry regulations can result in legal penalties and operational disruptions.

- Avoidance: Ensure the VDR provider has compliance certifications relevant to your industry, such as ISO 27001 for information security management or SOC 2 for data security controls (Startup Geek).

- Insufficient User Training:

- Risk: Employees may inadvertently compromise data security due to a lack of understanding of how to use the VDR properly.

- Avoidance: Provide comprehensive training on VDR usage, emphasizing best practices for data handling and security protocols .

- Vendor Reliability:

- Risk: Relying on an unreliable VDR provider can lead to service interruptions, data loss, or lack of support.

- Avoidance: Choose a reputable VDR provider with a proven track record, reliable customer support, and positive user reviews. Check the provider’s uptime guarantees and disaster recovery plans .

- Cost Overruns:

- Risk: Unexpected costs associated with VDR usage can strain a startup’s budget.

- Avoidance: Understand the VDR pricing model, including storage limits, user fees, and additional charges for advanced features. Opt for a provider that offers transparent pricing and flexible plans that can scale with your business needs (Startup Geek).

- Limited Scalability:

- Risk: A VDR that does not scale with your growing business needs can hinder your operations.

- Avoidance: Select a VDR that offers scalable solutions, allowing you to add users, increase storage, and access advanced features as your business grows (Startup Geek).

- Lack of Integration:

- Risk: A VDR that doesn’t integrate well with your existing systems can lead to inefficiencies and data silos.

- Avoidance: Ensure the VDR supports integrations with your current software and tools, such as CRM, project management, and collaboration platforms (Startup Geek).

Who’s using virtual data rooms (VDR) across different industries?

From startups to big corporations, these platforms are making waves:

Startup Scene:

- Life Sciences: With the innovative world of biotech and pharmaceuticals booming, startups in the life sciences industry rely on VDRs to safeguard their proprietary info during fundraising and collaboration talks.

- Energy Industry: From senior engineers to founders, everyone in the energy sector counts on secure communication via VDRs for sensitive data transactions and discussions.

- Investment Banking: Investment bankers swear by VDRs for smooth sailing through M&A activities, IPOs, and strategic partnerships, making transactions a breeze.

- Legal Eagles: Law firms keep their game tight with VDRs, meeting client demands for responsiveness and accessibility during activities like M&A, IPOs, and bankruptcy proceedings.

- Private Equity: Venture capital firms and private equity players hustle hard with VDRs, ensuring seamless transactions, investor communications, and fundraising activities.

- Big Business: Corporations are all over VDRs to safeguard their intellectual property and streamline various processes like fundraising, IPOs, and M&A due diligence, with CEOs to HR specialists getting in on the action!

Data Room for Investors Checklist, (Before Investing in a Startup Company!)

Company Overview

- Executive Summary:

- Brief overview of the company, including mission, vision, and objectives.

- Company History:

- Key milestones, founding date, and significant achievements.

- Business Model:

- Detailed description of how the company generates revenue.

Financial Information

- Financial Statements:

- Income statements, balance sheets, and cash flow statements for the past 3-5 years.

- Projections:

- Financial forecasts for the next 3-5 years, including assumptions and key drivers.

- Cap Table:

- Current capitalization table showing all equity holders and their respective ownership percentages.

- Audit Reports:

- Recent audit reports, if available.

Legal Documents

- Corporate Documents:

- Articles of incorporation, bylaws, and any amendments.

- Contracts and Agreements:

- Key customer and supplier contracts, partnership agreements, and licensing agreements.

- Intellectual Property:

- Patents, trademarks, copyrights, and any IP litigation documents.

- Regulatory Compliance:

- Relevant regulatory filings and compliance documentation.

Operational Information

- Organizational Structure:

- Organizational chart and key management team bios.

- Board of Directors:

- List of board members, their bios, and board meeting minutes.

- HR Documents:

- Employee contracts, stock option plans, and employee handbook.

- Operational Metrics:

- Key performance indicators (KPIs) and operational metrics.

Market and Competitive Analysis

- Market Research:

- Industry reports, market size, and growth projections.

- Competitive Analysis:

- Competitive landscape, including major competitors and market position.

- SWOT Analysis:

- Strengths, Weaknesses, Opportunities, and Threats.

Product Information

- Product Roadmap:

- Current product offerings and future development plans.

- R&D Documentation:

- Research and development efforts, including current projects and timelines.

- Customer Testimonials:

- Feedback and testimonials from key customers.

Sales and Marketing

- Sales Strategy:

- Sales processes, key sales channels, and major customers.

- Marketing Strategy:

- Marketing plans, advertising campaigns, and brand strategy.

- Customer Acquisition Costs:

- Metrics on customer acquisition costs (CAC) and customer lifetime value (LTV).

Risk Factors

- Risk Assessment:

- Identification of key risks and mitigation strategies.

- Contingency Plans:

- Plans for handling potential business disruptions.

Investor Relations

- Previous Funding Rounds:

- Details of past funding rounds, including amounts raised and key investors.

- Use of Funds:

- How the capital from previous rounds was utilized.

- Investor Reports:

- Regular updates provided to existing investors.

Additional Resources

- Pitch Deck:

- Investor pitch presentation.

- Video Presentations:

- Recorded presentations or webinars about the company.

Data Room Security

- Access Control:

- Ensure only authorized personnel have access to sensitive documents.

- Audit Trail:

- Track who accesses and views documents.

- Watermarking:

- Watermark sensitive documents to prevent unauthorized distribution.

Whether you’re a startup founder or a seasoned player, virtual data rooms have got your back in the high-stakes world of business!

Editor of Startups #nofilter