Are you a startup business owner with a successful business and some revenue coming in? Did you know that as of January 1, 2024, millions of startups and small businesses must file a Beneficial Ownership Information (BOI) Report with the U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN)? This is a crucial cog in the world of small business startup taxes.

The good news is that we have compiled a checklist of things that every startup owner should definitely review before they file a Beneficial Ownership Information Report with the IRS. Check it out below! And make sure to check each state – Florida is very different for BOR!

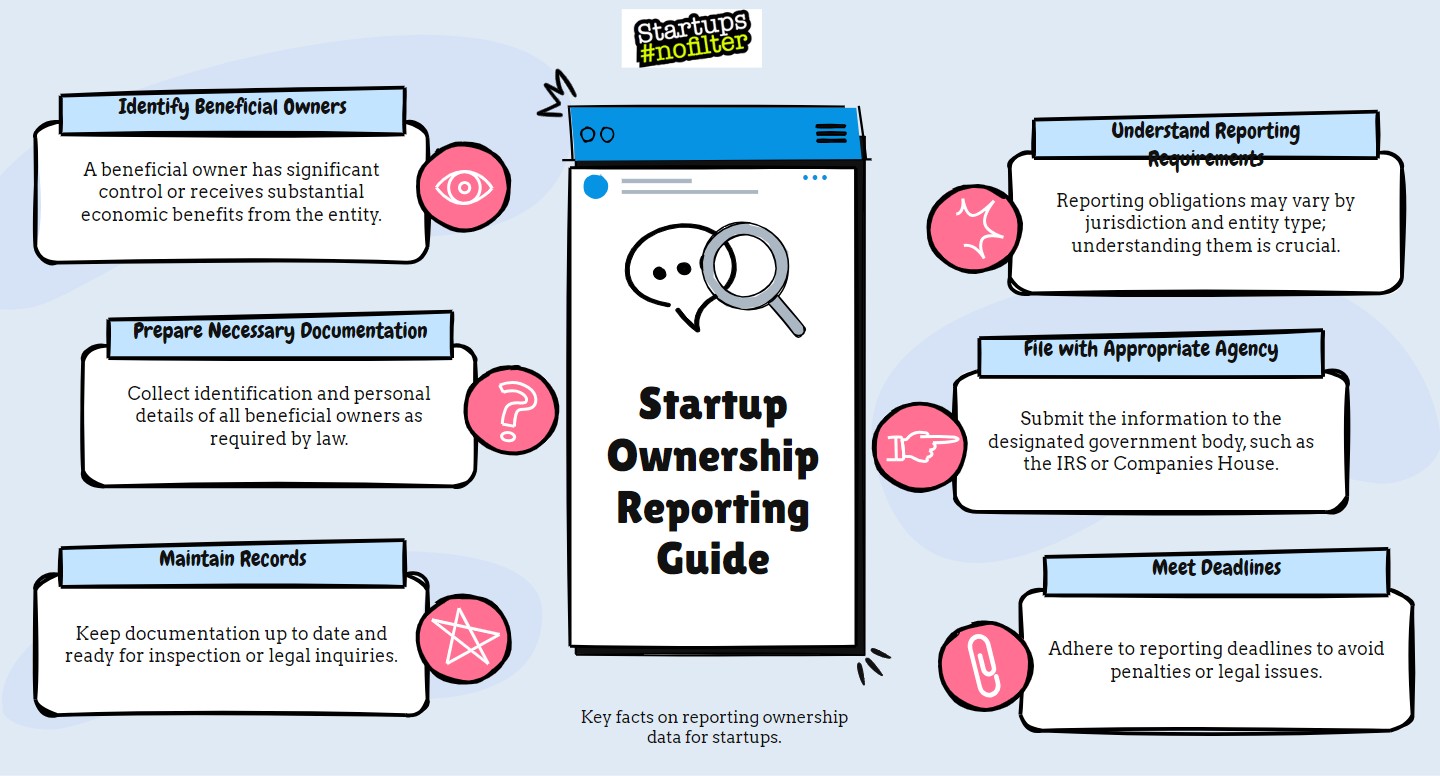

Checklist for Startup Owners Before Filing a Beneficial Ownership Report in 2024 and 2025:

- Understand Beneficial Ownership: Familiarize yourself with the concept of beneficial ownership, which refers to individuals who ultimately own or control a legal entity like your startup.

- Know Regulatory Requirements: Research the regulatory requirements for beneficial ownership information reporting applicable to your jurisdiction. These may include national laws or international standards like those set by the Financial Action Task Force (FATF).

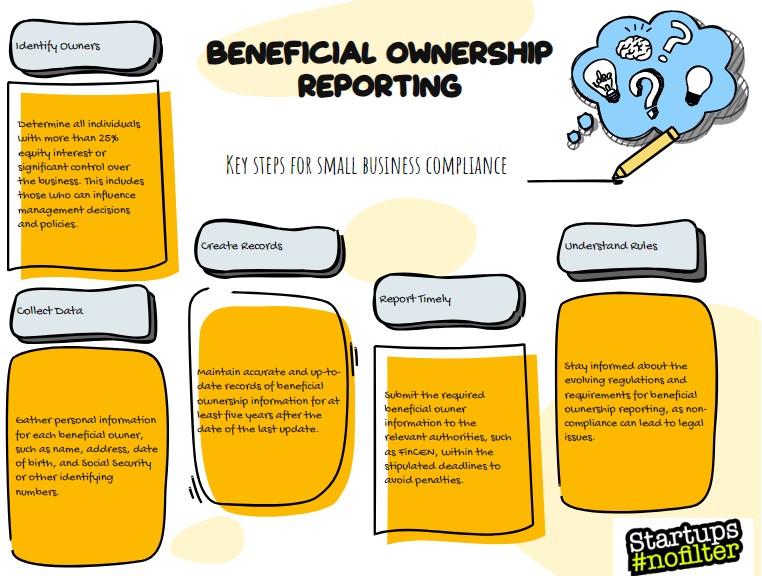

- Identify Ultimate Beneficial Owners (UBOs): Determine who qualifies as UBOs for your startup. This includes individuals who directly or indirectly hold a certain percentage of ownership or control.

- Collect Information: Gather accurate and up-to-date information about your startup’s UBOs, including their full legal names, dates of birth, addresses, and details of their ownership or control.

- Document Ownership Structure: Document your startup’s ownership structure, including any complex ownership arrangements, to ensure transparency and compliance with reporting requirements.

- Maintain Records: Establish a system to maintain records of beneficial ownership information, ensuring they are easily accessible and kept up-to-date.

- Verify Identity: Verify the identity of your startup’s UBOs through reliable means such as government-issued identification documents or other official records.

- Monitor Changes: Regularly monitor changes in your startup’s ownership structure and update beneficial ownership information accordingly.

- Assess Risks: Evaluate potential risks associated with your startup’s beneficial ownership structure, such as exposure to money laundering or other illicit activities.

- Seek Legal Advice: Consider seeking legal advice or consulting with professionals experienced in beneficial ownership reporting to ensure compliance with applicable laws and regulations.

- File Reports: File any required reports or disclosures related to beneficial ownership information with the relevant authorities within the specified deadlines.

- Review and Update Policies: Periodically review and update your startup’s policies and procedures related to beneficial ownership information reporting to adapt to changes in regulations or business circumstances.

- Educate Employees: Educate key employees within your startup about their responsibilities regarding beneficial ownership information reporting and compliance with relevant laws and regulations.

- Stay Informed: Stay informed about developments in beneficial ownership reporting requirements, including changes in laws, regulations, or industry best practices.

- Engage in Transparency: Embrace transparency and proactively disclose beneficial ownership information to stakeholders, fostering trust and credibility for your startup.

By following this checklist, you can ensure that your startup effectively manages beneficial ownership information reporting obligations, mitigates risks, and maintains compliance with relevant regulations in 2024 and beyond!

5 Bonus Tips for How to Prepare for Beneficial Ownership Reporting in 2024

Don’t think you can just escape to a tax haven! B.O.R. is crucial and as such here are five additional tips for startup founders regarding beneficial ownership information reporting, along with an example:

- Regular Internal Audits: Conduct regular internal audits to ensure the accuracy and completeness of your beneficial ownership information. This helps identify any discrepancies or gaps that need to be addressed promptly. For example, let’s say you run a tech startup called “TechGenius.” Conducting quarterly internal audits can help TechGenius maintain accurate records of its beneficial owners, ensuring compliance with regulatory requirements.

- Implement Technology Solutions: Explore technology solutions such as beneficial ownership management software or blockchain-based platforms to streamline the collection, verification, and maintenance of beneficial ownership information. For instance, “StartupSecure,” a cybersecurity startup, utilizes blockchain technology to securely record and manage its beneficial ownership information, enhancing transparency and security.

- Train Employees: Provide comprehensive training to employees responsible for managing beneficial ownership information to ensure they understand their roles and responsibilities. Offer ongoing education on compliance best practices and regulatory updates. For example, “EcoSolutions,” an environmental startup, conducts regular training sessions for its compliance team to stay updated on evolving regulations related to beneficial ownership reporting.

- Establish Clear Policies and Procedures: Develop clear and concise policies and procedures for collecting, verifying, and updating beneficial ownership information. Communicate these policies to all relevant stakeholders and ensure they are consistently followed across the organization. For instance, “HealthTech Innovations” a healthcare startup, has established detailed guidelines outlining the steps for verifying and documenting beneficial ownership information, promoting consistency and accuracy.

- Engage with Industry Peers: Stay engaged with industry peers and participate in forums, conferences, or industry associations focused on beneficial ownership reporting and compliance. Sharing insights and best practices with other startup founders can provide valuable guidance and support. For example, “FinTech Connect” a financial technology startup, regularly attends industry conferences to stay informed about emerging trends and regulatory developments related to beneficial ownership reporting.

Beneficial Ownership Information Reporting Instructions + Deadline

Beneficial ownership information for all companies including startups must be reported to the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) by certain types of U.S. and foreign entities, known as “reporting companies”. Reporting companies must file an initial Beneficial Ownership Information Report (BOIR) by the following deadlines:

- Existing companies (created/registered before January 1, 2024) must file by January 1, 2025.

- New companies (created/registered in 2024) must file within 90 days of receiving notice of creation/registration.

- Companies created/registered after January 1, 2025 must file within 30 days.

The BOIR must include the following 4 details information about each beneficial owner (someone who owns 25%+ or exercises substantial control!!)

- Full legal name

- Date of birth

- Home address (no P.O. boxes)

- ID number and issuer from a non-expired U.S. driver’s license, passport, or state-issued ID. Source

Companies can file the BOIR electronically through FinCEN’s secure BOI E-Filing portal. No attorney or CPA is required. There is no filing fee. Source

Companies must update the BOIR within 30 days if there are any changes to the reported information. Source

What Are The Penalties For Not Filing The A Beneficial Ownership Information Report?

- Willful failure to report complete or updated BOI to FinCEN, or willfully providing false or fraudulent BOI, can result in both civil and criminal penalties. Source

- Civil penalties can include fines of up to $500 per day for each day the violation continues.

- Criminal penalties can include fines of up to $10,000 and/or imprisonment of up to 2 years.

- Even if a reporting company files the BOI report on time, penalties can still be imposed if the report does not include the correct information. Source

- The penalties apply to the reporting company as well as the individuals who are beneficial owners but fail to provide accurate information.

Do Partnerships Have To Report Beneficial Ownership Information?

Partnerships (or startup co-founders partnerships) do not have to report beneficial ownership information under the Corporate Transparency Act (CTA) requirements:

- The CTA defines “reporting companies” that are required to file beneficial ownership information (BOI) reports, and this definition includes corporations, LLCs, and other business entities created by filing a registration document.

- However, the CTA specifically exempts “sole proprietorships and general partnerships” from the BOI reporting requirements. Source

- This means that general partnerships, which are formed without filing a registration document, are not considered “reporting companies” and do not have to file BOI reports with FinCEN.2

- The search results do not indicate that limited partnerships or limited liability partnerships are exempt from the BOI reporting requirements. These types of partnerships may need to comply if they meet the definition of a “reporting company”. Source

Is The Beneficial Ownership Information Reporting Considered To Be Unconstitutional?

A federal district court has ruled that the Corporate Transparency Act (CTA), which requires the reporting of beneficial ownership information (BOI) by businesses, is unconstitutional. The 5 key points are:

- In a lawsuit filed by the National Small Business Association (NSBA), a federal district court in Alabama granted summary judgment in favor of the NSBA, ruling that the CTA is unconstitutional and permanently enjoining the government from enforcing it.

- The court found that the CTA exceeds the constitutional limits on Congress’s legislative powers and lacks a sufficient connection to any enumerated power.

- The government had argued the CTA was authorized under Congress’s foreign affairs powers, Commerce Clause authority, and taxing power, but the court rejected all of these arguments.

- The court stated that while the CTA may have “sensible and praiseworthy ends”, the government must find a way to achieve these goals without exceeding the limits of the Constitution.

- An official from the Treasury Department, which oversees the agency administering the CTA, said they would comply with the injunction, though the Justice Department declined further comment.

The takeaway is that federal court has ruled the beneficial ownership reporting requirements of the CTA are unconstitutional, blocking their enforcement, though the government may appeal the decision.

Sources

- https://home.treasury.gov/news/press-releases/jy2015

- https://www.journalofaccountancy.com/news/2024/mar/federal-court-holds-corporate-transparency-act-unconstitutional.html

Common FAQ For Beneficial Ownership Information Reporting

-

Why is beneficial ownership information important?

- Beneficial ownership information is crucial for combating financial crimes such as money laundering, terrorist financing, and tax evasion. It helps authorities identify the real people behind legal entities, enhancing transparency and accountability.

-

Who is required to report beneficial ownership information?

- Reporting requirements vary by jurisdiction, but typically, certain types of legal entities, such as corporations, trusts, and partnerships, are required to disclose their beneficial owners to relevant authorities.

-

What information is usually required for beneficial ownership reporting?

- The required information often includes the names, addresses, dates of birth, and identification numbers of beneficial owners, as well as details of their ownership interests and the nature of their control over the entity.

-

How is beneficial ownership information reported?

- Reporting methods vary depending on the jurisdiction and regulatory requirements. Typically, entities may be required to submit beneficial ownership information to a government agency, such as a financial regulator or company registry, either electronically or through paper forms.

-

Are there any exemptions to beneficial ownership reporting?

- Some jurisdictions may exempt certain types of entities or beneficial owners from reporting requirements, such as publicly traded companies or entities with a minimal level of ownership or control.

-

What are the consequences of non-compliance with beneficial ownership reporting requirements?

- Non-compliance can result in penalties, fines, or legal sanctions imposed by regulatory authorities. In some cases, failure to report accurate beneficial ownership information may also lead to reputational damage or the loss of business opportunities.

-

How is beneficial ownership information protected?

- Governments and regulatory bodies typically have measures in place to safeguard the confidentiality and security of beneficial ownership information, including data encryption, restricted access, and confidentiality agreements.

-

Is beneficial ownership information accessible to the public?

- Access to beneficial ownership information varies by jurisdiction. While some jurisdictions maintain public registers of beneficial ownership, others restrict access to authorized persons, such as law enforcement agencies or financial regulators, for investigative or regulatory purposes.

-

How can entities ensure compliance with beneficial ownership reporting requirements?

- Startups and entities should stay informed about applicable regulations, maintain accurate and up-to-date records of their beneficial owners, and implement robust internal controls and procedures to ensure timely and accurate reporting. Seeking professional advice from legal or financial experts can also help ensure compliance.

Editor of Startups #nofilter