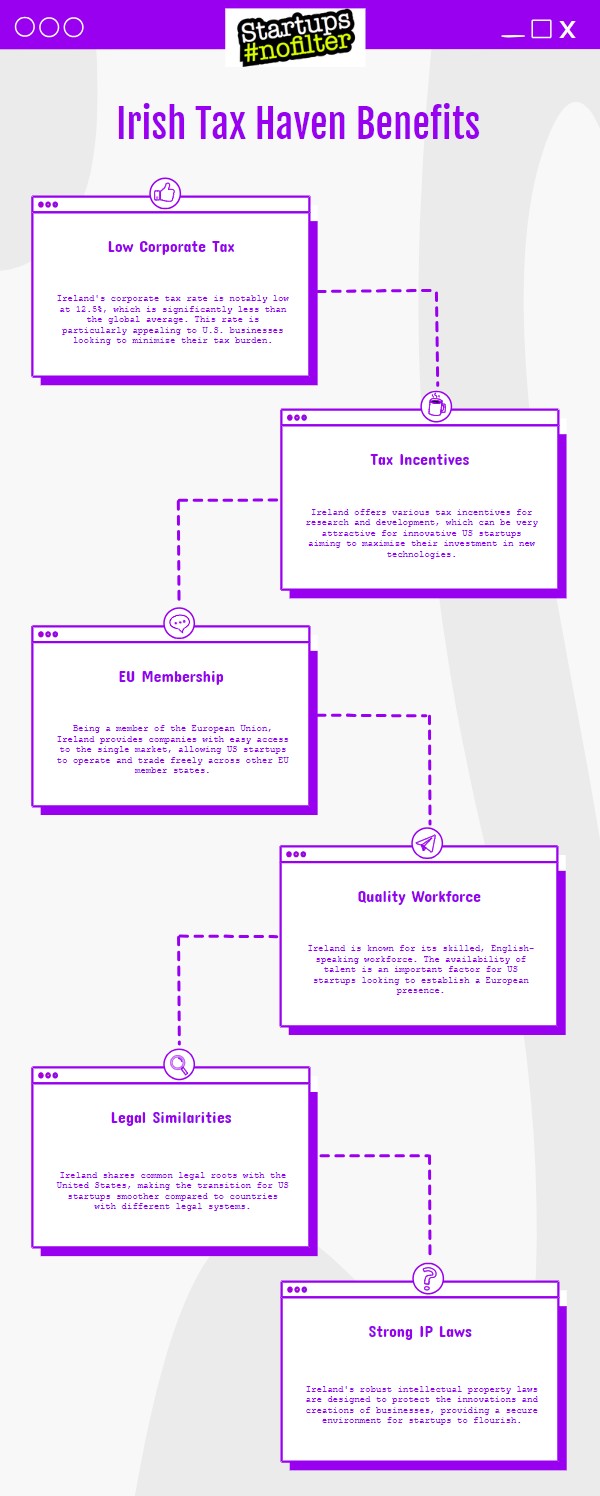

Ireland is a go-to spot for U.S. startups looking to benefit from its business-friendly tax policies, and is a very popular tax haven country for US citizens.

With a low corporate tax rate of 12.5% and generous R&D tax credits, Ireland offers a welcoming environment for entrepreneurs. Moreover, there are abundant funding opportunities like the Disruptive Technologies Innovation Fund and plenty of venture capital to tap into.

But it’s not just about taxes; Ireland also provides attractive employment incentives such as the Special Assignee Relief Programme and the Foreign Earnings Deduction, making it an ideal place to grow your team and expand your business. Understanding how Ireland’s tax system can work in your favor is key to optimizing your financial strategy.

By delving deeper into the benefits Ireland offers small businesses, you’ll uncover more ways to leverage its advantages.

Understanding Tax Havens

Looking to lighten the tax load for your startup? Understanding tax havens, like Ireland with its business-friendly tax policies, could be a game-changer for your small business.

These havens offer perks like a low Corporate Tax Rate, drawing in businesses looking to trim their tax bills.

Irelands Corporate Tax Advantage

Let’s break down why Ireland is such a magnet for US small business startups due to its corporate tax advantage. With a super low corporate tax rate of 12.5%, a sweet deal with a 6.25% rate for patent revenue under the Knowledge Development Box, and a history of tax relief dating back to 1956, Ireland has become a tax haven for businesses.

This setup not only lures US startups but also fosters intellectual property (IP) development and boosts exports. Ireland’s tax rates are lower than those in the US, making it a unique hub that supports global expansion for budding businesses. These perks make Ireland the perfect springboard for your startup’s growth.

R&D Tax Credits in Ireland

When setting up your small business in Ireland, it’s crucial to grasp the R&D Tax Credits on offer. You can snag a 25% tax credit on your R&D spending, along with an extra 12.5% revenue deduction.

If you’re venturing into R&D-related construction projects, there are more incentives waiting, potentially totaling a 37.5% tax benefit. Keep an eye out for upcoming laws that might introduce a 30% R&D tax credit tailored for micro and small companies. This could mean even more financial perks for your startup.

Understanding R&D Tax Credits

Diving into Ireland’s financial scene, you’ll find a sweet deal with a 25% tax credit on research and development (R&D) spending that businesses can cash in on. Pair that with a 12.5% revenue deduction for eligible R&D, and you’re looking at a total tax benefit of 37.5%.

Plus, companies can slash income tax down to 23% for key R&D staff, making Ireland a hotspot for startups.

Benefits for US Startups

US startups are gravitating towards Ireland for some pretty enticing reasons, especially when it comes to the attractive tax breaks available, particularly in the realm of research and development. The perks of kicking off your business here are plentiful, with favorable tax rates designed to support R&D spending.

| R&D Benefit | Tax Rate |

|---|---|

| Basic R&D Tax Credit | 25% |

| Additional Revenue Deduction | 12.5% |

| Construction Projects R&D Credit | TBD |

| Employee Income Tax Reduction | 23% |

| Micro/Small Companies R&D Credit | 30% (Proposed) |

Grant and Funding Opportunities

Ireland isn’t just about tax benefits; it’s a goldmine for US small business startups seeking grants and funding. Agencies like the Industrial Development Agency (IDA) offer financial support for research, development, training, and operations.

Moreover, venture capital is abundant, with funds like the Irish Strategic Investment Fund and the Disruptive Technologies Innovation Fund investing heavily in startups.

Government Grants in Ireland

Ireland has a bunch of government grants and funding opportunities waiting for US small business startups. The Industrial Development Agency (IDA) is a key player in this field, offering support for R&D projects, training programs, operational efficiency schemes, and tax relief through the Employment Investment Incentive.

When paired with other funding options, Ireland becomes a prime spot for launching your startup.

Venture Capital Availability

Venture capital options in Ireland, backed by the Industrial Development Agency (IDA), provide a solid funding source for small US business startups. For those focused on Research and Development (R&D), funding opportunities are abundant. Additionally, there are attractive tax relief programs. Here’s a quick look:

- IDA: Offers a robust funding source for Venture Capital.

- Irish Strategic Investment Fund: Provides substantial funding for R&D projects.

- Microfinance Ireland: Supports small businesses with loan options.

- Employment Investment Incentive: Offers tax relief for investors.

Employment Incentives in Ireland

Looking to grow your small business in Ireland? Here’s why it’s a smart move for US startups:

- Get a 30% income tax break with the Special Assignee Relief Programme.

- The Foreign Earnings Deduction encourages hiring overseas.

- These perks bring in top talent and investment, fueling growth.

- Benefit from a low Corporation Tax rate that supports your intellectual property.

These advantages set the stage for a business-friendly atmosphere in Ireland.

Potential Impact of 2024 European Elections

As you look ahead for your startup, keep in mind that the 2024 European elections could have a big impact on US small businesses in Ireland. This might change how taxes work and Ireland’s reputation as a tax-friendly location.

The results could affect tax laws, how companies set prices for goods and services, and how attractive the country is for foreign investors. New leaders could adjust corporate tax rates, which would directly affect how much money your business brings in.

Polands Rise to Powerhouse Status

When you look at Poland, you’ll see a country rapidly rising in Europe, boasting substantial economic growth to become the sixth-largest economy in the EU.

Poland’s tax system is friendly to global businesses. Its foreign investments thrive thanks to a stable political environment and strong infrastructure. The nation actively promotes innovation through business-friendly policies and attractive investment incentives. Key sectors like manufacturing and IT are driving Poland’s ascent to powerhouse status.

Irelands Booming Business Hub

Ireland has become a hotspot for American small businesses looking to minimize their taxes, thanks to a low corporate tax rate of just 12.5%. The country’s bustling business scene is a magnet for multinational corporations seeking favorable tax conditions.

Here are some key tax benefits that make Ireland so attractive:

- Low Corporate Tax: Set at 12.5%

- Knowledge Development Box: Offers a reduced 6.25% tax rate

- Extensive Tax Treaty Network: Covers over 70 countries

- R&D Tax Credit: Allows for a 25% deduction

These tax advantages have made Ireland a top choice for businesses looking to optimize their financial strategies.

Benefits of a Irish Business Startup

When it comes to starting a business in Ireland, one major advantage is the country’s low corporate tax rate of 12.5%. This can greatly boost your small business’s profits.

Additionally, you can benefit from a 25% R&D tax credit, which can help offset your research and development expenses.

Moreover, there’s a reduced patent tax rate of 6.25% for qualifying intellectual property.

On top of that, Ireland offers various tax incentives and grants that can encourage innovation, drive investments, and create job opportunities.

These perks collectively make Ireland a highly appealing destination for entrepreneurs looking to kickstart their businesses.

Very Common Questions & Some Answers

Why Do American Companies Register in Ireland?

So, you’re setting up your company in Ireland because of the perks it offers for incorporating, its friendly tax system, and robust legal safeguards. Many small businesses find the attractive corporate tax rates and special benefits for revenue from intellectual property quite appealing.

Do Small Businesses Pay Corporate Tax Ireland?

Absolutely, small businesses in Ireland do indeed pay corporate tax. Ireland’s tax system offers advantages to small businesses, such as low corporate tax rates, making it a favorable choice for startups looking to manage their taxes efficiently.

Is US Income Taxable in Ireland?

If you’re a US tax resident, you typically only pay taxes on your income in the US, not in Ireland. This is because of agreements that prevent double taxation and Ireland’s focus on taxing income earned within its borders. So, rest assured, your hard-earned money is safe from double taxation when it comes to Ireland.

Why Are American Companies Moving to Ireland?

American companies are flocking to Ireland because of attractive incentives like low tax rates and R&D credits. These perks have a big impact on the economy, making Ireland a popular choice for companies looking to manage their tax obligations efficiently.

The TLDR

Well, Ireland is a hotspot for US small business startups due to its low corporate tax rates, ample R&D credits, grants, and employment incentives.

Even with potential changes in 2024, Ireland’s appeal remains strong. While Poland is making waves, Ireland still shines as a top choice for startups.

Starting your business in Ireland could be a savvy move worth considering.

Editor of Startups #nofilter