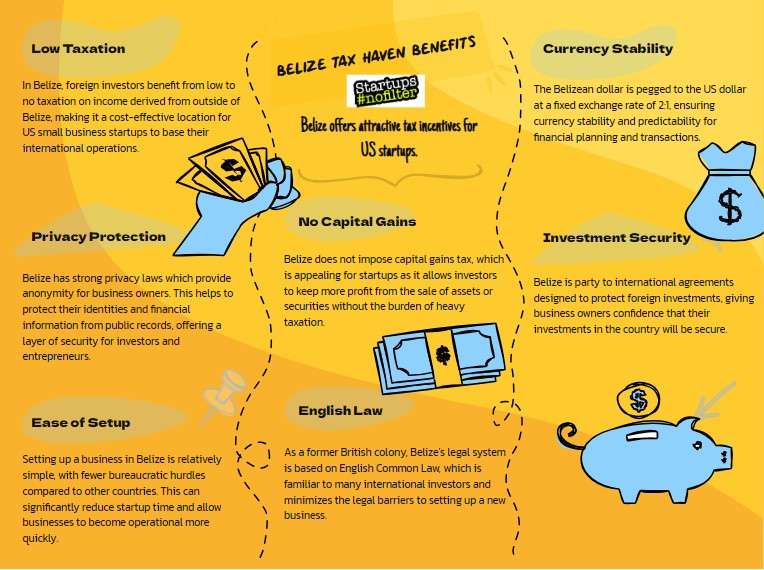

Belize is a hit with US small business startups thanks to its attractive tax benefits. Here, you can enjoy permanent exemptions from individual and corporate taxes, even inheritance taxes. The business regulations are hassle-free, making it easy to kickstart your venture. This is why Belize is the most popular tax haven country for US startups.

Belize also takes privacy seriously, ensuring that your business dealings remain confidential. This makes it a smart choice for startups looking to save money and safeguard their assets. Delving deeper into what Belize offers might unveil more reasons why it’s a top pick for making financial decisions for your startup.

Understanding Belize’s Tax Haven Status

To understand why Belize is a sought-after tax haven, consider this: the country’s policy of permanently exempting individuals and businesses from taxes makes it a prime choice for US small startups.

With tax breaks covering inheritance, forming a company in Belize offers not just financial benefits but also confidentiality and a secure setup for your new business venture.

Belizes Offshore Business Regulations

When it comes to Belize’s offshore business regulations, you’ll see that the country offers permanent tax exemptions for individuals and businesses, making it a top choice for US startups.

This business-friendly environment attracts foreign investors looking to set up shop in Belize, allowing them to lower their tax burdens.

Belize’s tax system and privacy laws also provide added protection from international tax authorities, making it a favorable option for offshore business ventures.

Belizes Tax Exemptions and Benefits

Belize offers a range of tax breaks and advantages that make it a top choice for setting up your offshore business. For offshore companies, Belize provides a permanent waiver from individual and corporate taxes.

You don’t need a specific amount of capital to get started, and the tax exemptions extend to inheritance, succession, and gifts. These perks make Belize a favorable destination for small businesses looking to reap significant benefits.

Privacy and Asset Protection in Belize

Belize has robust laws in place to protect the privacy of company members, ensuring that board members and business owners can operate without disclosing their identities.

Moreover, Belize offers strong asset protection by keeping individual assets separate from those of corporations.

However, it also maintains a balance between confidentiality and meeting regulatory requirements by disclosing names and account details in specific situations.

This is especially important given the reduced financial privacy safeguards in Europe.

Setting up a Business in Belize

Starting a business in Belize can be a smart move, especially with the country’s offer of permanent tax exemptions for offshore companies.

The process of setting up your company is straightforward, and Belize provides top-notch security and confidentiality, making it a desirable tax haven.

Moreover, offshore businesses can kick off with minimal capital and enjoy tax benefits.

These advantages make Belize a fantastic option for launching your new venture.

Very Common Questions & Some Answers

Do US Citizens Pay Taxes in Belize?

Yes, as a US citizen living in Belize, you’ll need to pay taxes to the IRS. Even though Belize offers residency and a favorable business environment, US tax laws still apply to American citizens. However, Belize does provide investment opportunities and offshore banking options that can help protect your assets.

Does Belize Have a Tax Treaty With United States?

Belize and the United States do not have a tax treaty in place. This lack of agreement affects how taxes are handled between the two countries and can lead to complications for businesses operating across borders. It also influences economic interactions and potential disagreements between Belize and the US regarding tax matters.

What Are the Tax Advantages of Belize?

When it comes to taxes in Belize, you get to enjoy some great benefits like offshore banking, corporate privacy, and safeguarding your assets. The business scene offers flexibility, easy operations, low setup costs, and no taxes on profits made from selling assets. Belize keeps regulations to a minimum and presents attractive investment prospects, making it a prime spot for tax advantages.

Why Register a Company in Belize?

When you set up a company in Belize, you’re tapping into a straightforward process with plenty of business flexibility and privacy perks. Belize company registration opens up opportunities for offshore banking, legal safeguards, and shielding your assets. It’s not just about establishing a business; it’s also a smart move for investing in a promising environment.

The TLDR on Belize as a Popular Tax Haven for US Startups and Citizens

Simply put, Belize’s tax haven status, business-friendly regulations, and strong privacy protections make it a great spot for US small businesses.

With tax exemptions and perks that can save you money, starting your business in Belize could give your startup the financial lift it needs.

Choosing Belize for your business could be a smart move that boosts your company’s potential for growth.

So, when you’re planning the future of your business, keep Belize in mind – it could make a real difference!!

Editor of Startups #nofilter