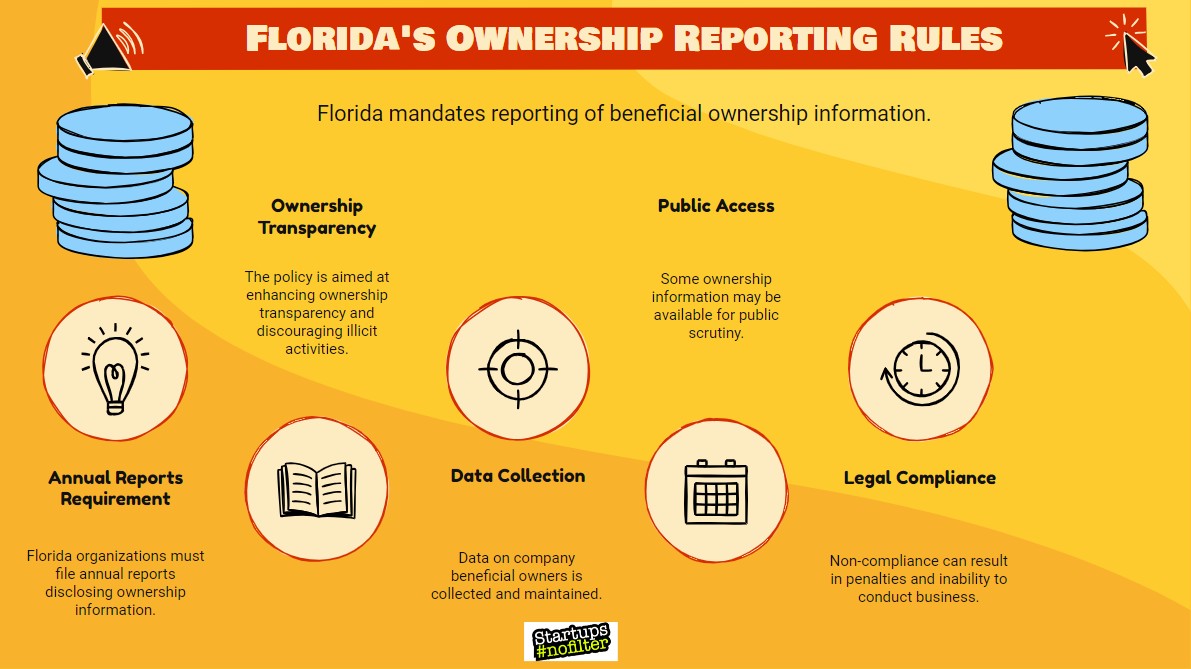

In Florida, beneficial ownership information reporting requirements can vary depending on the type of entity and its activities. Here are some important guidelines:

Guidelines

Corporations:

Florida requires corporations to maintain a list of their beneficial owners, including individuals who directly or indirectly own 25% or more of the corporation’s equity interests or voting rights. This information is typically included in the corporation’s records and must be provided to state authorities upon request.

Limited Liability Companies (LLCs):

Similar to corporations, LLCs in Florida are required to maintain records of their beneficial owners. Beneficial owners are individuals who directly or indirectly own 25% or more of the LLC’s membership interests. This information must be available for inspection by state authorities.

Partnerships:

Partnerships in Florida, including general partnerships, limited partnerships, and limited liability partnerships (LLPs), may be required to disclose beneficial ownership information as part of their registration or annual reporting requirements. The specific requirements can vary based on the type of partnership and its activities.

Trusts:

Florida law does not explicitly require trusts to disclose beneficial ownership information to state authorities. However, trustees have a fiduciary duty to act in the best interests of the trust’s beneficiaries and may be required to disclose relevant information as part of their duties.

Real Estate Transactions:

In certain real estate transactions, such as the purchase or sale of residential or commercial properties, individuals or entities may be required to disclose beneficial ownership information as part of the transaction process. This FL requirement is aimed at preventing money laundering and other illicit activities in the real estate sector.

Financial Institutions:

Financial institutions operating in Florida, including banks, credit unions, and money services businesses, are subject to federal anti-money laundering regulations, which may include requirements to collect and verify beneficial ownership information from customers as part of their customer due diligence procedures.

- It’s important for entities operating in Florida to consult with legal or financial advisors to ensure compliance with relevant laws and regulations regarding beneficial ownership information reporting. Additionally, staying informed about any updates or changes to regulatory requirements is essential for maintaining compliance over time.

10 Things to Consider When Filing the BOIR in Florida:

- Regulatory Compliance in Florida: Ensuring adherence to the specific state-level regulations and requirements established by Florida authorities concerning beneficial ownership reporting.

- Florida’s Customer Due Diligence (CDD) Practices: Implementing robust CDD procedures tailored to Florida’s regulatory environment to accurately identify and verify beneficial owners of entities operating within the state.

- AML/CFT Regulations in Florida: Complying with Florida’s anti-money laundering and combating the financing of terrorism (AML/CFT) regulations, which may include unique provisions related to beneficial ownership reporting to mitigate the risk of financial crimes.

- Corporate Governance Practices in Florida: Establishing and maintaining effective corporate governance practices consistent with Florida’s legal framework, emphasizing transparency and accountability in reporting beneficial ownership information.

- Technology and Data Management Solutions for Florida Entities: Leveraging technology solutions and data management practices that align with Florida’s privacy and data protection laws to securely collect, store, and manage beneficial ownership information.

- Legal Considerations Specific to Florida: Understanding the legal nuances of beneficial ownership reporting in Florida, including privacy rights, data protection laws, and potential liabilities for non-compliance within the state’s jurisdiction.

- Florida’s Alignment with International Standards: Staying informed about how Florida aligns with international standards and best practices related to beneficial ownership transparency, and any implications for entities operating within the state.

- Training and Awareness Initiatives in Florida: Conducting training programs and raising awareness among employees and stakeholders in Florida about the significance of beneficial ownership reporting and their roles in ensuring compliance with state regulations.

- Enforcement Measures and Penalties in Florida: Understanding the enforcement mechanisms and potential penalties for non-compliance with beneficial ownership reporting requirements specific to Florida, including regulatory actions and sanctions imposed by state authorities.

- Florida-Specific Industry Regulations: Recognizing industry-specific regulations and additional requirements related to beneficial ownership reporting in Florida, such as those applicable to financial institutions, real estate entities, or professional service providers operating within the state.

9 Steps to File a Beneficial Ownership Information Report in Florida:

Filing a beneficial ownership report in Florida typically involves following specific procedures established by the state authorities. Here are the general steps to file such a report:

- Gather Required Information: Collect all necessary information about the beneficial owners of your entity as required by Florida law. This includes details such as names, addresses, dates of birth, identification numbers, and ownership interests.

- Review Applicable Regulations: Familiarize yourself with the relevant regulations and reporting requirements governing beneficial ownership information in Florida. This may involve reviewing state statutes, administrative rules, or guidance provided by regulatory agencies.

- Choose the Correct Form or Method: Determine the appropriate form or method for filing the beneficial ownership report. Depending on the type of entity and its activities, you may be required to use a specific form provided by the state or submit the information electronically through an online portal.

- Complete the Form or Documentation: Fill out the required form or documentation accurately and completely. Provide all requested information about the beneficial owners of your entity, ensuring compliance with the formatting and submission requirements specified by the state.

- Verify Information Accuracy: Double-check the information provided for accuracy and completeness. Ensure that all names, addresses, and other details are spelled correctly and match the supporting documentation.

- Submit the Report: File the completed beneficial ownership report with the appropriate state agency or regulatory authority responsible for receiving such filings in Florida. This may involve submitting the report online through an electronic filing system or mailing it to the designated address.

- Pay Any Required Fees: Be prepared to pay any applicable filing fees associated with submitting the beneficial ownership report. Review the fee schedule provided by the state agency to determine the amount due and acceptable payment methods.

- Retain Records for Compliance: Keep copies of the filed beneficial ownership report and supporting documentation for your records. Maintaining accurate records is essential for demonstrating compliance with regulatory requirements and facilitating any future audits or inquiries.

- Monitor for Updates: Stay informed about any updates or changes to beneficial ownership reporting requirements in Florida. Regularly check for updates from state authorities or consult with legal advisors to ensure ongoing compliance with evolving regulations.

Common FAQ for Beneficial Ownership in FL:

- What entities in Florida are required to report beneficial ownership information? In Florida, various types of entities may be subject to beneficial ownership reporting requirements, including corporations, limited liability companies (LLCs), partnerships, and other business entities. The specific reporting obligations can vary based on factors such as the entity’s structure, activities, and regulatory classification.

- Is there a threshold for reporting beneficial ownership in Florida? Florida law may require entities to report beneficial ownership information for individuals who meet certain ownership or control thresholds. For example, individuals who directly or indirectly own a certain percentage of equity interests or voting rights in the entity may be considered beneficial owners and subject to reporting requirements. It’s essential for entities to understand the applicable thresholds and criteria for reporting under Florida law.

- How do I file a beneficial ownership report in Florida? To file a beneficial ownership report in Florida, entities typically need to complete and submit the appropriate form or documentation to the designated state agency or regulatory authority. Depending on the entity type and reporting requirements, this may involve using a specific form provided by the state or submitting the information electronically through an online portal. Entities should ensure they follow the prescribed procedures and adhere to any formatting and submission requirements outlined by Florida authorities.

- Are there any penalties for non-compliance with beneficial ownership reporting requirements in Florida? Failure to comply with beneficial ownership reporting requirements in Florida can result in various penalties and consequences. Depending on the severity of the non-compliance, entities may face fines, sanctions, or legal repercussions imposed by state authorities. Additionally, non-compliance with reporting obligations can damage an entity’s reputation, lead to regulatory scrutiny, and hinder its ability to conduct business in Florida. It’s crucial for entities to understand and adhere to their reporting obligations to avoid potential penalties and ensure compliance with Florida law.

Editor of Startups #nofilter