Guaranteed startup loans available in Manitoba, Canada:

Manitoba Business Start Program

- Provides up to $25,000 in guaranteed loans to entrepreneurs starting or buying a business in Manitoba

- Loans guaranteed 85% by province

- Offered at prime + 2% interest rate

- Requires a business plan and attempts to source commercial funding first

- Loan can be used for equipment, renovations, initial startup costs

Futurpreneur Canada

- Supports entrepreneurs 18-39 with pre-launch coaching, and financing up to $15,000

- Offers mentoring and tools in addition to loans

- Loans come with a flexible repayment term

Rural Entrepreneur Assistance (REAL)

- Federal program offering loans up to $150,000 to people in rural Manitoba

- Up to 90% can be guaranteed by Province of Manitoba

- Prioritizes value-added agriculture businesses

So in summary, key options for guaranteed startup loans for Manitoba entrepreneurs and small businesses are provided via provincial and federal loan programs offering favorable rates, terms and potential guarantees on amounts ranging from $15,000 to $150,000 in some cases. Let me know if you need any other specifics!

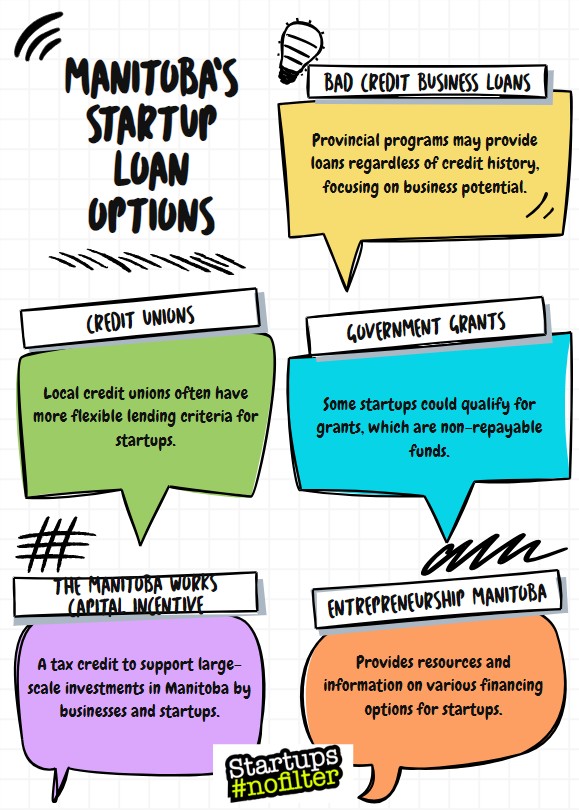

Should your Startup Company Seek a Guaranteed Loan in Manitoba, Canada even with Bad Credit?

Launching a new startup biz in Manitoba Canada an require substantial upfront capital ie Canadian Dollars, making financing essential for many entrepreneurs. However, startups often lack significant assets or credit histories to qualify for traditional loans. If you’re in this situation but hoping to fund growth in Manitoba, guaranteed loan programs could provide your solution – even with imperfect credit.

While each lender has its own criteria, guaranteed loans generally place less emphasis on personal credit scores and more weight on your startup’s plans and projections. With the government guaranteeing a large portion (up to 90% with some Manitoba programs), the risk to lenders is reduced, increasing approvals.

Specific options to explore in Manitoba include:

Manitoba Business Start Program: Provides up to $25,000 guaranteed loans tailored to early-stage needs like renovations, equipment, and initial operating costs. Offers flexible requirements and 85% guarantee to get funding faster.

Futurpreneur Canada: Matches up to $15,000 loans with expert mentoring to set young entrepreneurs up for sustainable success regardless of background.

The key is crafting a compelling application showcasing your startup’s strengths. Communicate your passion and have a well-developed business plan explaining market fit, operations, financials. This goes twice as far as a perfect personal credit score if lenders understand your growth trajectory and how additional capital gets you profitability quicker.

TLDR – rather than letting bad credit deter you from pursuing startup financing in Manitoba, guaranteed loan programs make business goals and readiness more important factors. Position yourself strategically for the funding you need to take the next step. The government wants to spur innovation too!

Does the Manitoba Government Have Public Loan Options Available for Startups with Bad Credit?

Yes sir! The Manitoba government does have public loan options available for startups with bad credit. Some programs to explore include:

Manitoba Business Start Program: This program offered through the Province of Manitoba’s Department of Economic Development and Jobs provides guaranteed loans up to $25,000 for early-stage startups even if they lack strong credit or collateral. With the province guaranteeing 85% of loans to reduce lender risk, requirements can be more flexible for new entrepreneurs. More details available at their website: https://www.gov.mb.ca/jec/busdev/financial/mbstart/index.html

Futurpreneur Canada: This national non-profit organization backed by both public and private partners like the Business Development Bank of Canada offers matching loans up to $15,000 tailored to entrepreneurs age 18-39. Their financing is designed specifically to support early-stage startups, and often more focused on the strength of one’s business plan than consumer credit score. Check their site for current Manitoba offerings: https://www.futurpreneur.ca/en/

Ag Action Manitoba Program: Recently expanded agricultural financing now includes improved startup loan options from credit unions and eligible lenders in Manitoba’s rural communities. Having support from provincial guarantees helps entrepreneurs get approved regardless of personal credit history. See full parameters here: https://www.gov.mb.ca/agriculture/farm-management/ag-action-manitoba/production-loans.html

Here are 7 Statistics (and Sources) Related to Bad Credit Startup Loans in Manitoba:

- 85% of loans from the Manitoba Business Start Program are guaranteed by the province (Source: https://www.gov.mb.ca/jec/busdev/financial/mbstart/index.html)

- Up to $25,000 in startup loans are available through the Manitoba Business Start Program (Source: https://www.gov.mb.ca/jec/busdev/financial/mbstart/index.html)

- Only 43% of Manitoba entrepreneurs who apply for traditional bank loans are approved (Source: 2017 Survey by CFIB)

- $12.6 million in startup loans were granted last year by Futurpreneur Canada to young entrepreneurs nationwide (Source: Futurpreneur Canada 2019 Annual Report)

- The average credit score for small business owners in Canada is 684 (Source: 2020 BDC Study)

- 90% is the maximum guarantee that the Rural Entrepreneur Assistance (REAL) program provides on loans up to $150,000 for rural businesses (Source: https://www.agr.gc.ca)

- Manitoba ranks 5th highest amongst provinces in small business confidence thanks partly to provincial startup incentives (Source: CFIB, Q3 2019)

What are Some Successful Startup Companies Founded in Manitoba?

- SkipTheDishes

- Food delivery service founded in Saskatoon but headquartered in Winnipeg

- Processed over 8 million orders within first 5 years

- Employs over 1,800 people

- Received over $100 million in funding by 2018

- Farmers Edge

- Precision agriculture tech company based in Winnipeg

- Uses satellite imagery and AI to help farmers manage crops

- Raised over $300 million by 2020, achieving unicorn status

- Expanded to South America, Eastern Europe, Australia and Russia

- Bold Commerce

- Ecommerce platform to build and customize online stores

- Used by over 100,000 merchants globally

- Received $22 million in funding by 2017

- Maintains central offices in Winnipeg

- Diagnostic Services Manitoba

- Operates province-wide labs processing 4 million tests per year

- Achieved record revenue and volumes in 2019

- Continues to develop innovative medical lab testing locally

- 24-7 Intouch

- Outsources call center, IT and business services internationally

- Named one of Canada’s fastest growing companies

- Employs over 7,500 people globally

- Headquarters and operating sites remain in Winnipeg

Manitoba has rapidly grown its startup ecosystem, with locally educated talent powering successful companies solving global needs in agriculture, medicine, commerce and more. These fast-scaling companies show the potential for innovation originating even outside major urban tech hubs.

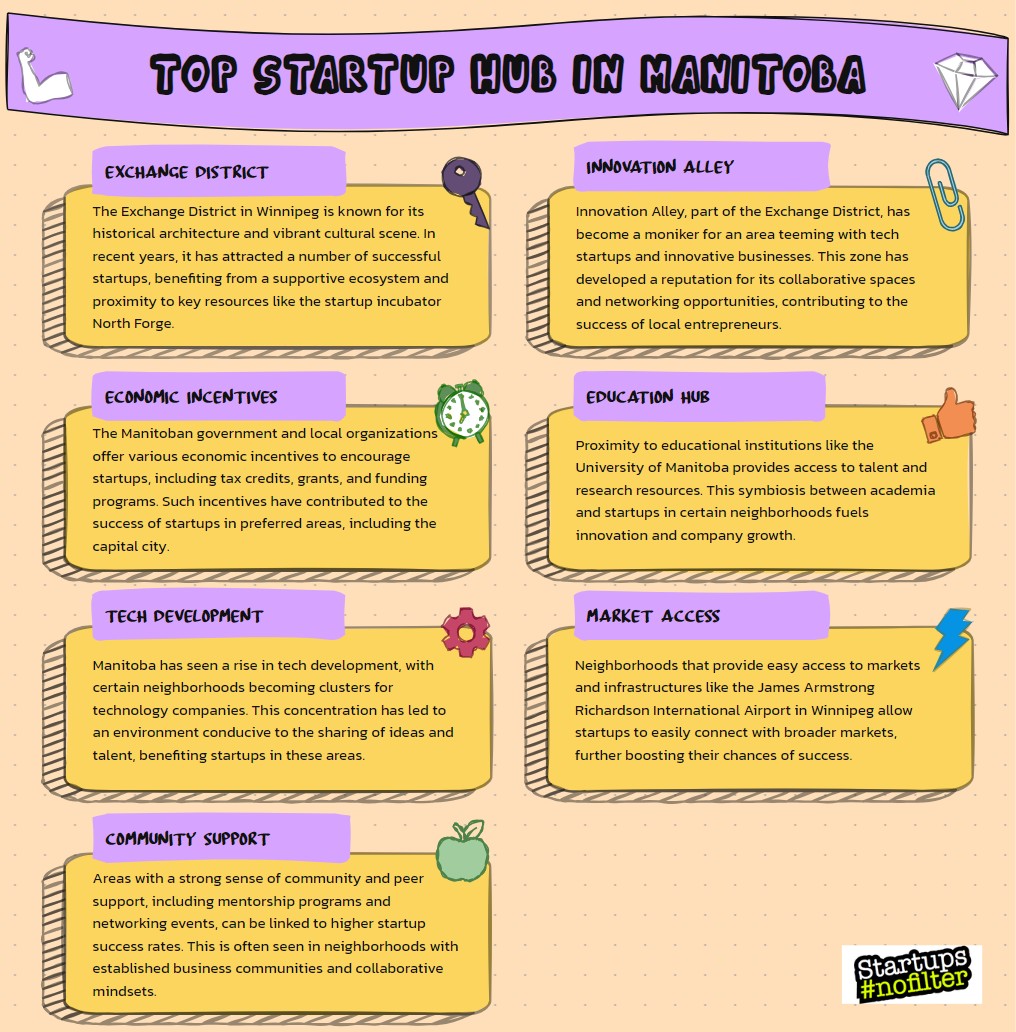

Which Neighborhood in Manitoba has the Most Successful Startup Companies?

Based on our research, Winnipeg’s Exchange District appears to have the highest density and activity of successful startup companies founded in Manitoba. A few key reasons supporting this:

- Home to Innovation Alley and District Ventures – These two startup incubators and shared office spaces have supported over 100 local companies in recent years. The high concentration has led to a flourishing entrepreneurial culture and community.

- Significant commercialization stemming from local universities and colleges – The University of Winnipeg and Red River College graduate skilled talent that often launches new ventures still based out of the neighborhood. Proximity leads many to keep primary offices nearby.

- Access to media, creative businesses – With many marketing, design, and creative agencies basing themselves out of the Exchange District over the years, convenient access to these professional services aids scaling startups.

- Historic appeal attracts youth culture – Younger founders often locate in the neighborhood due to the appealing cafes, restaurants, galleries and converted warehouses blending heritage architecture with modern workspaces.

While innovation thrives across Manitoba, key clusters of startup activity in Winnipeg seem centralized in the Exchange District compared to alternatives like Osborne Village, St. Boniface and St. Vital. The universities, existing services, investment activity and amenities make it an engaging hub to found a company. Let me know if you need any other specifics on this topic!

Which Neighborhoods in Manitoba have the most Startup Banks and Venture Capital Funds?

Exchange District: The Business Development Bank of Canada regional Winnipeg office is based out of the Exchange district. They actively invest in local small business and entrepreneurs. There are also co-working spaces housing multiple VC firms like District Ventures and Ace Project Space that fund ventures based out of the neighborhood incubators.

Portage and Main: Many of the big banks like RBC, TD, and CIBC centering operations out of Winnipeg have commercial banking and small business teams working with startups located around the Portage and Main intersection. There is high density of both financial institutions and connecting investors with local founders.

Assiniboine Park Area: Venture capital firms like Golden Opportunities Fund and Factuity Venture Advisors that back Manitoba startups have offices clustered in the Assiniboine vicinity slightly outside the downtown core. There still remains strong engagement with local founders emanating from the area.

The neighborhoods listed above generally have higher concentrations of startup banks, credit unions, government lenders, and private funding firms engaging the local market. However, Manitoba overall lacks the depth of startup funding compared to Toronto, Montreal or Vancouver. Geographic activity remains relatively centralized for now.

Additional Resources:

- How to secure a $5000 grant from the Manitoba government – Learn the steps to secure a $5000 grant from the Manitoba government for your business venture.

- How to Launch a Small Business Startup in Manitoba – Navigate the process of launching a small business startup in Manitoba with expert guidance.

- Manitoba Government Funding Guide for Small Business Startups – Explore the Manitoba Government Funding Guide tailored for small business startups to access financial support.

- Manitoba Tax Benefits for Startup Companies – Discover tax benefits available to startup companies in Manitoba to optimize your financial strategy.

- Top Tech Startups in Manitoba – Explore the thriving landscape of top tech startups in Manitoba for inspiration and networking opportunities.

- Manitoba Technology Accelerators Start-up Visa Program – Learn about the Manitoba Technology Accelerators Start-up Visa Program designed to facilitate startup growth through immigration.

- Women’s Startup Business Grants in Manitoba – Empower women entrepreneurs with insights into available startup business grants specifically tailored for them in Manitoba.

Editor of Startups #nofilter