To benefit from tax advantages for startup companies in Manitoba, meet government qualifications with a permanent establishment and active business operations. Make sure assets and revenue align with the annual limit of $15 million and invest a minimum of $25,000 in cash equity.

Enjoy non-refundable tax credits up to 45%, issue eligible shares within set investment boundaries, and consider Controlled Private Corporation criteria. Deductible startup expenses cover essential costs tied to business launching, excluding personal expenses. Apply for the Small Business Venture Capital Tax Credit program, get a guaranteed startup loan despite bad credit in Manitoba, or comply with criteria and submission requirements, and seek professional guidance for best tax savings. Discover more ways to optimize your financial strategy and growth potential.

Startup Eligibility Criteria for Tax Benefits in Manitoba

To qualify for tax benefits in Manitoba, startup companies must meet specific eligibility criteria outlined by the provincial government. The Income Tax Act of Manitoba requires that corporations have a permanent establishment in the province to be eligible for these tax credits.

Additionally, businesses must have assets used in active business operations and derive revenue from such activities. To qualify, annual revenue shouldn’t exceed $15 million, or the business should have fewer than 100 full-time equivalent employees. An essential requirement is a minimum cash equity investment of $25,000 for eligible Manitoba enterprises.

Also, at least 25% of employees must reside in Manitoba for the corporation to meet residency criteria. These stringent guidelines make sure that only deserving businesses benefit from the Small Business Venture Capital tax incentives.

Types of Tax Credits Available

Explore the diverse range of tax credits available through the Small Business Venture Capital Tax Credit program in Manitoba for eligible small businesses.

- Non-Refundable Tax Credit: Small businesses can benefit from a non-refundable tax credit of up to 45% under this program.

- Eligible Shares: Companies can issue eligible shares to investors with a minimum investment of $10,000 per investor and a maximum limit of $500,000 per company.

- Controlled Private Corporation: To qualify, businesses must meet specific criteria such as having a permanent establishment in Manitoba and meeting revenue and employee thresholds.

- Commercial Crop Production: Certain limitations exist on the shares that can be issued per company and per investor.

- Program Resources: Detailed guidelines and application documents are available in PDF format for reference and submission.

Deductible Startup Expenses

Discover the essential criteria for deductible startup expenses in Manitoba and ensure they align with the business’s initial operational needs.

In Manitoba, deductible startup expenses encompass essential costs like advertising, insurance, and professional fees. These expenses must be important and directly connected to launching the business. It’s important to mention that personal expenses don’t fall under deductible startup costs.

To be eligible for deduction, the business must be active during the fiscal period when these expenses are incurred. The Canada Revenue Agency (CRA) provides a detailed list of allowable deductible startup expenses on their website.

Ensuring your expenses meet these criteria will help in optimizing your capital allocation and tax benefits as you establish your business in Manitoba.

Application Process for Tax Incentives

When considering Manitoba’s tax benefits for startup companies, understanding the specific Application Process for Tax Incentives is essential for maximizing potential savings and compliance with regulatory requirements.

- Companies must apply for approval to participate in the Small Business Venture Capital Tax Credit program in Manitoba.

- Approved corporations must meet specific criteria and have a permanent establishment in Manitoba.

- The application process involves submitting required documents and meeting eligibility requirements.

- Legal advisors can help with evaluating eligibility, completing applications, and ensuring compliance.

- Once approved, companies have 12 months to close the offering, with the option of an extension if needed.

Maximizing Tax Savings for Startups in Manitoba

To maximize tax savings for your startup in Manitoba, strategically leveraging the available non-refundable tax credits based on specific investment criteria can greatly impact your financial outcomes. One key aspect to contemplate is that as a Canadian Controlled Private Corporation in Manitoba, your small business Manitoba start-up could be eligible for significant tax credits. By ensuring your company meets the criteria of annual revenues under $15 million and less than 100 full-time equivalent employees, you can qualify for the tax credit. Investing in approved shares of at least $10,000 per investor can access tax benefits of up to 45% for eligible Manitoba enterprises, with a maximum credit of $225,000 per year per company. Furthermore, companies meeting specific requirements could receive up to $500,000 in tax credits, providing substantial savings opportunities.

| Criteria | Maximum Tax Credit | Eligibility |

|---|---|---|

| Annual Revenues < $15 million | Up to 45% | Small business start-ups in Manitoba |

| < 100 Full-time Equivalent Employees | $225,000/year | Canadian Controlled Private Corporations |

| Direct Investment of $10,000 | Up to $500,000 | Eligible Manitoba enterprises |

Common questions about Manitoba Taxes for Startups

- What Is the Small Business Limit in Manitoba?

- The small business limit in Manitoba for small business deductions is $500,000. Manitoba tax breaks provide provincial tax exemptions for startup company benefits. Consider tax planning strategies to maximize income tax thresholds and take advantage of Manitoba tax relief.

- What Is the Corporate Income Tax Rate in Manitoba?

- The corporate income tax rate in Manitoba is 12%, but small businesses can benefit from a reduced rate of 0% on their first $450,000 of income. Understanding these tax implications is important for your tax planning strategies.

- What Manitoba Tax Credits Can I Claim?

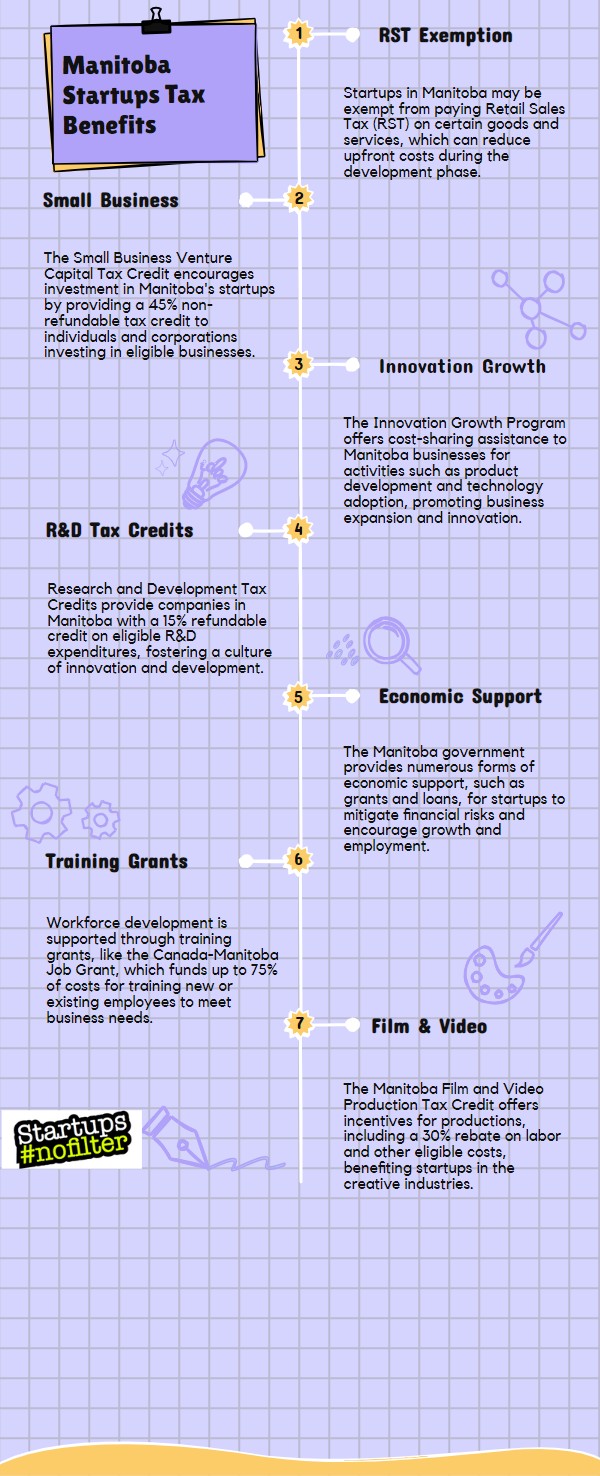

- You can claim various tax credits in Manitoba for startup expenses, research, innovation grants, technology development, employee benefits, export opportunities, and sustainability investments. Explore these incentives to maximize your company’s financial benefits.

- What Is the Manitoba CED Tax Credit?

- You can benefit from the Manitoba CED Tax Credit as a startup seeking funding. This program encourages economic development through investment opportunities, providing financial incentives for business growth. It supports entrepreneurial ventures by offering tax savings and valuable support.

Final thoughts on amazing tax benefits for Manitoba Startups

Overall, Manitoba offers a range of tax benefits for startup companies. These include eligibility criteria, various types of tax credits, deductible startup expenses, and a streamlined application process. By taking advantage of these incentives, startups can maximize their tax savings and improve their financial viability.

It’s important for entrepreneurs to thoroughly understand the tax benefits available to them. This understanding will help them make informed decisions that will benefit their business in the long run.