You would be surprised by Manitoba’s diverse government funding options like grants, loans, tax credits, and specialized programs. These resources cater to small business startups, aiding in the establishment and growth of ventures.

Eligibility criteria vary, and aligning with these requirements is essential for successful applications. Different types of grants, such as innovation and business expansion grants, are available to support your specific business goals.

Understanding the application process, financial planning, and key factors for funding success are vital steps. Discover top government grant programs and valuable resources for business development in Manitoba. Access the potential for your startup’s success.

Understanding Manitoba Government Funding

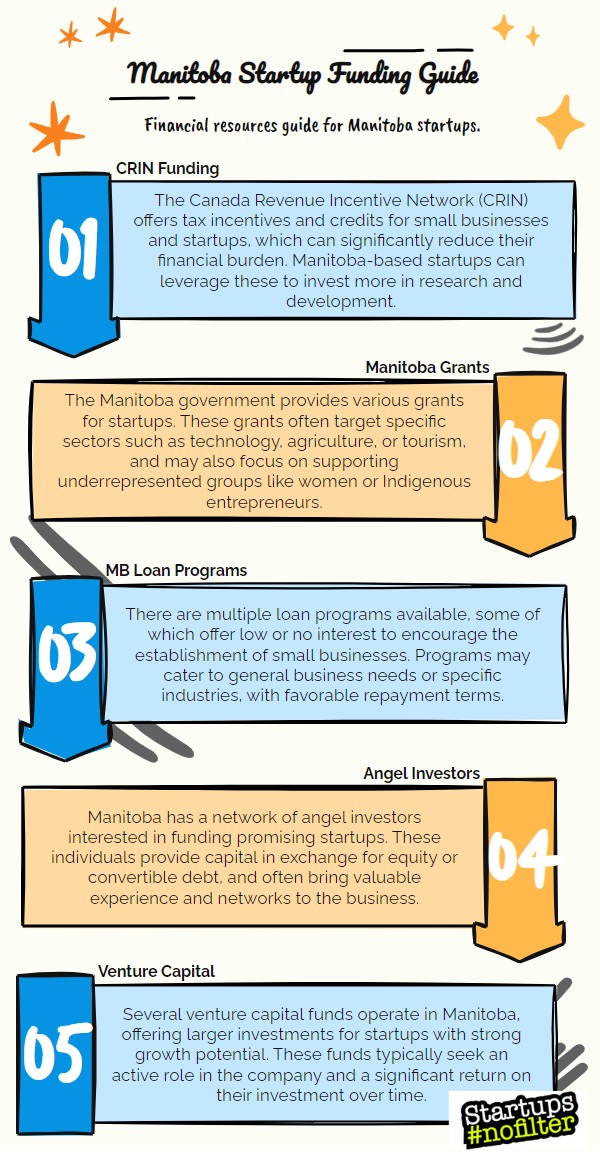

To grasp the intricacies of Manitoba Government Funding for small business startups, understanding the diverse range of financial support options available is essential. Small business owners in Manitoba have access to various government funding options such as grants, loans, tax credits, and funding programs tailored to support their unique business models. Bad credit startup loans are also available in Manitoba.

These funding avenues serve as vital lifelines for entrepreneurs looking to establish or expand their ventures. Grants offer non-repayable funds, while loans provide financial assistance that must be paid back over time. Tax credits enable businesses to reduce their tax liabilities, fostering financial stability.

Eligibility Criteria for Small Businesses

When considering eligibility for small business funding in Manitoba, ensure your business operates legally within the province.

Small businesses in Manitoba seeking government funding must meet specific eligibility criteria. Eligible entities include small and medium businesses, for-profit corporations, and sometimes not-for-profits. Grant eligibility may also be location-specific within the province.

Each grant program has its own set of criteria that businesses must meet to qualify. It’s important to thoroughly identify and understand these eligibility requirements before applying for small business grants in Manitoba.

Types of Business Grants Available for Small Business Startups in Manitoba, Canada

When considering the types of business grants available in Manitoba, it’s essential to understand the grant application process and the eligibility criteria requirements.

By grasping these key points, you can strategically align your small business goals with the specific grants that best suit your needs.

This proactive approach can help you secure the necessary funding to propel your business forward.

Grant Application Process

For small business owners in Manitoba seeking financial support, exploring the various types of business grants available can be a strategic step towards enhancing competitiveness and sustainability. The Manitoba government offers grants such as innovation grants, business expansion grants, and research and development grants to support small businesses.

To apply for these grants, small business owners need to understand the grant application process, which involves following specific eligibility criteria, financial guidelines, and deadlines set by the government. Ensuring that the application is submitted correctly and following the funding assistance guidelines is essential for a successful grant approval.

Eligibility Criteria Requirements

Businesses in Manitoba can access a range of grants tailored to support their growth and development by meeting specific eligibility criteria requirements. Different grant programs are available for Manitoba small businesses, including for-profit companies, to assist in obtaining funding.

It’s important to understand the eligibility criteria set for each program. Eligibility may vary based on the type of business and its location within the province. Ensuring legal operations within Manitoba is a fundamental requirement to qualify for government grants. By carefully examining and fulfilling the eligibility criteria of each grant program, businesses increase their chances of a successful application.

| Eligibility Criteria | Description |

|---|---|

| Business Type | Small and medium businesses, for-profit corporations, and sometimes not-for-profits. |

| Location | Grants may have location-specific eligibility criteria within Manitoba. |

| Legal Operations | Businesses must operate legally within Manitoba to be eligible for government funding. |

Application Process for Funding

To initiate the funding application process effectively, guarantee your business plan meticulously details financials and projections. Some key steps to take into account include:

- Familiarize yourself with specific requirements, eligibility criteria, and deadlines of each funding program.

- Be prepared for potential personal capital investment requirements from the business owner.

- Make sure your business plan and PitchDeck are well-prepared and professional.

Key Factors for Funding Success

To guarantee funding success for your small business startup in Manitoba, it’s vital to closely align with the specific eligibility criteria and follow application process tips.

Understanding the nuances of the requirements, necessary documentation, and deadlines can greatly increase your chances of securing funding.

Seeking guidance from experienced organizations and utilizing helpful tools can streamline the process and enhance your overall funding approval prospects.

Funding Eligibility Criteria

Ensuring your business complies with Manitoba’s legal requirements is paramount to qualify for government funding. When considering funding eligibility criteria in Manitoba, keep in mind the following key points:

- Small and medium businesses, for-profit corporations, and sometimes not-for-profits are eligible for funding.

- Eligibility criteria may vary among different grant programs in Manitoba.

- Location-specific grants may have specific eligibility requirements for businesses.

Understanding and meeting these criteria are essential for a successful funding application. By aligning your business with Manitoba’s regulations and the specific requirements of grant programs, you increase your chances of securing the necessary funding for your Small Business Startup.

Application Process Tips

Developing a thorough business plan is crucial for maximizing your chances of success in the application process for funding your Manitoba small business startup. Make sure your business is legally registered in Manitoba before applying for government funding.

Familiarize yourself with the specific requirements, eligibility criteria, application process, required documents, and deadlines for each funding program offered by the Manitoba government. Some funding programs may require a personal capital investment to qualify for assistance.

Utilize professional guidance and resources like CanadaStartups to craft a robust business plan and PitchDeck, enhancing your prospects of securing funding. By understanding and meeting the criteria and requirements of the available programs, business owners can streamline the application process and increase their likelihood of funding success.

Top Government Grant Programs

When exploring government grant programs in Manitoba for small business startups, it’s imperative to assess the various funding opportunities available to support entrepreneurs. Here are some top government grant programs to contemplate:

- Canadian Agricultural Partnership (CAP) Funding: $176 million allocated over five years.

- Small Business Venture Capital Tax Credit: Up to a 45% non-refundable tax credit for investors.

- Manitoba Bridge Grant Program: One-time financial relief of $5,000 for businesses impacted by the COVID-19 pandemic.

These programs offer significant support for small businesses in Manitoba, aiding in startup or expansion efforts and contributing to the growth of the Manitoba economy. Be sure to explore these opportunities further in the Funding Database provided by the Canadian government.

Financial Planning for Startups

How can small business startups establish a solid financial foundation for sustainable growth and success?

To guarantee success, business owners in Manitoba must access all government funding, loans, and funding options available. Utilize tools like the Funding Calculator Tool to determine the funding you need. By understanding startup costs, revenue streams, and financial risks, businesses affected can create detailed budgets, cash flow projections, and financial forecasts essential for securing funding.

Financial planning aids in making informed decisions, resource management, and achieving long-term goals. Regularly reviewing and adjusting financial plans enables startups to adapt to changing market conditions and business needs. Government agencies offer valuable resources to support startups in their financial planning journey.

Resources for Business Development

To enhance your business growth and development in Manitoba, leverage the resources offered by small business startup centers like Erickson, Ansell, and Gonor for valuable support and guidance. These centers provide workshops, training programs, and networking opportunities to assist entrepreneurs in starting and managing their businesses efficiently.

Additionally, Manitoba government funding resources focus on key sectors like agriculture and technology to promote innovation and job creation. Business owners can access resources for emergency preparedness and business continuity planning, ensuring operational resilience during crises.

Collaboration with universities and research institutions in Manitoba encourages innovation and research initiatives for small business development, fostering a supportive environment for businesses in the region.

Commonly Asked Questions

- Can You Get Money From the Government to Start a Business?

- You can get money from the government to start a business through various funding options like government grants, startup funding, financial assistance, business grants, entrepreneurial support, and small business loans. Understanding eligibility criteria and guidelines is essential.

- How to Get a Loan to Start a Business in Canada?

- To get a loan to start a business in Canada, explore different loan options, meet eligibility requirements, prepare a solid business plan, secure collateral, understand repayment terms, apply through a strategic process, and compare interest rates.

- How Much Is It to Register a Business in Manitoba?

- Registering a business in Manitoba involves a $250 fee for a sole proprietorship or $325 for a corporation. Additionally, there is a $60 fee to register a business name. You can complete the registration process online or in person.

The TLDR on Manitoba Government Funding Guide for Small Business Startups in 2024:

To sum up, exploring the Manitoba government funding landscape can be a strategic and lucrative opportunity for small business startups. By grasping eligibility criteria, types of grants available, and the application process, entrepreneurs can enhance their chances of funding success.

Leveraging top government grant programs and resources for business development will aid in financial planning and overall growth. With careful planning and perseverance, small businesses in Manitoba can access the support they need to thrive.

View this post on Instagram