If you’re a Canadian citizen or landed immigrant aged 18 to 29, you could qualify for a $5000 grant to kickstart your small business in Manitoba!! Hell yea! This is way better than having to take out a bad credit startup loan in Manitoba.

The grant focuses on supporting profitable, year-round businesses that offer full-time self-employment opportunities. The application process involves meeting specific criteria and presenting a detailed business plan.

Additionally, you may be eligible for financial support of up to $10,000 to cover start-up costs. This grant also provides technology enhancement resources to bolster your business capabilities. Learn how this grant can benefit your small business startup in Manitoba.

Eligibility Requirements

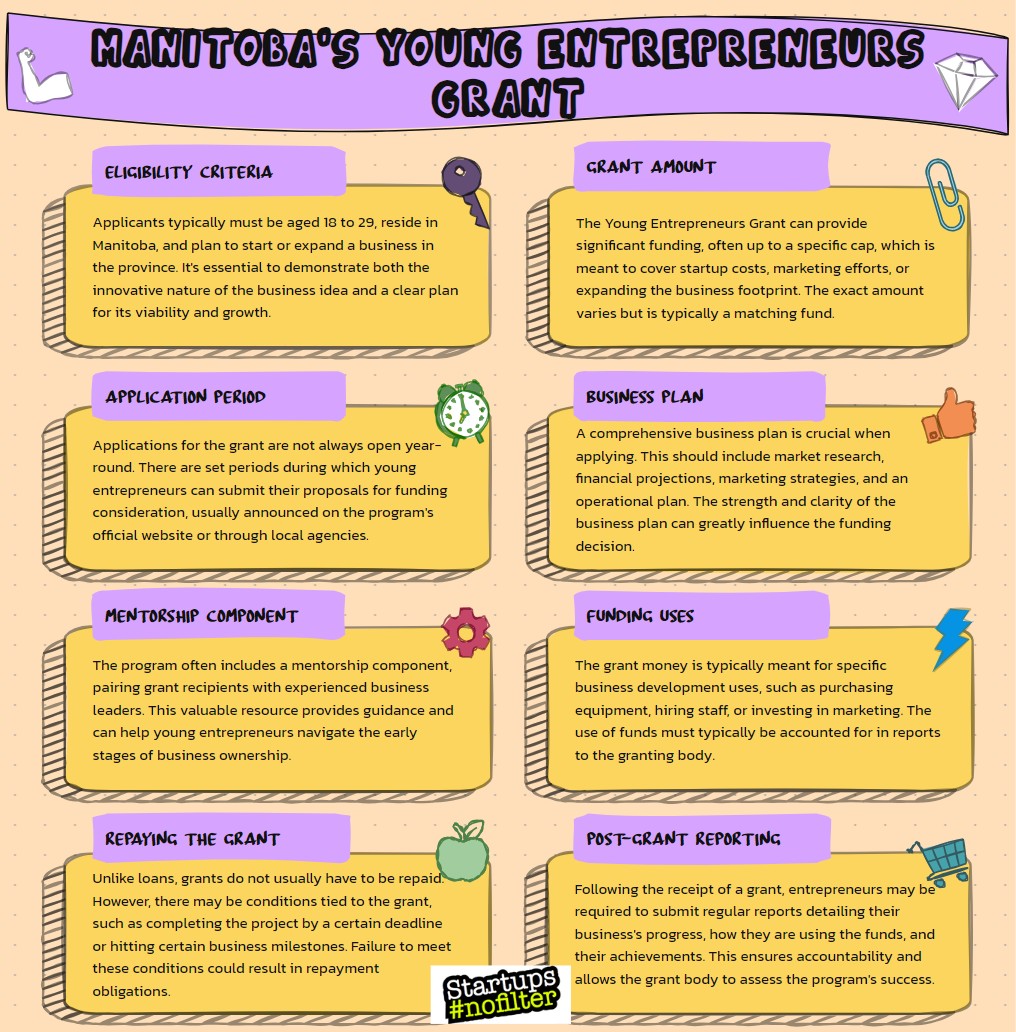

To qualify for the small business startup grant in Manitoba, you must meet specific eligibility requirements. Applicants must be Canadian citizens or landed immigrants aged between 18 to 29.

The business must be profitable, year-round, provide full-time self-employment, and managed by the principal applicant. Additionally, businesses operational for up to twelve months are eligible to apply for the grant.

Ensuring your business meets these criteria is essential in securing the small business startup grant in Manitoba. By adhering to these requirements, you pave the way for financial assistance that can greatly boost your entrepreneurial endeavors.

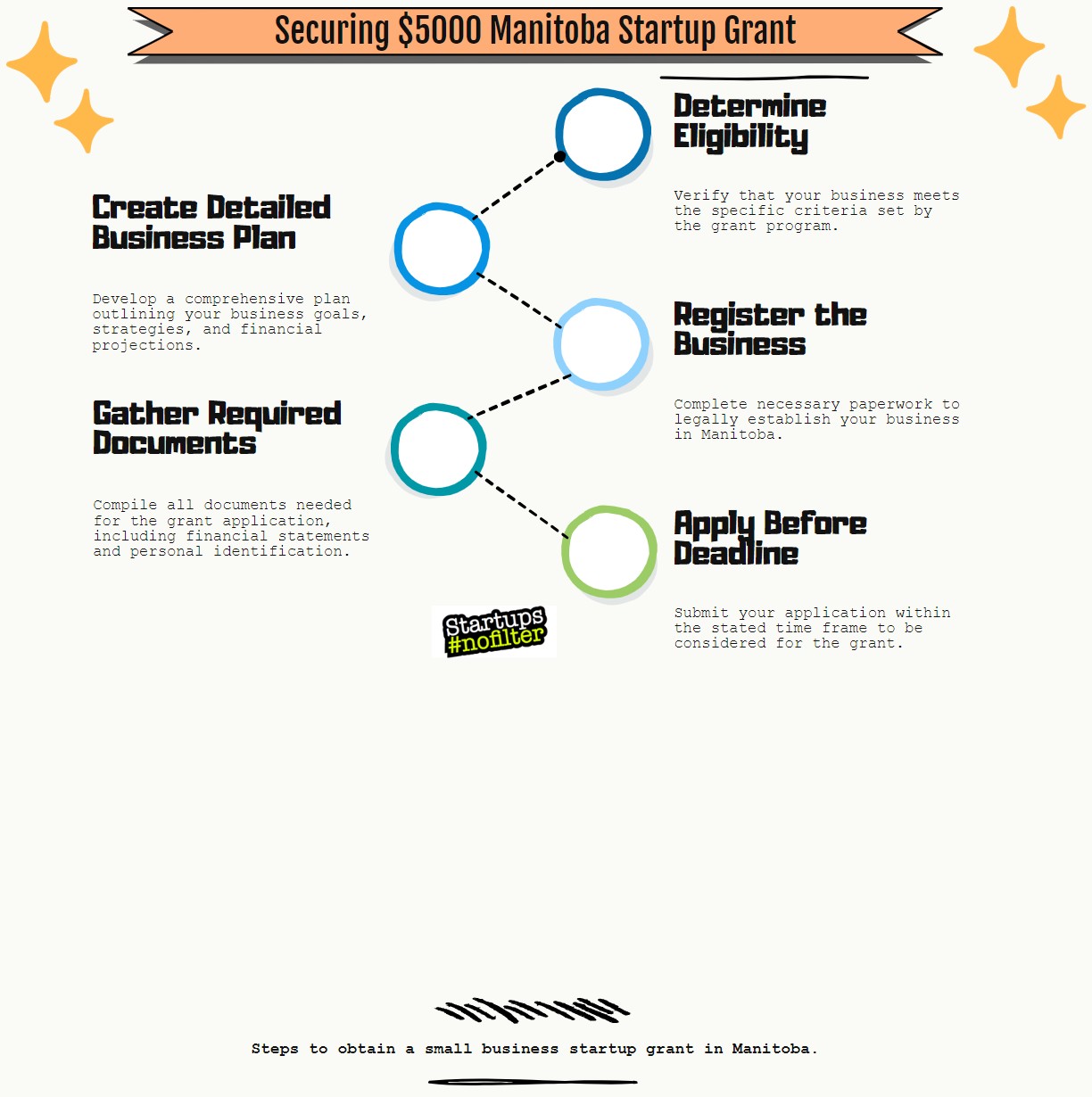

Application Process for the $5000 Manitoba Small Business Grant

Completing the Young Entrepreneurs Grant application form is the initial step in the process of applying for the small business startup grant in Manitoba.

Before submitting your application, make sure to review the Business Plan Overview checklist to guarantee all necessary documents are included. It’s recommended to keep copies of all application materials for your records.

Applications can be submitted either via email or mail to the designated authority.

To strengthen your application, maintain a detailed log of your daily business activities and hours worked. This information won’t only support your grant application but also demonstrate your dedication to your business venture.

Financial Support Details

When considering the financial support details for the small business startup grant in Manitoba, it’s important to understand the eligibility criteria overview, application process details, and funding disbursement timeline.

This information will guide you through the necessary steps to qualify for up to $10,000 in funding based on 25% of your start-up costs.

Ensuring you meet the contribution requirements and understand the eligible start-up costs can greatly impact your chances of securing the grant for your business.

Eligibility Criteria Overview

Applicants aged 18 to 29 can access the Young Entrepreneurs Grant in Manitoba by meeting specific eligibility criteria. To qualify, businesses must be profitable, Manitoba-based, operate year-round, and offer full-time self-employment.

The grant, which can provide up to $10,000, covers 25% of startup costs, with a minimum 25% contribution required from applicants. Startup costs considered for funding include license fees, utilities, and equipment rental. Capital costs such as land, buildings, and equipment purchases are also eligible. Additionally, the grant can reimburse up to 50% of inventory costs.

Funding decisions are made following a thorough assessment process, ensuring that the support is allocated effectively to deserving Manitoba-based small business startups.

Application Process Details

To successfully secure the Grant for Small Business Startups in Manitoba, you must meticulously outline your financial needs and business plans in the application process. The grant offers up to $10,000, equivalent to 25% of your start-up costs, requiring you to contribute a minimum of 25% towards these expenses.

Eligible costs encompass license fees, utilities, equipment rental, as well as capital expenses like land, buildings, and equipment purchases. Additionally, the grant can cover up to 50% of inventory costs for your business.

Ensuring your application clearly articulates these details increases your chances of receiving the financial support needed to kickstart your small business venture. Invest time in presenting a detailed breakdown of your start-up costs and business intentions to align with Manitoba’s small business grant requirements.

Funding Disbursement Timeline

After carefully outlining your financial needs and business plans during the application process for the Grant for Small Business Startups in Manitoba, the next critical step is understanding the Funding Disbursement Timeline.

Once your application has been assessed for eligibility and viability, the funding decisions are made. If approved, you’ll need to contribute a minimum of 25% towards your start-up costs to access the grant.

The grant program can provide up to $10,000, equivalent to 25% of eligible start-up costs. This highlights that the grant can also cover up to 50% of inventory costs incurred by your small business startup.

Here are some key points to keep in mind:

- Grants are designed to support the development of technological capabilities.

- Funding can cover expenses related to software, hardware, and digital tools.

- Improving technology infrastructure can enhance operational efficiency.

- Accessing grants can boost competitiveness in the market.

- Small businesses in Manitoba can benefit from these resources to stay ahead in the digital age.

Relief Funding Eligibility Criteria

Eligibility for the Manitoba Bridge Grant Program’s relief funding assistance requires small and medium-sized businesses in Manitoba to have experienced a revenue decline due to the impact of COVID-19. To qualify for this financial support, businesses must meet the following criteria:

- Revenue Decline: Businesses must demonstrate a decline in revenue directly attributable to the COVID-19 pandemic.

- Size Specification: Only small and medium-sized businesses are eligible for the relief funding assistance.

- Impact Focus: The program aims to support businesses facing challenges arising from the pandemic’s impact on operations.

- Grant Amount: Eligible businesses can receive a one-time grant of $5,000 or 10% of their 2019 gross income for home-based businesses.

- Recovery Support: Relief grants are part of efforts to help businesses recover and sustain their operations during the COVID-19 crisis in Manitoba.

$5000 Manitoba Small Business Grant Application Process Details for 2024

When applying for COVID-19 relief assistance through the Manitoba Bridge Grant Program and Downtown Winnipeg Connect Grant, make sure your small or medium-sized business meets the eligibility criteria and follows the designated grant application process.

Eligible businesses experiencing revenue decline due to the COVID-19 pandemic can seek relief through these programs. The Manitoba Bridge Grant Program offers up to $5,000 for affected businesses, including home-based ones that may receive a grant equal to 10% of their 2019 gross income.

To access the Downtown Winnipeg Connect Grant, your business must have its primary establishment within Downtown Winnipeg BIZ. The grant amount varies based on services needed and targets businesses with fewer than 50 employees.

Be thorough in your application process to increase your chances of receiving the necessary assistance.

Funding Allocation Timeline

The funding allocation timeline for COVID-19 relief assistance through the Manitoba Bridge Grant Program is crucial for small and medium-sized businesses seeking financial support. This timeline guarantees that businesses in Manitoba receive the necessary funding promptly to navigate the challenges posed by the pandemic.

Here are key points to keep in mind regarding the funding allocation:

- Businesses receive a one-time contribution of $5,000 through the Manitoba Bridge Grant Program.

- Home-based businesses in Manitoba may obtain a grant equal to 10% of their 2019 gross income.

- The grant amount varies based on the specific services required and the impact of COVID-19 on businesses.

- Eligible businesses must have a primary establishment within Downtown Winnipeg BIZ and employ fewer than 50 workers.

- The Manitoba Bridge Grant Program offers financial relief to help mitigate the effects of the pandemic on business operations.

HR and Employee Training Support

Regularly, businesses in Manitoba can access workforce training grants focusing on HR and employee training to enhance operational capabilities. Small and medium-sized enterprises with a Canadian Business Number and necessary licenses are the primary targets for these grants.

Funding resources are available to support businesses in investing in their workforce development and skill enhancement initiatives. The Canada-Manitoba Job Grant (CMJG) is a key program that can cover up to 75% of training costs for companies with fewer than 100 employees.

To be eligible for the CMJG, training applicants must be Canadian citizens, permanent residents, or unemployed individuals. This grant serves as a valuable resource for businesses seeking to improve their HR practices and provide essential training for their employees.

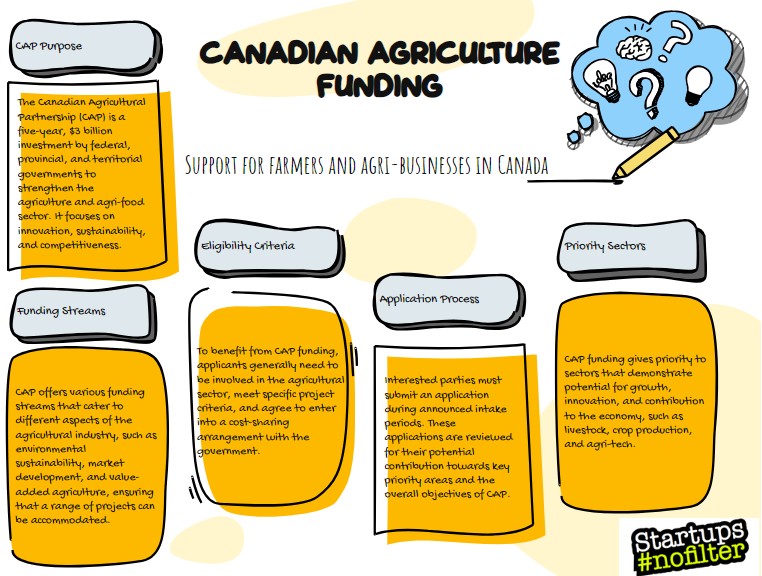

Canadian Agricultural Partnership Funding

Enhancing agricultural sustainability and innovation through strategic funding initiatives is a primary focus of the Canadian Agricultural Partnership (CAP) in Manitoba. CAP provides funding over five years, from 2018 to 2023, with support ranging from 50% to 75% for eligible agricultural and farming costs.

The Manitoba government has dedicated $176 million to agricultural projects under CAP, aiming to foster innovation, sustainability, and growth in the sector. Eligible initiatives in agriculture can leverage CAP funding to boost productivity and competitiveness in Manitoba.

This funding opportunity opens doors for farmers and agricultural businesses to invest in new technologies and practices, driving progress and resilience in the province’s agricultural landscape.

- CAP funding covers 50% to 75% of eligible agricultural costs.

- $176 million allocated by the Manitoba government for CAP projects.

- Focus on innovation, sustainability, and growth in Manitoba’s agriculture sector.

- Enhances productivity and competitiveness for eligible agricultural initiatives.

- Supports investments in new technologies and practices for agricultural advancement.

Small Business Venture Capital Tax Credit

In Manitoba, the Small Business Venture Capital Tax Credit program incentivizes investors with up to a 45% non-refundable tax credit. Investors have the opportunity to claim a maximum of $120,000 on taxable income in a tax year through this initiative. Learn more about startup taxes here.

Eligible investors can potentially receive a maximum tax credit of $225,000 by participating in the Small Business Venture Capital Tax Credit program. This tax credit aims to encourage investment in small businesses in Manitoba, fostering their growth and development.

Before we let you go:

You should take advantage of the $5000 grant for small business startups in Manitoba. With eligibility requirements, application processes, and financial support details provided, this opportunity offers the resources needed to kickstart your entrepreneurial journey.

Additionally, technology enhancement resources, COVID-19 relief assistance, HR and employee training support, Canadian Agricultural Partnership funding, and the Small Business Venture Capital Tax Credit are all available to help you succeed.