When starting a business, tax breaks like 3-year rebates on profits and exemptions on long-term capital gains can greatly boost your bottom line for your startup!

Consider R&D credits and Empowerment Zone incentives to reduce operational costs and attract investors. Leveraging tax incentives can enhance shareholder value and stimulate growth. Seek startup tax advice from tax professionals to navigate changing laws and maximize deductions. Understanding these tax benefits is essential for sustainable financial health and prosperity.

Types of Tax Holidays for Startups

Tax holidays for startups offer a strategic financial advantage by providing a 3-year tax rebate on profits within a 7-year timeframe, fostering growth and sustainability in the entrepreneurial landscape. This is very different from finding a foreign tax haven country for your US startup business!

These tax breaks extend to various aspects, including investment, capital gains, and the ability to carry forward losses. Startups meeting the criteria can also benefit from a tax exemption on long-term capital gains by investing in specified funds.

The primary goal of these tax holidays is to stimulate innovation and promote scalability within the startup ecosystem. By encouraging startups to reinvest their profits and expand their operations, these incentives aim to create a conducive environment for entrepreneurial development and economic growth.

Essential Tax Considerations for Startups

To navigate the financial landscape effectively, startups must carefully consider key tax implications that can greatly impact their growth trajectory and operational sustainability. Tax considerations such as R&D tax credits and Empowerment Zone credits play an essential role in reducing operational costs and fostering growth.

Government support programs offer tax incentives to promote economic development and job creation, providing startups with the necessary financial support. Understanding startup tax credits and incentives is important for leveraging available government-sponsored programs and maximizing financial growth.

Maximizing Tax Benefits for Startups

To maximize tax benefits for your startup, consider:

- Delving into tax incentives overview

- Exploring startup tax deductions

- Devising tax planning strategies

By taking advantage of these opportunities, you can optimize your tax savings and improve your financial health.

Understanding these points can help you make informed decisions to navigate the complexities of tax benefits effectively.

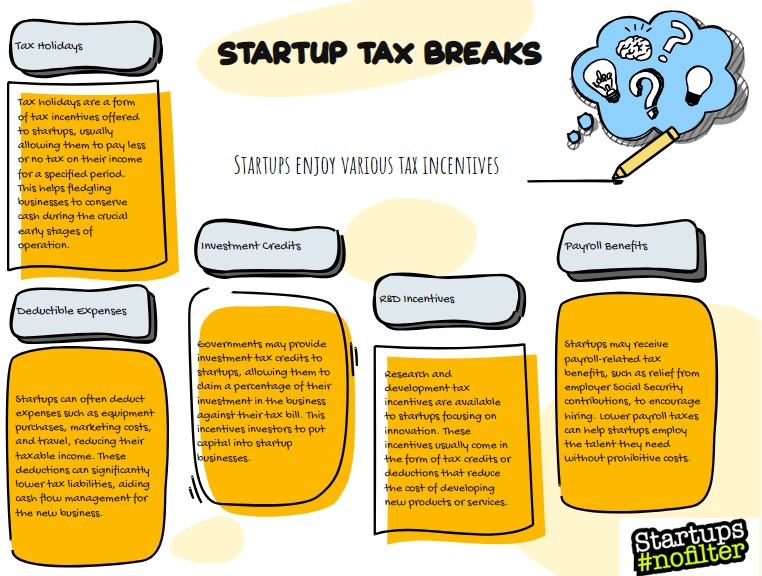

Tax Incentives Overview

How can startups strategically capitalize on available tax incentives to maximize their financial advantages and spur business growth? Here are four key ways to make the most of tax incentives:

- Research and Development Tax Credits: Explore credits for innovative activities that can help offset costs and encourage further innovation.

- Employee Retention Credits: Take advantage of incentives that reward retaining employees, promoting stability, and reducing turnover costs.

- Empowerment Zone Credits: Utilize credits specific to designated geographic areas to support community development and access tax benefits.

- Consult with Tax Professionals: Seek guidance from experts to navigate complex tax laws, identify eligible incentives, and optimize savings for your startup’s growth and success.

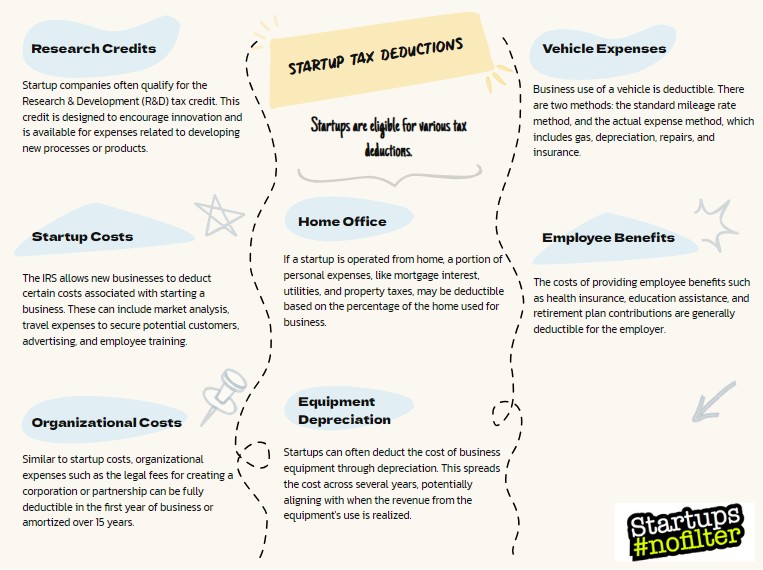

Startup Tax Deductions

Startups looking to maximize tax benefits can strategically leverage a range of deductions to reduce taxable income and enhance financial efficiency. By categorizing expenses properly and keeping meticulous records, startups can take advantage of deductible costs related to research and development, marketing, office supplies, business travel, salaries, benefits, utilities, rent, software subscriptions, and professional services.

Proper documentation is key to maximizing these deductions and lowering the tax burden on startups to a considerable extent. Effective utilization of tax deductions not only results in savings but also positively impacts cash flow, supporting the growth and sustainability of the business. Ensuring that all eligible expenses are recorded and claimed can lead to substantial financial benefits for startups aiming to optimize their tax efficiency.

Tax Planning Strategies

Maximizing tax benefits for startups involves strategically implementing various tax planning strategies to optimize financial outcomes and enhance overall efficiency. When considering tax planning strategies, keep in mind the following:

- Leverage Tax Holidays: Take advantage of specific periods of exemption from certain taxes to support growth and development.

- Minimize Tax Liabilities: Consider tax implications early on to reduce tax burdens and capitalize on available incentives.

- Utilize Tax Credits: Explore credits for research and development activities to offset taxable income effectively.

- Maximize Deductions: Make sure you qualify for deductions on expenses to optimize tax savings and improve financial health and sustainability.

Exploring Tax Incentives for Startups

When contemplating tax incentives for startups, it’s crucial to explore options like tax credits and accelerated depreciation benefits that can greatly impact your financial bottom line.

These incentives can provide valuable opportunities for cost savings and increased cash flow, enabling you to reinvest in your business’s growth and development.

Understanding the intricacies of these tax breaks can help you maximize your benefits and optimize your startup’s financial strategy.

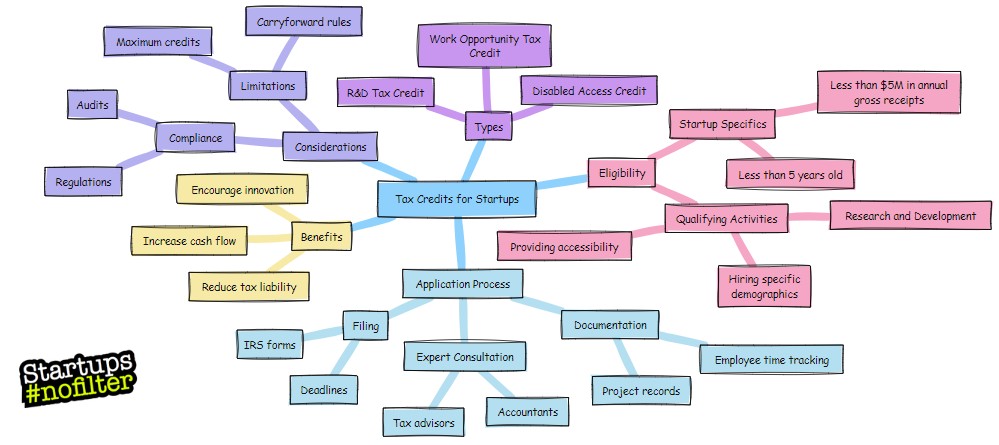

Tax Credits for Startups

Exploring various tax credits can greatly benefit new businesses in their financial planning and growth strategies. When considering tax credits for startups, keep these key points in mind:

- Research and Development (R&D) tax credits allow deduction of expenses related to innovative activities.

- Qualified Small Business Stock (QSBS) offers capital gains exclusion, encouraging investment.

- Payroll rebate programs in specific states provide tax rebates, especially beneficial for emerging tech sectors.

- The Work Opportunity Tax Credit (WOTC) incentivizes hiring from disadvantaged groups, granting tax credits to employers.

Consulting a tax professional can help navigate the complexities of these incentives, ensuring startups maximize their eligibility and potential benefits.

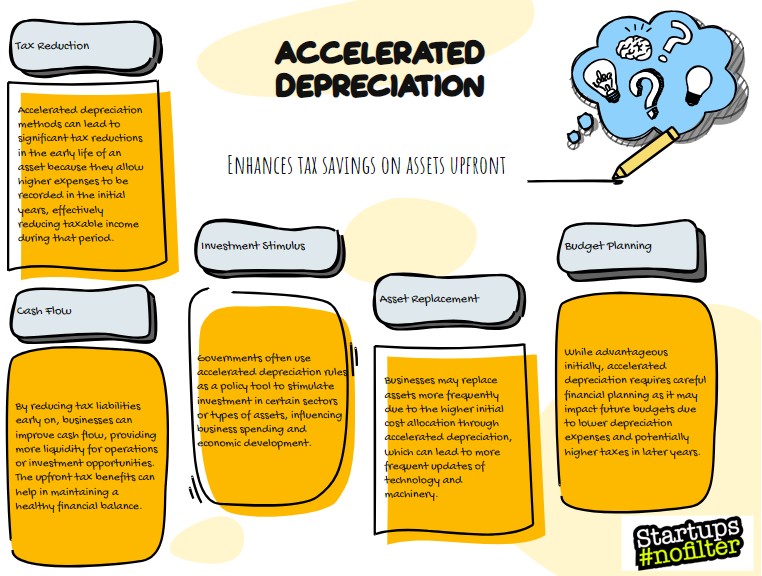

Accelerated Depreciation Benefits

Startups can leverage accelerated depreciation benefits to strategically reduce taxable income and enhance cash flow by deducting a larger portion of asset costs upfront. This tax strategy allows for faster tax savings on equipment, machinery, and technology essential for business operations.

Methods like Section 179 and bonus depreciation offer immediate tax relief, encouraging startups to invest in vital assets. By taking advantage of accelerated depreciation, startups can improve cash flow and maximize tax savings.

Understanding these benefits enables startups to optimize their tax strategies efficiently. Incorporating accelerated depreciation into financial planning can positively impact a startup’s bottom line, providing a significant advantage in managing expenses and enhancing overall financial health.

Understanding Startup Tax Breaks

To comprehend the complexities of startup tax breaks, it’s vital to explore the specific incentives and exemptions offered to new businesses by government authorities. When delving into startup tax breaks, consider the following key points:

- Tax Holidays: Some regions offer periods where startups are exempt from certain taxes, providing breathing room for financial planning.

- Exemptions: Startups may qualify for exemptions from specific taxes like long-term capital gains to stimulate investment and growth.

- Credits: Governments may provide tax credits to startups based on criteria like industry, location, or innovation to foster development.

- Incentives: Tailored incentives are designed to support startups, ranging from reduced tax rates to grants promoting research and development efforts.

Understanding these aspects can help you navigate the tax landscape effectively and optimize benefits for your startup’s growth.

Leveraging Tax Credits for Startups

Exploring the domain of startup tax breaks involves strategically leveraging tax credits to optimize financial benefits for your new business. Consider utilizing the Research and Development Tax Credit to deduct R&D expenses, or offering Qualified Small Business Stock (QSBS) to potential investors for capital gains exclusion.

In some states, payroll rebate programs can provide rebates on payroll taxes, particularly beneficial for emerging technology sectors. Additionally, taking advantage of the Work Opportunity Tax Credit (WOTC) can incentivize hiring from underrepresented groups.

Consulting a tax professional can assist in determining eligibility for these incentives. By incorporating these strategies into your tax planning, you can maximize benefits, minimize tax liabilities, and ultimately boost your startup’s financial health and growth.

Utilize strategic tax planning to navigate the complex landscape of tax strategies for your startup, optimizing financial benefits and ensuring long-term success. When considering tax strategies, keep in mind the following:

- Tax Holidays: Take advantage of 3-year tax rebates within a 7-year period to boost profitability and growth.

- Tax Considerations: Understand and minimize tax liabilities to optimize available benefits.

- Tax Benefits: Benefit from exemptions on long-term capital gains and investments above fair market value for financial sustainability.

- Tax Incentives: Leverage incentives like the R&D tax credit and CGT relief for angel investors to foster innovation.

Seeking professional assistance can further enhance your ability to maximize tax benefits and incentives, setting your startup on a path towards long-term prosperity.

Very Common Questions & Some Answers

Do You Get a Tax Break for Starting a New Business?

For starting a new business, you can receive tax breaks in the form of deductions, credits, and exemptions. These benefits support your financial planning, boost investment opportunities, and provide small business incentives, helping you thrive in entrepreneurship.

Is a Tax Break an Incentive?

Yes, a tax break is an incentive for startups. It provides financial relief, encourages growth, and aids in business success. Analyzing these incentives is essential for maximizing tax savings, supporting investment opportunities, and fostering economic development.

How Do Startups Avoid Taxes?

To avoid taxes, startups benefit from strategic tax planning, maximizing business deductions, meticulous expense tracking, selecting the right entity, capital gains management, utilizing tax credits, deducting eligible expenses, implementing effective tax strategies, and maintaining accurate financial records.

What Is the Startup Stock Tax Exemption?

The startup stock tax exemption enables investors to exclude capital gains from qualified small business stock, potentially up to $10 million or 10 times their initial investment. Understanding this exemption can maximize your investment benefits.

The TLDR for 2024

To sum up, tax breaks for startups offer a variety of benefits to help these new businesses thrive. By making the most of tax holidays, considering essential tax aspects, maximizing benefits, exploring incentives, understanding breaks, leveraging credits, and strategizing, startups can greatly reduce their tax burden and improve their financial stability.

It’s vital for startups to carefully plan and utilize these tax breaks to support their growth and success in the competitive market.