New startup companies are not immune to filing taxes! Uncle Sam will come calling so it is best you file your startup taxes ASAP! As such, below is a guide on how to file startup taxes:

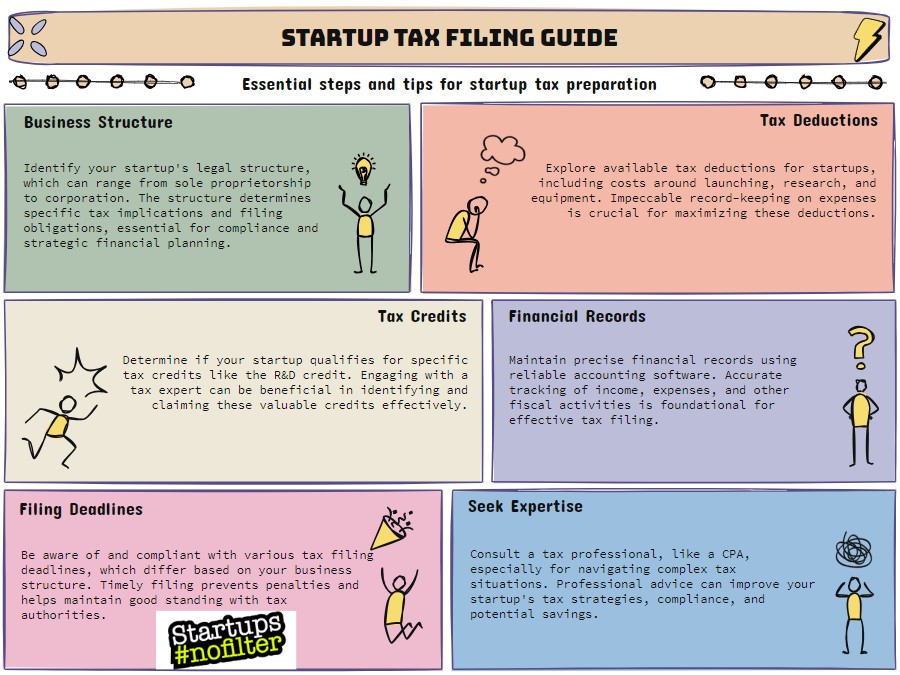

A Step-by-Step Guide to Tax Filing for Startups

- Determine Your Business Structure:

- Identify the legal structure of your startup (sole proprietorship, partnership, LLC, C-corp, S-corp).

- Understand the tax implications and filing requirements for your chosen business structure.

- Understand Startup Tax Deductions:

- Research the various tax deductions available to startups, such as those for startup costs, R&D expenses, equipment and asset depreciation, and more.

- Maintain detailed records of all your business expenses to maximize your deductions.

- Take Advantage of Tax Credits:

- Identify the tax credits your startup may be eligible for, such as the R&D tax credit, work opportunity tax credit, and state-level credits.

- Consult with a tax professional to ensure you’re taking advantage of all the credits you qualify for.

- Maintain Accurate Financial Records:

- Use accounting software to track your startup’s income, expenses, assets, and liabilities.

- Keep all relevant documentation, including invoices, receipts, and 1099 forms.

- Meet Tax Deadlines:

- Familiarize yourself with the tax filing deadlines that apply to your startup’s business structure.

- Ensure you file your returns on time to avoid penalties.

- Seek Professional Assistance:

- Consider consulting with a tax professional, such as a certified public accountant (CPA) or enrolled agent, to help navigate the complexities of tax filing for your startup.

- A tax professional can help you identify deductions and credits, ensure compliance with regulations, and optimize your tax strategy.

By following these steps, you can ensure your startup’s tax filing process is efficient, compliant, and maximizes the available tax benefits. Remember to stay organized, informed, and proactive throughout the process to set your startup up for long-term success.

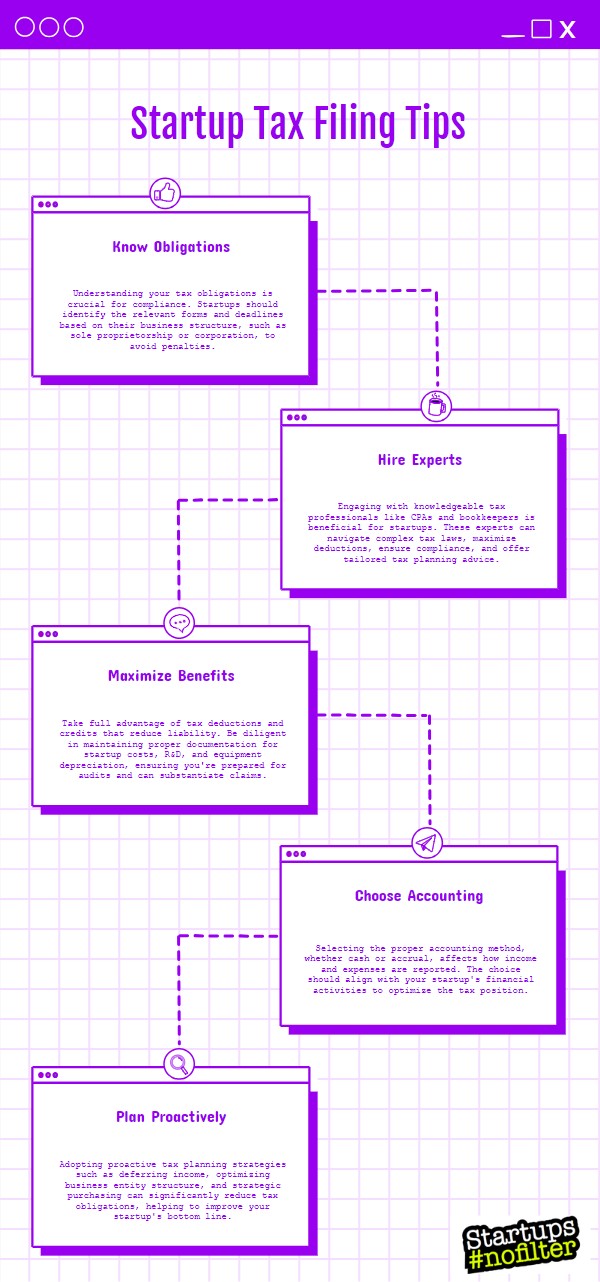

Here are 5 super important tips for tax filing and planning for Startups:

- Understand Your Filing Obligations: Familiarize yourself with the specific tax forms and deadlines that apply to your startup’s business structure, whether it’s a sole proprietorship, partnership, LLC, or corporation.

- Hire the Right Tax Professionals: Consider working with a CPA, enrolled agent, or bookkeeper who can help you manage your startup’s taxes, maximize deductions, and ensure compliance.

- Leverage Tax Deductions and Credits: Identify all the tax deductions and credits your startup is eligible for, such as those for startup costs, R&D expenses, equipment depreciation, and more. Maintain detailed records to support your claims.

- Choose the Optimal Accounting Method: Carefully consider whether the cash or accrual accounting method is more advantageous for your startup’s tax planning, as this can impact your taxable income.

- Implement Proactive Tax Planning Strategies: Strategies like deferring income, reviewing your business entity, and making strategic purchases or charitable contributions can help you minimize your startup’s tax liabilities.

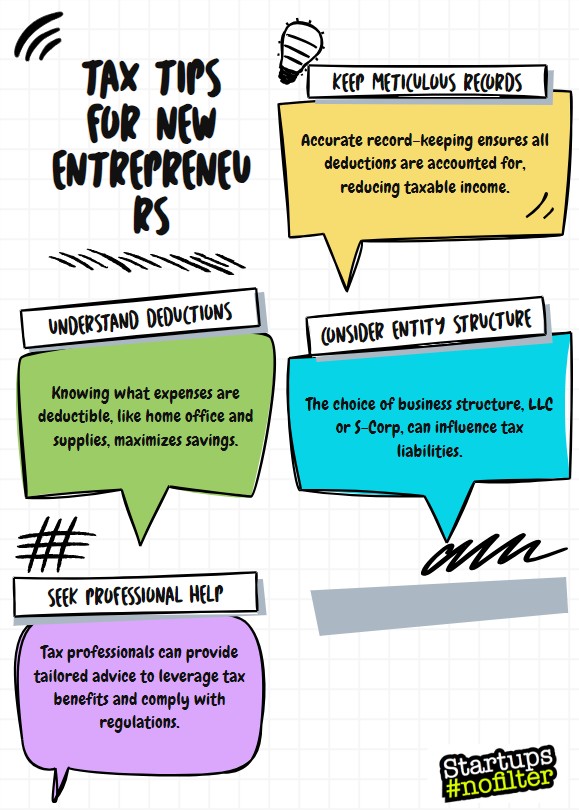

3 Things to look out for when filing taxes for a Startup

- Properly Deducting Startup Expenses:

- The search results indicate that startup costs are considered capital expenses by the IRS and need to be deducted over multiple years through depreciation or amortization, rather than deducted fully in the first year.

- It’s important for startups to keep detailed records of all their startup-related expenses, such as market research, legal fees, and organizational costs, in order to maximize their deductions. This may change a bit if you have moved your startup to a tax haven country.

- Making Quarterly Tax Payments:

- Startups, like other businesses, are generally required to make quarterly estimated tax payments throughout the year, rather than a single annual payment.

- Failing to make these quarterly payments can result in penalties and interest charges, so startups need to be diligent about staying on top of their tax obligations.

- Separating Business and Personal Finances:

- The search results emphasize the importance of maintaining a clear distinction between a startup’s business finances and the personal finances of the founders.

- Mixing up business and personal expenses can complicate the tax filing process and make it more difficult to accurately track deductible business expenses.

Share this!

Editor of Startups #nofilter