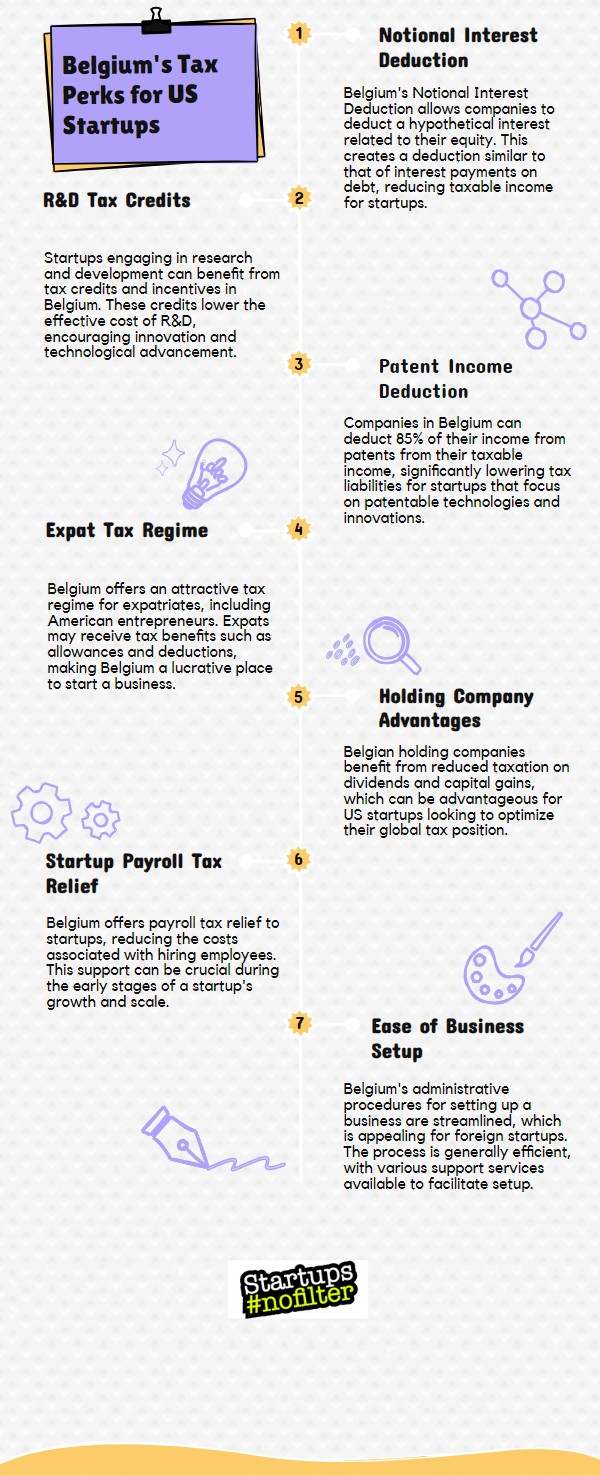

Belgium is a tax haven for US startups due to its favorable tax incentives tailored to boost entrepreneurship, especially in tech-driven industries. These perks include low corporate tax rates, R&D tax credits, Innovation Income Deduction (IID), and exemptions on capital gains.

Additionally, there’s a tax shelter program offering benefits of up to €250,000. This system is ideal for fostering investment and expansion for startups like yours.

Have you considered how leveraging these advantages could propel your business towards greater success?

Understanding Belgiums Tax System

Belgium has a tax program that supports startups and small businesses by offering up to €250,000 for those established in the last four years.

This initiative aims to boost entrepreneurship, particularly in innovative and tech-focused companies.

The system is structured to attract foreign investment and create a favorable environment for startup growth and success.

Unique Tax Advantages for Startups

Let’s dig into why Belgium stands out for US small businesses with its sweet tax perks.

Belgium keeps corporate tax rates low and hands out R&D tax credits like candy.

Startups get a pat on the back with the Innovation Income Deduction (IID), scoring tax breaks for being innovative.

And here’s the cherry on top – qualifying startups can pocket capital gains exemptions, giving a green light for investment and growth.

The Belgian Tax Shelter Program

Let’s talk about the Belgian Tax Shelter Program.

For U.S. startups, understanding this tax shelter and how it can benefit your business is key.

While Belgian tax laws may seem complex, grasping them is crucial to take advantage of the country’s favorable tax environment for your startup’s growth.

Understanding the Tax Shelter

Looking into investing in Belgian startups? The Belgian Tax Shelter Program is a great opportunity to explore. Here’s what you need to know:

- This program offers tax benefits for small businesses, startups, or SMEs established within the last four years.

- It promotes investing in early-stage companies.

- The goal is to boost entrepreneurship and innovation by providing financial assistance to eligible businesses.

Get involved in supporting Belgian small businesses and potentially enjoy tax perks along the way.

Benefits for US Startups

Let’s get into the details of how the Belgian Tax Shelter Program can benefit US startups. This program offers great advantages, such as immediate tax relief and significant financial incentives, specifically designed for small businesses, startups, and SMEs established within the past four years.

Here’s a breakdown of the benefits available:

- Funding: Access to up to €250,000 in financial support.

- Immediate Tax Relief: Lower initial costs for your startup.

- Financial Incentive: A compelling opportunity for business growth.

- Attracting Investment: Encouraging entrepreneurial ventures.

- Access to Support: Simplifying the process of business development.

These benefits can make a real difference for US startups looking to expand their operations and reach new heights of success.

To make the most of Belgium’s tax benefits, US startups should grasp the Belgian Tax Shelter Program. This initiative can offer startups perks of up to €250,000, alongside tax breaks for investors backing these ventures.

The aim is to fuel entrepreneurship and draw more funding into Belgium‘s burgeoning startup scene. By mastering these regulations, your startup can optimize its advantages in the Belgian tax landscape.

Case Studies: Successful US Startups in Belgium

Belgium has become a hot spot for successful US startups like Uber and Airbnb, thanks to its friendly tax policies, central location, and skilled workforce. Let’s take a look at some examples:

- Uber took advantage of Belgium’s tax shelter program and set up its European headquarters there.

- Airbnb benefited from the country’s low corporate tax rates and has experienced significant growth.

- Another unnamed startup thrived in Belgium due to access to ample funding.

- Yet another startup expanded its operations thanks to the business-friendly regulations in Belgium.

Comparing US and Belgian Tax Rates

Belgium’s corporate tax rate of 25% is lower than the US federal rate of 21%.

Here’s the deal: Belgium hooks up investors in startups with tax credits, while small businesses in the US can face a hefty 35% tax rate.

Belgium’s tax system is all about those sweet deductions and incentives to keep things interesting.

Understanding Belgian tax laws can have a big impact on your US startup. Knowing these rules can bring you some serious advantages that will help your business grow. So, let’s break down these regulations and see how they can benefit your startup.

Getting a handle on Belgian tax regulations is key for your US startup. These laws can open up doors to valuable benefits that can drive your business forward. Let’s unpack these regulations and see how they can give your startup a boost.

Understanding Belgian Tax Laws

Understanding Belgium’s tax laws can make a world of difference for your startup to navigate the financial landscape effectively. Here are some key things to keep in mind:

- Belgium has a tax shelter tailored for startups, offering significant support.

- Various perks like tax credits, deductions, and exemptions are up for grabs.

- Lower corporate income tax rates and favorable treatment for research and development can enhance your company’s financial health.

Benefits for US Startups

Being a US startup in Belgium comes with some great financial perks thanks to the country’s tax laws. You can benefit from a tax shelter program that allows you to access up to €250,000 and enjoy corporate income tax rates ranging from 25% to 34%.

Additionally, you can take advantage of deductions for your research and development expenses. With Belgium’s strong economy, strategic location, and diverse workforce, it’s a smart choice for expanding your business internationally.

How to Qualify for Belgian Tax Incentives

If you want to snag those sweet Belgian tax perks for your small business startup, there are a few boxes you need to check. Your venture should fall under the categories of a micro-enterprise, startup, or SME established within the last four years. Here’s the lowdown:

- Make sure you stick to the government’s rules.

- Take advantage of tax breaks like credits and deductions.

- Confirm that your startup qualifies for the tax shelter program, which can score you up to €250,000 in benefits.

The Impact of Tax Savings on Growth

Curious about how tax savings in Belgium can impact the growth of a small business?

Well, with tax benefits like the Tax Shelter program, not only do you save money, but you also boost your profit margin.

This can help drive the expansion of your business, making Belgium an attractive spot for your startup to thrive.

Maximizing Profit Margins

Belgium offers enticing tax incentives that can give your US small business startup a significant boost in profit margins, paving the way for growth.

The country’s tax-friendly policies attract foreign investors, providing a strategic advantage for businesses looking to optimize their growth potential.

Taking advantage of Belgium’s tax benefits can result in higher returns on investment and improved financial performance, ultimately helping your startup maximize its profits.

Belgiums Tax Incentives

Belgium’s tax shelter program is a lifeline for small businesses, offering up to €250,000 in funding for startups. This support helps fuel growth and innovation by easing financial burdens, allowing companies to focus on expanding and evolving.

Paired with income tax relief, Belgium’s favorable tax environment sets the stage for U.S. startups to flourish in Europe.

Additional Financial Benefits in Belgium

The Tax Shelter program in Belgium provides a generous €250,000 in funding for startups, small businesses, and SMEs under four years old. This initiative aims to boost private investments and spur innovation. It offers some cool advantages:

- Investors enjoy a 30% tax cut.

- It attracts both local and international investments.

- This program nurtures the growth of the startup ecosystem in a big way.

Choosing Belgium for Your Startup

Considering a spot for your new startup? Look no further than Belgium. This country’s tax shelter program, ideal European location, and access to a highly skilled workforce make it a top pick.

With tax incentives reaching up to €250,000 and a buzzing startup scene, Belgium provides a stable and innovative environment. Its solid infrastructure and political reliability only add to its appeal as a startup hub.

Very Common Questions & Some Answers

Is Belgium a Good Place to Start a Business?

Absolutely, Belgium is a great place to kickstart your business. Thanks to its tax perks, competitive corporate tax rates, and enticing government incentives, you’ll have solid support. Additionally, its strategic location opens up doors for international trade ventures.

Is Belgium a Tax Haven?

So, you’re wondering if Belgium is considered a tax haven, right? Well, technically speaking, it’s not classified as one. However, it does offer some pretty sweet tax benefits for small businesses, making it a bit like a hidden gem without the usual tax haven reputation. It’s definitely worth looking into for its appealing perks.

How Much Tax Do You Have to Pay in Belgium When You Are a Company?

If you run a company in Belgium, you’ll face a 25% corporate income tax. But don’t fret – there are ways to bring that rate down with deductions and incentives. Plus, tax rulings can help clarify your obligations. So, while taxes are inevitable, there are ways to navigate them smartly in Belgium.

Why Is Belgium Income Tax so High?

Belgium’s income tax hits high marks because it operates on a progressive scale, ranging from 25-50%. This means the more you earn, the higher percentage you contribute. The deal is you’re chipping in for social benefits and public services that everyone can access. But hey, there’s a silver lining – you can snag tax deductions and credits to help ease the burden of those rates.

The TLDR for 2024

Belgium is a hotspot for US startups! Its tax system offers a plethora of incentives and financial perks. Picture growing your business while cutting down on taxes significantly. It’s not just a dream; it’s a reality.

So why not head to Belgium and watch your startup thrive in a tax-friendly environment? Don’t miss out on the opportunity to claim your share of the Belgian business benefits!

Editor of Startups #nofilter