Dear Startup Founder,

Are you looking to secure a $100,000 business loan to get your startup venture off the ground? Well, you’ve come to the right place. But we have to warn you! It will not be easy!

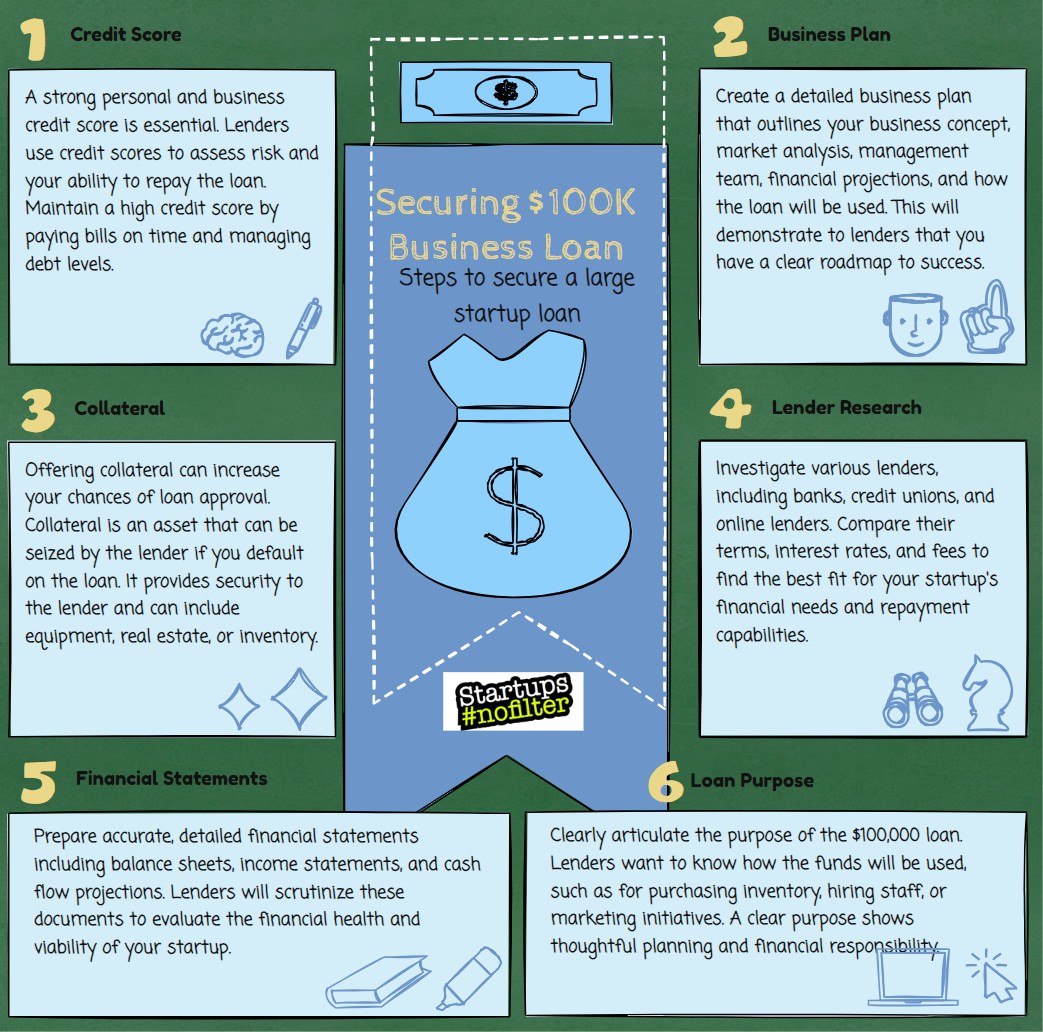

Let me walk you through the key steps to make this $100,000 startup loan happen.

First things first, you’ll need to make sure your personal credit score is in good shape – typically, lenders are looking for a score of at least 670. But don’t worry, some online lenders may be willing to work with you even if your score is as low as 600.

Next up, the lender is going to want to see that your business has been around for a while. Most traditional banks will require at least 2 years in operation, but some alternative lenders may be open to startups that have been running for as little as 6 months. And when it comes to revenue, you’ll generally need to show that your business is bringing in at least $100,000 to $250,000 per year. This helps the lender feel confident that you can reliably make those loan payments.

Oh, and one more thing – you’ll likely need to put up some collateral or provide a personal guarantee to secure that $100,000 loan. This gives the lender a little extra assurance that they’ll get their money back.

Now, I know that’s a lot to take in, but don’t worry – we have got your back! The key is to really do your research, compare different lender options, and make sure you’ve got all your ducks in a row when it comes to documentation and financial statements. With a little bit of preparation and persistence, I’m confident you can land that $100,000 startup loan and get your business off the ground. Just remember to start small, focus on your cash flow, and build up that business credit over time.

Yours Truly,

Startups #nofilter

Need some more background information? No problem. Read below for the boring technical stuff.

How Can You Qualify for a $100k Business Loan? Use The Simple Approach

As a startup founder, you might be wondering how to qualify for that $100,000 business loan you’ve been eyeing. Well, the good news is that with the rise of alternative lenders, the process has become a whole lot simpler in 2024!

The Basics

To qualify for a $100k loan through an alternative lender, you generally only need to meet a few basic requirements:

- $500K in annual sales: This shows the lender that your business has the revenue to support the loan payments.

- 6+ months in business: Lenders want to see that you’ve got some experience under your belt, even if you’re a relatively new startup.

- No minimum credit score: Unlike traditional banks, many online lenders are more focused on the potential of your business than your personal credit history.

The Easy Application Process

Even if you’ve had some credit challenges in the past, most alternative lenders will still consider you for financing. Instead of scrutinizing your history, they’re more concerned with the opportunity ahead and how that $100k loan could help take your business to the next level. The application process itself is usually pretty straightforward too. Rather than drowning in paperwork, you can often skip the documentation by connecting your bank accounts digitally. This saves you a ton of time and effort, getting you the funds you need faster.

Exploring Your Options

While qualifying for a $100k business loan might be relatively easy through an alternative lender, remember that this isn’t necessarily the limit. As National Business Capital explains, you can actually speak with a Business Finance Advisor who can inform you about other, potentially larger financing options that might be a better fit for your specific needs and goals.So don’t be afraid to think big, my fellow startup founder. With the right lender and the right approach, that $100k (or more!) could be just what you need to take your business to new heights.

Bottom Line: Here a 5 Lenders Who Will Give You that $100,000 Startup Loans

Here are 5 lenders that can provide $100,000 startup loans based on the requirements discussed:

- National Business Capital

Address: 120 West 45th Street, New York, NY 10036

Requirements:- $500K in annual sales

- 6+ months in business

- No minimum credit score

Tips and Advice:

-

- Apply through their simple online application process

- Speak with a Business Finance Advisor to explore larger loan options

- Take advantage of their Hybridge SBA Loan program for faster funding

- Fundbox

Address: 1501 4th Ave, Seattle, WA 98101

Requirements:

-

- $100K+ in annual revenue

- 6+ months in business

- Personal credit score of 600+

Tips and Advice:

-

- Utilize their AI-powered underwriting to get approved faster

- Consider their business line of credit for more flexible financing

- Provide access to your business bank account to streamline the process

- Kabbage

Address: 730 Peachtree St NE, Atlanta, GA 30308

Requirements:

-

- $50K+ in annual revenue

- 1+ year in business

- Personal credit score of 640+

Tips and Advice for getting a Kabbage startup loan for $100k:

-

- Apply online in minutes with just a few basic business details

- Qualify for up to $250K in funding based on your cash flow

- Explore their flexible repayment terms to fit your needs

- OnDeck

Address: 1400 Broadway, New York, NY 10018

Requirements for getting that $100k startup loan from OnDeck:

-

- $100K+ in annual revenue

- 1+ year in business

- Personal credit score of 600+

Tips and Advice:

-

- Leverage their fast and easy online application process

- Consider their term loans or lines of credit options

- Provide access to your business bank account for quicker approval

- Lendio

Address: 4100 Chapel Ridge Rd, Orem, UT 84058

Requirements:

-

-

- $50K+ in annual revenue

- 6+ months in business

- Personal credit score of 550+

-

Tips and Advice for securing a $100k startup loan from Lendio in 2024:

-

-

- Use their free loan matching service to find the best lender

- Be prepared to provide financial statements and tax returns

- Explore their unsecured loan options if you lack collateral

-

How You Can Use Your $100k Business Loan Funds:

- Cover Expenses: Whether it’s payroll or operational costs, your business loan can alleviate financial strain and provide breathing room for other investments.

- Purchase Inventory: Securing ample inventory to meet demand is crucial. With a business loan, you can expand purchasing capabilities, benefit from bulk discounts, and prepare for peak seasons effectively.

- Bridge Seasonal Gaps: Anticipating slow periods or recovering from them requires financial stability. A $100k startup loan offers flexibility to manage cash flow, address challenges, and seize opportunities confidently.

- Acquire New Equipment: Upgrading outdated equipment enhances productivity and minimizes repair costs. Leveraging a business loan enables the acquisition of necessary tools to optimize operations without immediate financial strain.

- Invest in Technology, Marketing, and Training: Investing in technology, marketing strategies, and staff training can seem daunting with limited cash flow. However, a business loan empowers you to embrace these enhancements, driving efficiency, extending market reach, and elevating team performance, propelling your business forward.

Editor of Startups #nofilter