As a startup founder in2024, you’re the lead quarterback of your venture’s financial game plan! Accurate bookkeeping is super important to making informed decisions, securing funding, and driving business growth. A skilled startup bookkeeper is your financial right-hand, maintaining accurate records, ensuring compliance, and performing data entry efficiently. Outsourcing to professionals can improve financial accuracy, reduce errors, and cut operational costs.

Don’t fumble your finances – choose a bookkeeper with expertise in managing cash flow and technology. With the right startup bookkeeping firm, you’ll be on track to securing funding and achieving financial stability.

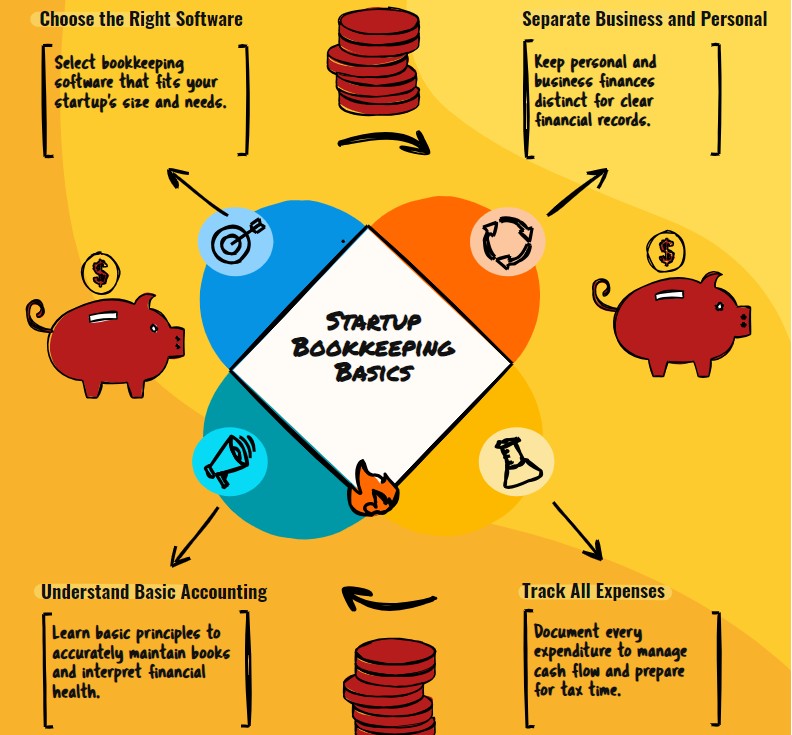

5 Things to Know about Startup Bookkeeping:

- Accurate bookkeeping is crucial for startups to uncover their financial reality and make informed decisions for success.

- A skilled bookkeeper maintains accurate records, ensures compliance, and plays a multifaceted role beyond number-crunching.

- Outsourcing bookkeeping to professionals can reduce errors by up to 50% and operational costs by up to 40%.

- A reliable bookkeeper should have expertise in managing cash flow, proficiency in technology, and scalable services for valuable insights.

- Common bookkeeping mistakes, such as inaccurate records and inconsistent methods, can lead to tax penalties and cash flow problems.

Importance of Accurate Books

As a startup founder, you need accurate books to uncover the financial reality of your business, driving informed decisions that can make or break your venture.

Accurate bookkeeping provides a clear picture of your financial health, ensuring compliance with tax laws and enhancing credibility with potential investors.

It’s essential for maintaining financial transparency and stability, ultimately leading to informed decisions that propel your startup forward.

Roles and Responsibilities of Startup Bookkeepers

Your startup’s financial fate rests in the hands of a skilled bookkeeper, who assumes a multifaceted role that extends far beyond mere number-crunching. They’re responsible for maintaining accurate records of sales and expenses, ensuring compliance, and performing data entry efficiently.

Benefits of Professional Bookkeeping

By outsourcing bookkeeping to a professional, you’ll reap a multitude of benefits that can greatly impact your startup’s financial health and overall success.

You’ll improve financial accuracy, reducing errors by up to 50%.

You’ll also save up to 40% in operational costs and have a 16% higher chance of securing funding.

Choosing the Right Bookkeeper

When selecting a bookkeeper for your startup, it’s crucial you find someone who can effectively navigate the unique financial landscape of a startup. Look for expertise in managing cash flow and tracking expenses, plus proficiency in technology and accounting software.

Seek recommendations, and make sure they offer scalable services providing valuable financial insights for decision-making, with a track record of reliability.

Here are 5 recommended bookkeepers for startups in 2024:

- Bookkeeper360

Address: 1200 Corporate Dr Suite 300, Birmingham, AL 35242

Summary: Bookkeeper360 is a technology-driven accounting solution specializing in bookkeeping, advisory, payroll, and tax compliance services for startups and established businesses. Their 100% US-based team utilizes cloud accounting software to provide efficient and accurate bookkeeping.

LinkedIn: https://www.linkedin.com/company/bookkeeper360-com - Smart Business Concepts

Address: 5949 Sherry Ln #1295, Dallas, TX 75225

Summary: Smart Business Concepts is a modern, tech-driven accounting practice focused on helping startups and small/mid-size businesses achieve optimal profitability and scalability. They offer a comprehensive suite of services, including bookkeeping, tax, payroll, financial strategy, and virtual CFO services.

LinkedIn: https://www.linkedin.com/company/smartbizconcepts - BooksTime

Address: 1200 G St NW Suite 800, Washington, DC 20005

Summary: BooksTime provides tech-savvy bookkeeping services tailored for modern entrepreneurs and startups. They leverage cloud-based accounting software and automation to deliver efficient and accurate bookkeeping solutions.

LinkedIn: https://www.linkedin.com/company/bookstime - IncSight

Address: 1200 Abernathy Rd NE Building 600, Atlanta, GA 30328

Summary: IncSight focuses exclusively on small businesses across the USA, offering accounting, bookkeeping, tax, payroll, and advisory services. They believe in leveraging technology to provide valuable financial guidance and help businesses achieve their goals.

- Illumin8

Address: 1200 N El Paso St, Colorado Springs, CO 80903

Summary: Illumin8 is an accounting firm that aims to free small business owners from outdated processes through cloud-based technology and innovative solutions. They offer bookkeeping services tailored for startups and growing businesses.

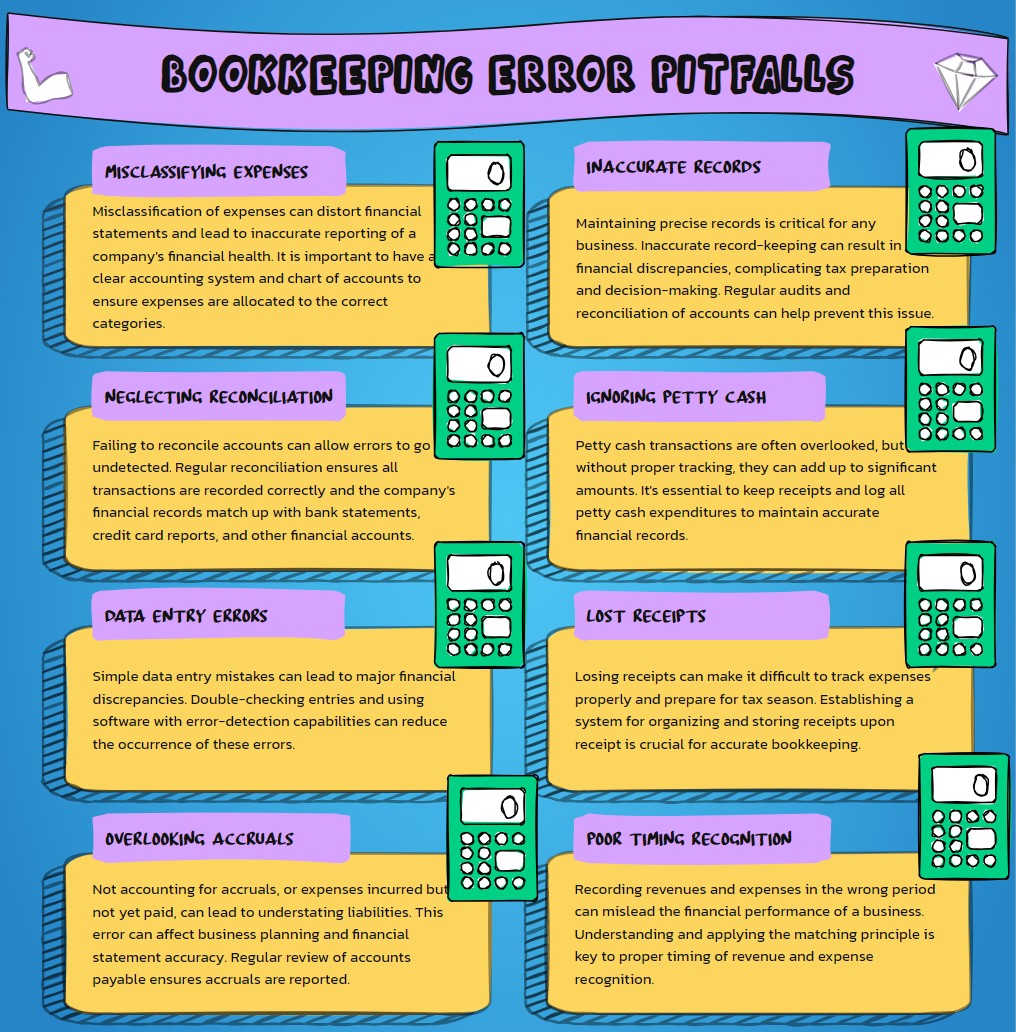

3 Common Bookkeeping Mistakes

Navigating the world of startup bookkeeping requires recognizing the common mistakes that can throw your financial records off track.

You’ll want to avoid inaccurate financial records, lack of organization, and inconsistent accounting methods – the trifecta of bookkeeping blunders that can lead to financial missteps.

1. Inaccurate Financial Records

Inaccurate financial records can be a silent killer for startups, derailing even the most promising ventures with misinformed business decisions. You make critical financial decisions based on your accounting, so errors can lead to tax penalties, cash flow problems, and damage to your credibility.

Inaccurate records can also hinder funding and lead to costly consequences.

2. Lack of Organization

Disorganization in your bookkeeping can be a ticking time bomb, waiting to set off a cascade of financial errors and missed opportunities. Without organized systems, you risk missing important financial data, leading to errors in reports and tax filings.

This hinders decision-making and financial planning, making it tough to track expenses and income accurately, ultimately leading to costly mistakes.

3. Inconsistent Accounting Methods

When you’re juggling multiple financial tasks, it’s easy to fall into the trap of inconsistent accounting methods, which can lead to a tangled web of financial reporting errors. This can hinder your business’s financial performance and decision-making.

Establishing a standardized accounting method, either cash basis or accrual basis, can guarantee uniformity in financial records and avoid compliance issues, potential penalties, and tax headaches.

Setting Up a Bookkeeping System

Now that you’ve avoided common bookkeeping mistakes, it’s time to set up a bookkeeping system that works for your startup.

You’ll need to choose the right startup accounting CPA or software for your business, considering factors like scalability and customization options.

Choosing Accounting Software

Selecting an accounting software that aligns with your startup’s specific requirements is essential for establishing a seamless bookkeeping system.

You’ll want to explore options like QuickBooks or Xero, which offer features for creating invoices, managing expenses, and generating financial reports.

Customize these tools to fit your unique bookkeeping needs and business structure, and you’ll streamline your process, ensuring accurate financial records for your startup.

Setting Up Accounts

With your accounting software in place, you can turn your attention to setting up a bookkeeping system that accurately reflects your startup’s financial situation.

Open a separate business bank account to keep personal and business finances separate.

Confirm that your bookkeeping system aligns with your business structure, and use accounting software to automate processes and maintain organized records, including balance sheets, cash flow statements, and income statements.

5 Popular questions about startup bookkeeping

How to Do Bookkeeping for a Startup?

To master bookkeeping, you’ll set clear financial goals, leveraging accounting tools tailored to your business size, track cash flow, and generate financial reports to inform budgeting tips, invoicing strategies, and tax compliance, while prioritizing expense tracking to overcome startup challenges.

Do Startups Need a Bookkeeper?

As you scale, you’ll face financial priorities, cash flow management, and industry standards, making it important to decide if you need a bookkeeper, considering business size, financial expertise, and the benefits of outsourcing versus in-house management to avoid financial mistakes.

What Is the Best Accounting Method for Startups?

When selecting an accounting method, you’ll want to take into account factors like cash management, financial transparency, and tax efficiency to guarantee accurate financial reporting, asset tracking, and budgeting tools, ultimately offering financial flexibility for your business.

What Do Startups Use for Accounting?

You’ll find that startups like you often use QuickBooks alternatives, accounting software, and financial tools to manage cash flow, track expenses, and generate invoices, while leveraging cloud solutions for real-time financial reporting and budgeting with ease.

The TLDR on Startup Bookkeeping:

You’ve got a solid foundation for your startup, but without accurate bookkeeping, you’re flying blind. By now, you know the importance of precise financial records, the roles and responsibilities involved, and the benefits of professional bookkeeping.

You’ve learned how to choose the right bookkeeper and avoid common mistakes. With a well-set-up bookkeeping system, you’ll be able to make informed decisions, stay on top of cash flow, and focus on growing your business.

Editor of Startups #nofilter