The British Virgin Islands (BVI) is a popular choice for U.S. small business startups looking for a tax haven country to minimize taxes, thanks to its zero corporate, capital gains, and income tax policies. This tax-friendly environment is even more beneficial if your business operates outside of the BVI.

With its stable political environment and strong legal system, the BVI offers a secure and cost-effective location to run your business. Taking advantage of the tax benefits in the BVI can significantly boost your business opportunities, especially if you’re mindful of your budget.

If you’re keen on understanding the detailed BVI corporate tax structure or considering expanding globally, there’s more comprehensive information available for you.

Understanding BVIs Tax Laws

When it comes to the tax laws in the British Virgin Islands (BVI), you’ll find a sweet deal for businesses operating outside the territory. Here, there are no corporate, capital gains, or income taxes to worry about.

This tax-friendly setup is a big draw for small American startups looking to save on taxes and keep their costs down. With these taxes off the table, running your business in the BVI becomes a smart and budget-friendly choice.

Benefits of BVIs Tax Haven

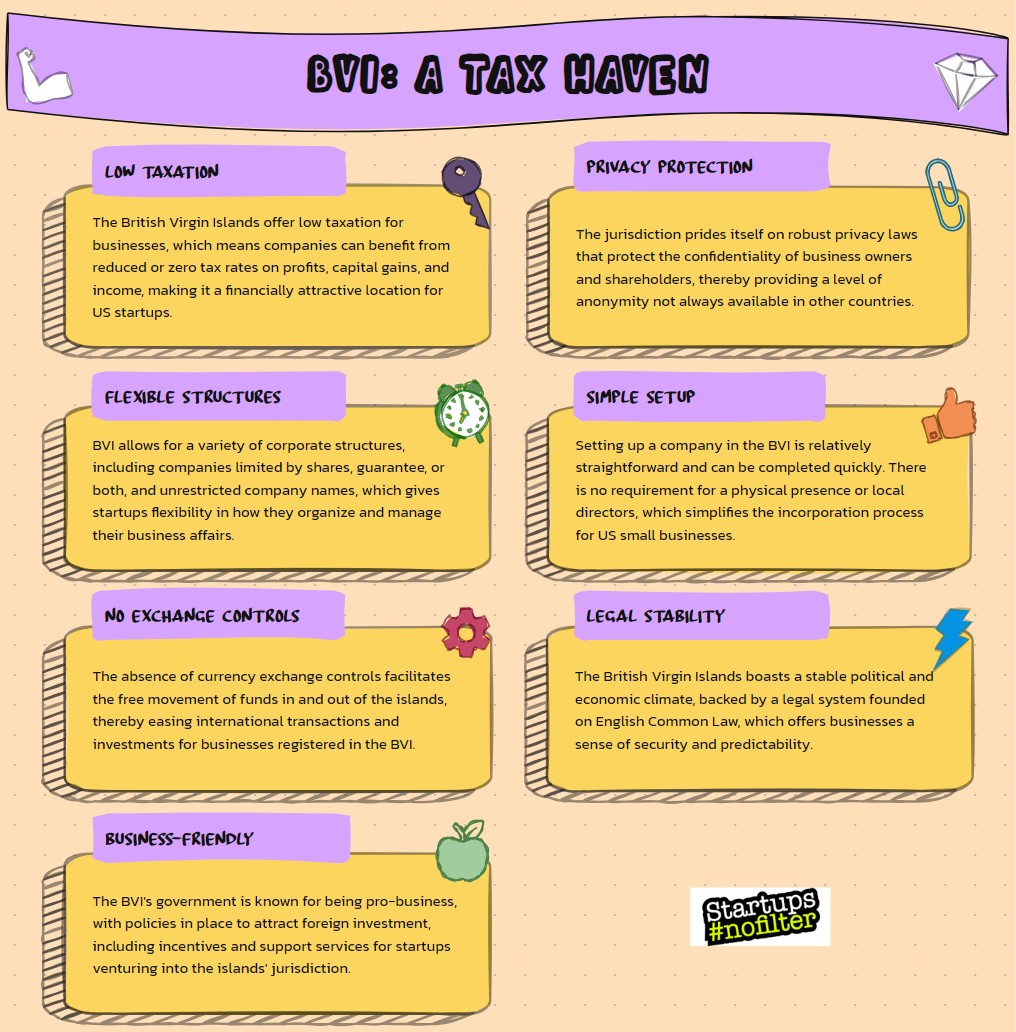

When it comes to optimizing taxes, the British Virgin Islands (BVI) shines as a top choice for US small businesses starting up, thanks to its zero corporate income tax. BVI’s tax haven status offers notable benefits, such as no capital gains or wealth taxes.

The strong legal system, political stability, and opportunities for global growth make BVI an appealing option. Additionally, the absence of personal income tax adds to its allure for entrepreneurs.

BVIs Corporate Tax Structure

Let’s talk about how corporate taxes work in the British Virgin Islands (BVI).

Here’s the deal: if your business is based outside the BVI, you won’t have to pay any corporate taxes. This tax-friendly setup in the BVI is a real boon for small businesses, turning it into a sought-after tax haven.

This unique advantage allows small startups from the US to take full advantage of the BVI’s tax system, leading to smart tax planning and substantial cost savings.

Implication for US Startups

If you’re a US startup, considering the tax benefits of the British Virgin Islands could really boost your business setup and improve your financial situation.

The BVI offers a tax-friendly environment, streamlined company registration, a stable political landscape, and a robust legal framework, making it a trusted location for expansion.

This opens up opportunities in global markets, especially in sectors like finance, tourism, and IT.

Registration Process in BVI

Setting up your company in the British Virgin Islands is a breeze, usually taking just 2 to 5 business days to kickstart your operations. Your startup enjoys tax exemptions, and adherence to the Economic Substance Act is a must.

For small businesses in the US, this straightforward process offers an enticing opportunity to establish a presence in the BVI, a well-known tax-friendly destination.

Common Questions

Why Do Companies Incorporate in the British Virgin Islands?

If you’re thinking about setting up shop in the British Virgin Islands, it’s for some solid reasons. The process is budget-friendly, the legal system is robust, your privacy is well-protected, assets are secure, and the Islands have a stellar reputation worldwide. Operating there is a breeze with a variety of business structures to choose from and a streamlined regulatory system. Plus, the investment options are diverse, making it an appealing choice for many businesses.

What Are the Tax Benefits of the British Virgin Islands?

When it comes to the British Virgin Islands (BVI), you get some sweet tax perks, the ability to do offshore banking, and keep your business dealings on the down-low. The laws in BVI are all about protecting your cash and ensuring nobody noses into your financial biz. On top of that, you can score cool investment incentives, legal advantages, and a stable economy that’s just right for running international companies.

Do Companies Pay Tax in Bvi?

In the British Virgin Islands, companies don’t have to worry about paying corporate income tax. The laws there offer some pretty neat perks, like keeping your financial info private and safeguarding your assets. This setup helps keep things running smoothly in the BVI economy and makes it a great spot for businesses to set up shop hassle-free.

Do BVI Companies File Tax Returns?

In simple terms, if a BVI company is doing business outside the British Virgin Islands, it typically doesn’t have to file tax returns there. This is because the BVI offers a legal setup that prioritizes financial confidentiality, making it a popular choice for international businesses looking to keep their financial matters private.

The TLDR for 2024

In short, the British Virgin Islands (BVI) offers appealing tax advantages and a straightforward registration process, making it an attractive option for US startups.

Taking advantage of BVI’s tax structure can lead to financial benefits for your small business. Just remember to stay compliant with all legal obligations.

Choosing BVI as your tax haven could be a savvy move for your startup.

Editor of Startups #nofilter