A Book Summary of The Tax Free Wealth Book: Perfect for Startup and Small Business Founders

“Tax-Free Wealth” by Tom Wheelwright is not your typical dry tax guide. It’s a roadmap to financial freedom specifically tailored for startup and small business founders like you. It may qualify as a startup book, or even help you with tax accounting for startups! If the mere mention of taxes makes you cringe, fear not! Wheelwright breaks down complex tax concepts into digestible nuggets of wisdom that could potentially save you thousands of dollars.

Understanding the Tax Code:

First things first, Wheelwright emphasizes the importance of understanding the tax code. But don’t worry, you don’t need to become a tax expert overnight. Instead, focus on learning the key principles and strategies that apply to your situation as a startup or small business owner.

Leveraging Tax Incentives:

One of the most powerful tools in your arsenal is leveraging tax incentives. Wheelwright reveals the myriad of deductions and credits available to entrepreneurs, from research and development credits to startup costs deductions. By strategically taking advantage of these incentives, you can significantly reduce your tax burden.

In “Tax-Free Wealth” by Tom Wheelwright, he illuminates the path to financial success by harnessing the power of tax incentives. Leveraging tax incentives, as outlined in the book, is akin to uncovering hidden treasures within the labyrinth of the tax code. It’s about identifying specific provisions that enable you to slash your tax liability while propelling your entrepreneurial aspirations forward.

1. Research and Development (R&D) Credits: Wheelwright’s book underscores the importance of documenting R&D expenses meticulously.

-

- By adhering to the guidelines laid out in “Tax-Free Wealth,” startup founders can claim valuable tax credits for their innovative endeavors.

- This not only reduces their overall tax burden but also fosters a conducive environment for innovation and growth.

2. Startup Costs Deductions: Startup founders, as highlighted in “Tax-Free Wealth,” can capitalize on deductions for startup expenses.

-

- These initial costs, such as market research and legal fees, are often substantial but can be offset through strategic tax planning.

- By leveraging the rules surrounding startup costs deductions, entrepreneurs can alleviate their tax burden and allocate resources more effectively towards business development.

In essence, “Tax-Free Wealth” emphasizes that by strategically leveraging R&D credits and startup costs deductions, entrepreneurs can unlock significant tax savings. These incentives, as elucidated in the book, not only provide immediate relief but also pave the way for sustained growth and prosperity in the dynamic landscape of entrepreneurship.

Maximizing Business Expenses:

Another crucial aspect Wheelwright explores is maximizing business expenses. From office supplies to travel expenses, every legitimate business expense is a potential tax deduction. By keeping meticulous records and understanding what qualifies as a deductible expense, you can minimize your taxable income and keep more money in your pocket.

The Power of Entity Structure:

Choosing the right entity structure for your business can make a world of difference in your tax liability. Wheelwright discusses the pros and cons of different entity types, such as sole proprietorships, partnerships, LLCs, and S corporations. By selecting the optimal structure for your business, you can enjoy significant tax savings while protecting your assets.

Investing for Tax-Free Growth:

Lastly, Wheelwright dives into the world of tax-free investing. From retirement accounts to real estate investments, he shares strategies for growing your wealth without triggering unnecessary tax liabilities. By strategically allocating your investments and taking advantage of tax-advantaged accounts, you can build a solid financial foundation for the future.

“Tax-Free Wealth” is a must-read for startup and small business founders looking to navigate the murky waters of taxation. With practical tips, real-world examples, and actionable advice, Wheelwright empowers you to take control of your finances and keep more of your hard-earned money. So grab a copy, roll up your sleeves, and get ready to unlock the secrets of tax-free wealth!

Free Download of the Tax Free Wealth Book PDF Version

There is no official free PDF download of the Tax Free Wealth book however you can easily find it here on the Internet Archived available for PDF download.

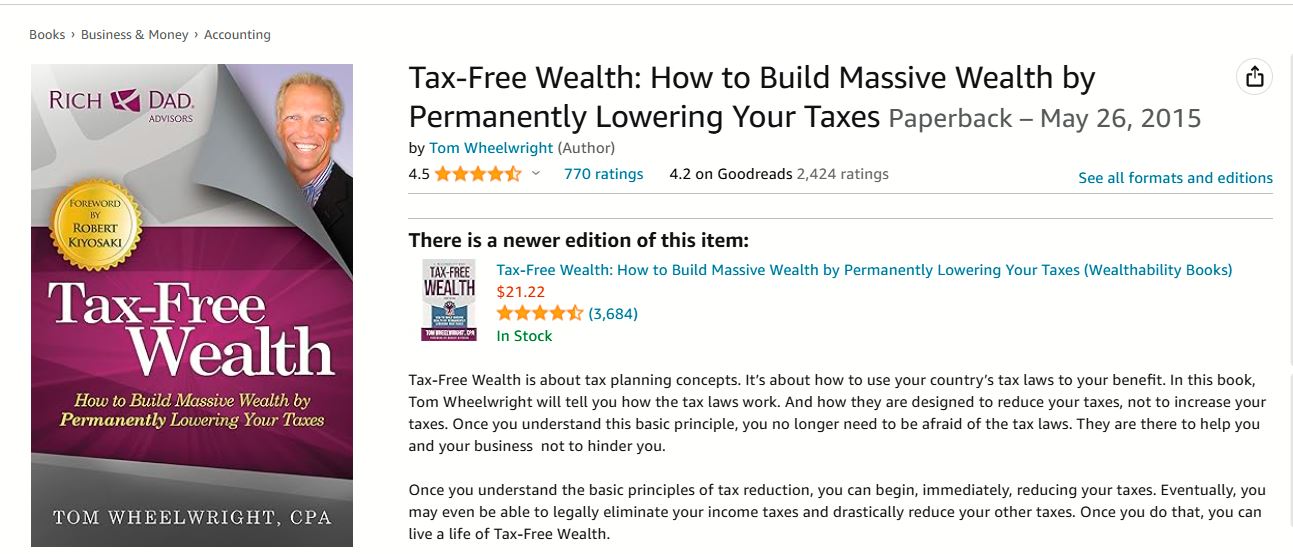

Was The Tax Free Wealth Book Popular? Did it Sell Many Copies?

Editor of Startups #nofilter