When you outsource your sales tax compliance, you can focus on growing your startup while experts take care of tasks like registering with authorities, filing reports, and ensuring timely payments. This not only saves you money on operations but also gives you access to specialized knowledge and skills, improving the accuracy of your sales tax reporting and helping you stay in line with regulatory requirements.

It is for those reasons that hiring the right type of taxing company that outsources for startups can make or break your bottom line profit margin and ensure your startup’s survival in 2024!

When selecting a service taxing company that outsource for startups provider, look for their experience working with startups, understand their pricing to avoid surprises, and ensure they can tailor their services to meet your specific needs. By exploring these options, you can find ways to use these services to support your business’s growth effectively.

The TLDR:

- Outsourcing sales tax compliance can really help startups by giving them access to expert knowledge and cutting down on operational costs.

- By doing this, it ensures that tax reporting is accurate and payments are made on time, reducing the risks of non-compliance.

- When looking for a provider, make sure to check their experience with startups and their grasp of intricate tax regulations.

- Opt for a service that has transparent pricing to avoid any surprises in costs.

- It’s also wise to pick a provider that fits well with your startup’s growth plans and can adjust to changing regulatory demands.

Understanding Sales Tax Compliance in 2024

Managing your startup effectively involves dealing with the complexities of sales tax compliance. This includes tasks like registering with tax authorities, filing reports, and making timely tax payments to different jurisdictions in 2024.

To stay on top of this, you’ll need to obtain the necessary certificates and grasp the various startup tax laws that apply. One way to simplify this process is to enlist the help of consultants such as Cherry Bekaert.

Benefits of Tax Company Compliance Outsourcing for Business Startups

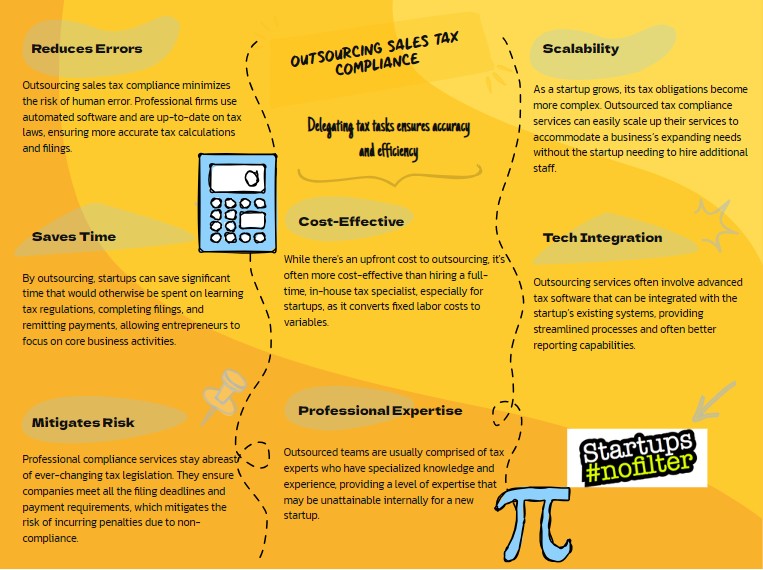

When startups outsource their compliance tasks, it can help them save money on operations, giving them a financial edge. By using services that handle sales tax compliance, you tap into expert knowledge and skills, lowering the chances of costly mistakes.

Incorporating tax compliance software into the process also improves the accuracy of sales tax reporting. Moreover, outsourcing sales tax compliance can aid in business growth by ensuring that your resources are in line with changing regulatory requirements.

Choosing the Right Taxing Company to Outsource Sales Tax Compliance for Your Startups

- When you’re looking at different service providers to handle your sales tax compliance, it’s crucial to check out their experience and how well they’ve worked with startups before.

- Make sure you understand their pricing clearly to avoid any surprise costs that could throw off your budget.

- This step is key to finding a partner that can help your startup grow while staying compliant with tax regulations.

5 Best Taxing Companies that Outsource Services to Startups:

- Immedis: Immedis is a global payroll and mobility tax services provider that specializes in sales tax compliance, business technology solutions, and taxing outsourcing for startups.

- ADP, Gusto, and Paychex: These 3 taxing companies are some of the top payroll outsourcing companies that startups can use to handle their payroll processing and compliance needs in 2024.

- EisnerAmper: EisnerAmper provides outsourced accounting, finance, tax, and advisory services for early-stage startups, allowing founders to focus on growth and innovation.

Taxing Company Provider Expertise Level

When picking a company to handle your sales tax compliance, make sure they know the ins and outs of dealing with complicated tax rules that suit startup businesses. Check that they’ve a strong history working in your industry, offering guidance that fits your specific compliance needs.

This type of tailored expertise is key for navigating tricky tax regulations and protecting against any risks of non-compliance.

Cost Transparency Analysis

To manage your startup’s budget effectively, it’s vital to break down and compare the pricing structures of different sales tax compliance service providers. By analyzing costs transparently, you can assess the value and pricing models of each provider.

This transparency helps you pick a service that fits your financial constraints and compliance requirements, ensuring a productive outsourcing partnership.

Implementation of Outsourced Solutions

- By using outsourced taxing company solutions for sales tax compliance, startups can save time and resources while following complex regulations.

- These solutions provide expert guidance and automate tax processes, reducing the risk of costly errors and penalties.

- They can easily adapt to your business’s growth, ensuring compliance without taking away from your core activities and expansion efforts.

Common Sales Tax Compliance Outsourcing Pitfalls for Biz Startups

When it comes to outsourcing sales tax compliance, startups need to tread carefully to avoid costly mistakes and ensure they meet all regulatory requirements. Clear communication is key to preventing misunderstandings, while having a detailed contract in place can help address any disputes that may arise.

- Determining which services are subject to sales tax. Startups that offer bundled services may struggle to identify which components are taxable, leading to errors.

- Keeping up with evolving sales tax regulations across different jurisdictions. Startups operating in multiple states or countries must comply with the varying sales tax laws, which can be difficult to track.

- Calculating the correct sales tax amounts and remitting them on time. Improper tax calculations or late payments can result in penalties and fines for startups.

- Maintaining accurate financial records and documentation to support sales tax filings. Poor bookkeeping can make it challenging for startups to demonstrate compliance during audits.

- Ensuring the outsourcing provider has the necessary expertise and up-to-date knowledge of sales tax regulations. Startups risk non-compliance if the provider does not have the right capabilities.

Selecting the right partner and maintaining strict oversight is crucial to minimize errors and ensure compliance. Regular assessments are essential to make sure the outsourcing services stay current with the latest tax rates and technology integration capabilities.

Exploring Managed Service Features

Now, let’s talk about how managed services can really step up your sales tax compliance game as a startup. These services basically take the hassle out of staying on top of your sales and use tax responsibilities by automating the whole process.

They check out where you need to pay tax, handle all the paperwork, and deal with any official notices that come your way in 2024.

Plus, you’ll get personalized advice from seasoned experts to make sure you’re doing things right and making the most of external help!

Common Questions about Outsourcing Tax Compliance for Startups in 2024

- How Does Sales Tax Compliance Affect E-Commerce Startups?

- Navigating through the complexities of tax nexus, dealing with jurisdictional variations, and overcoming challenges across multiple states can be quite a task. It’s crucial to have a good grasp of economic nexus thresholds and understand the ins and outs of dropshipping tax regulations. To make things easier, consider using compliance software and automated reporting tools to streamline the management of exemption certificates efficiently.

- Can Startups Recover From Early Sales Tax Compliance Failures?

- Absolutely, bouncing back from early sales tax compliance slip-ups is possible. You can turn things around by investing in user-friendly compliance software, getting advice from legal experts, and using voluntary disclosure and penalty reduction programs to minimize any fines and enhance your future compliance strategies.

- What Are the Risks of Changing Service Providers?

- Changing service providers can be risky, leading to potential service interruptions, fines for breaking contracts, and the possibility of data leaks. Additionally, you might encounter challenges with integrating new services, differences in company cultures, and concerns about the reliability of the new provider. It’s important to be cautious of hidden expenses and the potential for a decrease in quality with the switch.

- How Does Sales Tax Compliance Outsourcing Impact Financial Transparency?

- Thinking about outsourcing sales tax compliance? It can help cut costs and prepare you for audits, but there are some things to consider. While it can make things easier, there might be issues with transparency and keeping your data safe. Working with a reliable vendor can ensure accuracy and improve communication with everyone involved.

5 Services Offered by Sales Compliance Outsourcing Firms:

There are specialized compliance outsourcing services tailored to specific industries, such as CliftonLarsonAllen, Accounting Prose, and TaxConnex. These services bring in-depth knowledge of different sectors, seamless integration options, and the ability to scale as needed. They prioritize keeping data secure, staying up-to-date with regulations, and offering flexible contracts to help manage costs effectively.

- Grant Compliance Services: Assistance with grants management software, indirect cost rate proposal preparation, grant report preparation, subrecipient monitoring, and training on compliance requirements.

- Sales Tax Compliance Outsourcing: Handling sales tax registrations, filings, account closures, taxability research, nexus studies, and general consulting related to sales and use tax compliance.

- Chief Compliance Officer (CCO) Outsourcing: Providing a dedicated team of compliance professionals to oversee the entire compliance program, including policy development, risk assessments, audits, and regulatory updates.

- IT/Technology Compliance Outsourcing: Ensuring continued regulatory adherence, such as for data privacy (GDPR) and security standards, when outsourcing IT functions and services.

- Compliance Training and Awareness: Developing and delivering compliance training programs to educate employees on regulatory requirements across different industries.

10 Industry-Specific Compliance Outsourcing Services for These Niches:

- Healthcare Compliance: Outsourcing compliance programs for healthcare organizations like hospitals and physician practices to help them meet complex regulatory requirements.

- Financial Services Compliance: Outsourcing compliance tasks for financial firms to navigate the ever-changing regulatory landscape without building a large in-house compliance team.

- IT/Technology Compliance: Outsourcing IT functions while ensuring continued regulatory adherence for industries with strict data privacy and security rules.

- Data Privacy Compliance: Outsourcing the management of data privacy regulations like GDPR to maintain compliance and mitigate risks.

- Anti-Money Laundering (AML) Compliance: Outsourcing AML compliance processes like transaction monitoring and reporting to stay ahead of evolving regulations.

- Anti-Bribery and Corruption Compliance: Outsourcing the implementation and oversight of anti-bribery and corruption policies to meet global regulatory standards.

- Cybersecurity Compliance: Outsourcing the implementation and management of cybersecurity controls to adhere to industry-specific security regulations.

- Sustainability Compliance: Outsourcing the tracking and reporting of environmental, social, and governance (ESG) metrics to comply with sustainability regulations.

- Regulatory Change Management: Outsourcing the monitoring of regulatory changes and the implementation of necessary compliance updates across the organization.

- Compliance Training and Awareness: Outsourcing the development and delivery of compliance training programs to educate employees on regulatory requirements.

Who are the Compliance Officers Who Can Help?

- Compliance officer

- Anti-money laundering compliance officer

- Anti-money laundering reporting officer

- Deputy anti-money laundering compliance/reporting officer

- Responsable du contrôle du respect des obligations

- Responsible du respect des obligations

- Risk manager or officer

- Internal auditor

- Finance officer

- Data protection officer

Here is what you need to know about Sales Tax Compliance Outsourced Companies before you leave here:

When considering outsourcing sales tax compliance, make sure to pick a provider that meets your startup’s specific regulatory requirements. By opting for such solutions, you can avoid issues like non-compliance and financial errors.

Evaluate taxing company managed service features carefully to see how they can simplify and secure your compliance processes effectively. Partnering with the right provider will help boost operational efficiency, ensure adherence to intricate tax laws, and set your business up for sustainable growth with reduced risks.