Getting a guaranteed approval for a startup business loan with bad credit in 2025 can be really tough! Most traditional lenders have strict credit requirements and may not be willing to lend to individuals with a poor credit history. Read this guide on how to get your guaranteed loan very quickly – even if your credit is terrible!

Based in NYC? No problem! Check out our guide for securing a guaranteed bad credit startup business loan in New York City, updated for 2024! Or how about Miami? Or Vegas? How about Houston? Or Manitoba? Toronto? Mississauga?

How to Get a Guaranteed Startup Business Loan Right Now – Even with Poor Credit – in Just 5 Steps:

Business and startup credit scores are numerical representations of a startup business’s creditworthiness, similar to personal credit scores. Business credit scores are used by lenders to assess the risk of lending money to a startup – especially a startup company with bad credit that is looking for an essential guarantee – and to determine the terms and interest rates of a loan. Here are 5 steps on how to get that loan ASAP:

- Research Lenders Specializing in Bad Credit Loans: Identify alternative lenders or online platforms that offer startup loans for borrowers with poor credit, such as Kabbage, Fundbox, or Lendio. Avoid traditional banks, as they typically have stricter requirements. Our list above is a great start!

- Prepare a Strong Business Plan: Draft a detailed plan with clear financial projections, a unique value proposition, and a strategy for profitability. This can reassure lenders of your startup’s potential, even with a low credit score.

- Leverage Collateral or Co-Signers: If possible, offer collateral (like equipment or inventory) or find a co-signer with good credit to secure the loan. This minimizes the lender’s risk and may improve your chances of approval.

- Explore Government-Backed Loans: Look into SBA microloans, particularly the Community Advantage program, designed for startups with credit challenges. These loans often have relaxed credit criteria and may go up to $50,000.

- Demonstrate Cash Flow and Income: Show proof of consistent revenue, even if small, to highlight repayment ability. Lenders prefer businesses with some income history, so submit bank statements and any sales or revenue records you have.

Wait – Should I Even Try to Look for a Bad Credit Business Loan? Or First Improve My Company Credit Score?

We already know that it is super important to work on improving your credit score before applying for a loan, as this can increase your chances of getting approved for a loan with better terms and interest rates. This may include paying bills on time, keeping balances low on credit cards, avoiding applying for new credit, and disputing errors on your credit report.

Can I get a Startup Business Loan With Poor Credit Score 600?

Can I get a Startup Business Loan With Bad Credit Score 500?

Can I get a Startup Business Loan With Low Credit Score 400?

A credit score of 400 is considered to be very poor credit and can make it challenging to get approved for a traditional business loan from a bank or credit union. However, it is still possible to get approved for a business .

17 Awesome Tips for Startups to Get Guaranteed Loan Offers Even if They Have Bad Credit Histories in 2025

- Improve your credit score: Before applying for a loan, it’s important to take steps to improve your credit score for your startup business! This may include paying bills on time, keeping balances low on credit cards, avoiding applying for new credit, and disputing errors on your credit report.

- Put together a comprehensive business plan: A comprehensive business plan can help you convince lenders that your startup business will be successful, even if you have bad credit. This should include detailed information about your startup products or services, target market, marketing strategy, and financial projections.

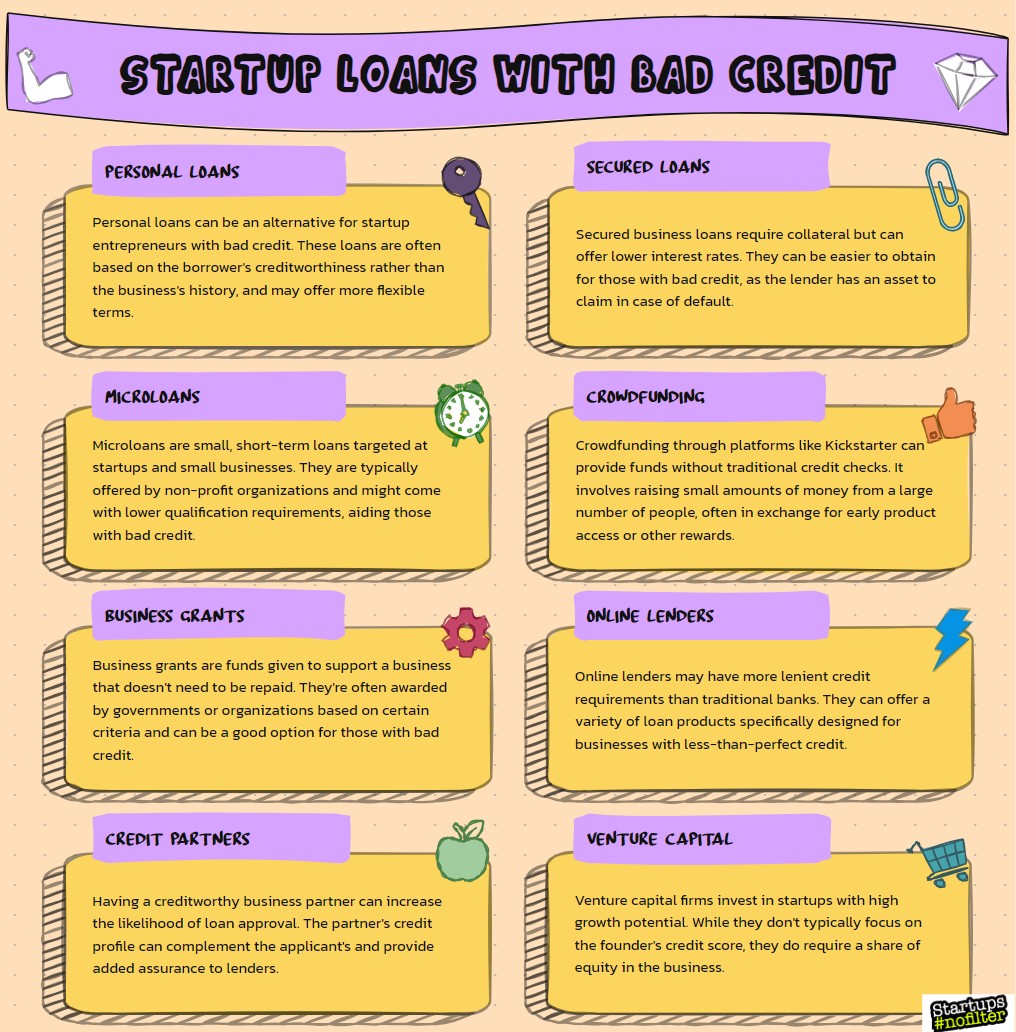

- Consider alternative lending options: Alternative lending options, such as online startup loans, peer-to-peer lending, and microloans, may be more willing to lend to startup founders and individuals with bad credit. These startup business loans specifically for bad credit and guaranteed approval may have higher interest rates and fees compared to traditional loans, so it’s important to compare multiple lenders and compare the terms and rates to find the best loan for your needs.

- Offer collateral: Offering collateral, such as SAAS access products, real estate or equipment, can increase your chances of getting approved for a startup business loan and may improve the terms and interest rate of the loan you receive.

- Find a co-signer: Having a co-signer with good credit can increase your chances of getting approved for a startup business loan and may improve the terms and interest rate of the loan you receive.

- Show proof of income: Providing proof of income, such as bank statements or tax returns from your fledgling startup company, can help you demonstrate to lenders that you have the ability to repay the startup business loan.

- Be transparent about your credit history: Being transparent about your startup business’ credit history and explaining why you have bad credit can help you build trust with lenders and increase your chances of getting approved for a loan.

- Consider a secured loan: A secured guaranteed startup loan, where you put up collateral in exchange for the loan, can be easier to get approved for and may have a lower interest rate compared to an unsecured loan.

- Shop around: Shopping around and comparing multiple lenders can help you find the best loan for your needs and increase your chances of getting approved for a startup business loan with bad credit – though a guarantee for this startup loan approval will be tough to get!

- Demonstrate strong financials: Demonstrating strong financials, such as positive cash flow and a solid business plan, can increase your chances of getting approved for a loan and potentially improve the terms and interest rate of the loan you receive.

- Consider a business credit card: Getting a business credit card and using it responsibly can help you establish a startup credit history for your business and improve your chances of getting approved for a loan in the future.

- Consider a government-backed loan: Government-backed loans, such as Small Business Administration (SBA) loans, may be easier to get approved for, even with bad credit, and can provide lower interest rates and more favorable terms compared to alternative lending options. The US Chamber of Commerce just released an amazing new loan offering in April, 2025!

- Demonstrate your business’s potential for growth: Demonstrating your startup business’s potential for growth, such as a solid marketing plan or partnerships with other businesses, can help you convince lenders that your business will be successful, even if you have bad credit.

- Be prepared to pay higher interest rates: With bad credit, you may face higher interest rates compared to individuals with good credit. Be prepared to pay these higher rates and factor them into your financial projections.

- Negotiate with lenders: Negotiating with lenders and being open to alternative loan structures, such as revenue-based financing or startup equipment financing, can increase your chances of getting approved for a loan and potentially improve the terms and interest rate of the loan you receive. Most people do not know about this!

- Build a network of mentors and advisors: Building a network of mentors and advisors who can provide support and advice can help you navigate the startup business loan approval process and increase your chances of getting approved for a loan to help your poor credit startup company.

- Consider a personal loan: If you are unable to get a startup business loan, consider taking out a personal loan and using the funds for your business. This can be a good option if you have a solid personal credit score and are confident in your ability to repay the loan.