Launching a startup company in 2023 requires a significant amount of capital. While some entrepreneurs may have enough savings to launch their venture, others rely on external funding sources such as loans.

However, securing startup loans can be a daunting task, especially if its a startup loan with bad credit, for many new business owners due to the strict requirements and intense competition in the market.

This complete guide aims to provide aspiring entrepreneurs with an in-depth understanding of startup loans, including different types of loans available, credit requirements, collateral and guarantees needed, preparation of business plans, tips for approval and success stories.

By familiarizing themselves with these key aspects of startup financing, entrepreneurs can make informed decisions about their funding options and improve their chances of obtaining necessary funds to turn their ideas into reality.

Finding Startup Funding & Startup Loans

Identifying suitable sources of startup funding and securing startup loans are crucial steps towards achieving financial stability for new businesses. Startup loans provide an initial influx of capital that can be used to cover a variety of expenses, including equipment purchases, marketing costs, and personnel salaries.

However, finding the right loan, whether it is SAAS, fintech, gaming, or more, can be challenging as many traditional lenders often require established credit histories or collateral before approving a loan.

To overcome these challenges, entrepreneurs should consider alternative sources of startup funding such as crowdfunding platforms or angel investors.

Crowdfunding platforms allow businesses to raise capital from a large number of individuals while angel investors offer financial support in exchange for equity in the company. Additionally, there are also government-backed programs available that offer low-interest loans and grants to qualifying startups.

By exploring all available options and carefully considering the terms and conditions of each potential lender, entrepreneurs can secure the necessary funds to establish their business and achieve long-term success.

Types of Loans

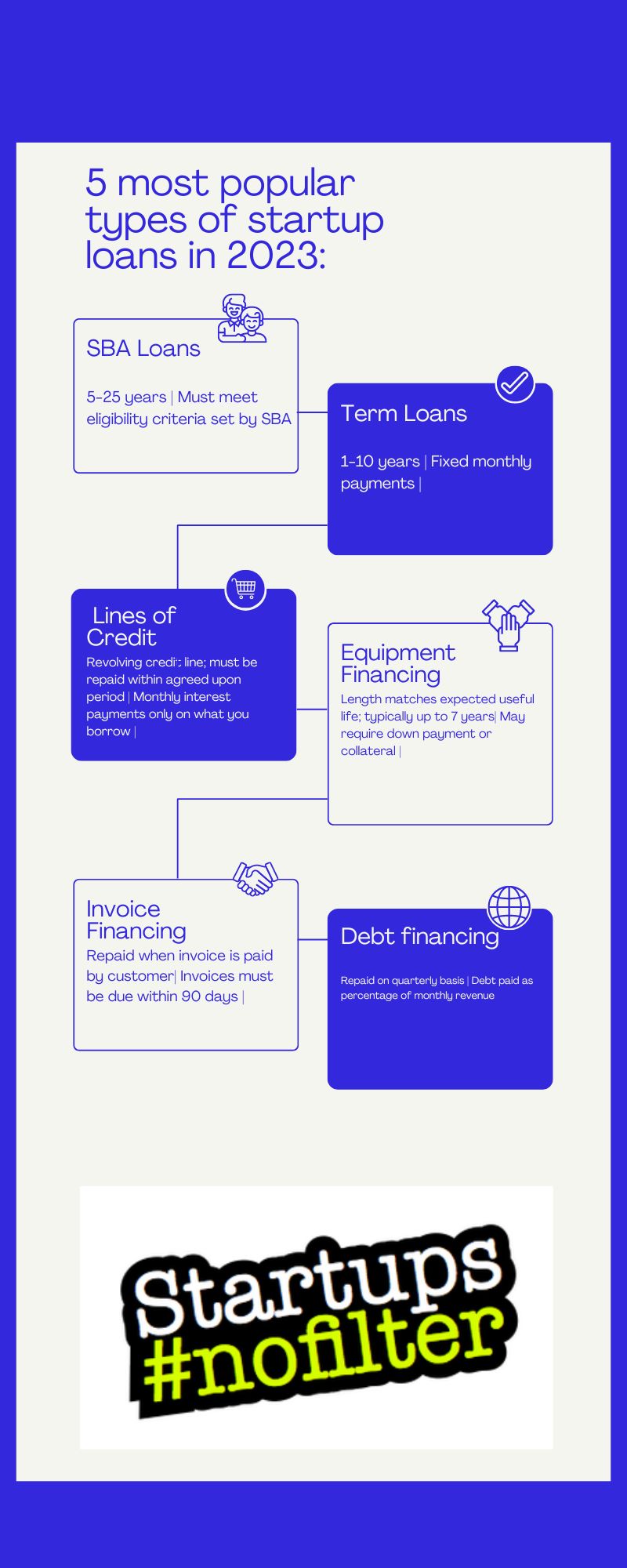

There are several loan options available for businesses seeking financial assistance, each with its own unique terms and requirements. Below are some of the most common types of loans that startup businesses can consider:

- – Term Loans: A traditional loan where a lump sum is borrowed and repaid over a set period of time, usually with fixed interest rates.

- – SBA Loans: Guaranteed by the Small Business Administration (SBA), these loans have longer repayment terms and lower interest rates than traditional bank loans.

- – Equipment Loans: Used to finance equipment purchases, this type of loan allows for the equipment to be used as collateral for the loan.

- – Lines of Credit: Similar to credit cards, lines of credit allow businesses to borrow money up to a certain limit and only pay interest on the amount borrowed.

- – Invoice Financing: This option allows businesses to receive funds upfront based on outstanding invoices that they expect to receive payment for in the future.

When considering which type of loan is best suited for their business needs, entrepreneurs should carefully evaluate factors such as their current financial situation, cash flow projections, and growth plans. It is also important to research different lenders and compare rates and fees before making a decision.

With proper planning and research, startup business loans can provide much-needed capital for new ventures.

Credit Requirements

Credit requirements play a crucial role in determining the eligibility of entrepreneurs for obtaining loans. Lenders use credit scores and reports to evaluate the creditworthiness of borrowers, which helps them foresee how likely it is that they will repay their debts on time.

A good credit score indicates that an entrepreneur has been financially responsible and has a history of timely payments and low debt-to-income ratios. On the other hand, a poor credit score may indicate that the borrower has defaulted on previous loans or has high levels of debt relative to their income.

Meeting the minimum credit requirements is essential for obtaining startup business loans. Most lenders require a minimum FICO score of 600-640, though some may have stricter criteria. Borrowers with lower scores may still be eligible but may need to provide additional documentation or collateral to secure financing.

Therefore, before applying for startup business loans, entrepreneurs should review their credit reports from all three major reporting agencies and take steps to improve their scores if necessary by paying off outstanding debts or disputing errors on their reports. By meeting the necessary credit requirements, entrepreneurs can increase their chances of securing funding for their startups’ success and financial stability in the future.

Collateral and Guarantees

Entrepreneurs can increase their chances of securing financing for their ventures by providing collateral or guarantees to lenders. Collateral refers to assets that a borrower pledges as security against the loan, such as property, equipment, or inventory. This provides a sense of security for lenders in case the borrower defaults on the loan.

Lenders may also require personal guarantees from entrepreneurs, which means they pledge their own assets or income to cover any outstanding debts should the business fail.

Collateral and guarantees are crucial components of securing startup business loans because they provide assurance to lenders that they will be able to recoup their losses in the event of default. Additionally, these requirements demonstrate an entrepreneur’s commitment to their venture by putting up personal assets as collateral.

However, it’s important for entrepreneurs to carefully consider what they’re willing and able to pledge before signing any loan agreements; if a business fails and there isn’t enough collateral or guarantees available, entrepreneurs risk losing personal assets as well as the business itself.

Overall, while providing collateral and guarantees may increase an entrepreneur’s chances of securing funding, it’s essential for them to weigh all factors involved before making a final decision.

Business Plan Preparation

One crucial aspect of securing financing for a new venture involves the development of a well-crafted business plan. A business plan is essentially a roadmap that outlines the company’s goals, strategies, and financial projections. It provides lenders with an in-depth understanding of how the company plans to use the funds, what its potential for success is, and how it intends to make repayments.

A well-written business plan can help entrepreneurs secure financing by demonstrating their commitment, knowledge, and expertise in their field. It should also include market research that shows there is a demand for their product or service and an analysis of competitors’ strengths and weaknesses.

The following are three emotional benefits entrepreneurs can experience by developing a comprehensive business plan:

- – Confidence: A solid business plan gives entrepreneurs confidence in their strategy and helps them communicate it effectively to others.

- – Clarity: Creating a detailed plan forces entrepreneurs to confront potential challenges and develop contingency plans.

- – Focus: By outlining clear goals and objectives, entrepreneurs can remain focused on achieving them even when faced with setbacks or distractions.

Overall, a well-prepared business plan not only increases the likelihood of securing financing but also sets entrepreneurs up for success by providing clarity, focus, and confidence in pursuing their dream venture.

Startup Loan Application Process

The loan application process is a crucial step for individuals seeking startup company financial support to start or grow their business venture.

This process involves submitting an application to lending institutions, which usually requires providing personal and business information such as credit history, income statements, balance sheets, and cash flow projections.

The lender will then evaluate the applicant’s creditworthiness, ability to repay the loan, and overall financial health of the business before deciding on whether or not to approve the loan.

It’s important for applicants to have a clear understanding of their financial situation and needs before applying for a loan. This includes having a solid business plan in place that outlines how the funds will be used and repaid.

Additionally, it’s essential to research different lenders and their requirements to find one that best fits your needs. By being prepared and knowledgeable about the loan application process, individuals can increase their chances of securing funding for their startup or expanding business.

Alternative Lenders

Moving on from the traditional loan application process, alternative lenders offer a more flexible and innovative approach to funding for startup businesses. These lenders are typically non-bank financial institutions that provide loans with less stringent requirements and faster processing times compared to banks.

Alternative lenders come in various forms, such as online lenders, peer-to-peer lending platforms, crowdfunding sites, and microfinance institutions. Online lenders use technology to streamline the application process while peer-to-peer lending platforms allow investors to fund loans directly without intermediaries.

Crowdfunding sites enable entrepreneurs to raise capital through small contributions from a large number of people while microfinance institutions provide access to credit for individuals who do not have collateral or credit history. With their diverse range of offerings, alternative lenders can cater to different types of startups and help them obtain financing that meets their specific needs.

SBA Loans

SBA loans are a government-backed loan program designed to provide accessible funding options for small businesses. The Small Business Administration guarantees up to 85% of the loan, which means that lenders are more willing to lend money to small businesses that may not have collateral or a strong credit history. SBA loans can be used for a variety of purposes such as working capital, equipment purchases, real estate purchases, and debt refinancing.

There are several types of SBA loans available for small business owners. The most popular one is the 7(a) Loan Program, which provides up to $5 million in financing for small businesses. Another option is the CDC/504 Loan Program, which can be used for purchasing fixed assets such as machinery and real estate.

Additionally, there are microloans available through SBA intermediaries that can provide up to $50,000 in funding.

It’s important to note that while SBA loans can be an attractive option for small business owners due to their lower interest rates and longer repayment terms compared to traditional bank loans, they do require extensive documentation and a lengthy application process.

Crowdfunding

Crowdfunding, a relatively new method of financing, involves raising small amounts of money from a large number of people through online platforms. This approach to funding has gained popularity in recent years due to its ability to connect entrepreneurs with potential investors and supporters from all over the world.

Here are some key points to consider when exploring crowdfunding as a funding option for your startup business:

- – Crowdfunding can be an effective way to test the market demand for your product or service before investing significant time and resources into development.

- – There are several different types of crowdfunding platforms available, including donation-based (where backers receive no tangible reward), rewards-based (where backers receive a product or service in exchange for their investment), equity-based (where backers become part owners of the company), and debt-based (where backers lend money that must be repaid with interest).

- – Successful crowdfunding campaigns require careful planning, compelling storytelling, and a strong marketing strategy.

- – Crowdfunding can also offer valuable exposure and publicity for your business.

- – However, it’s important to remember that not all crowdfunding campaigns are successful. It’s crucial to have realistic expectations and understand the risks involved before pursuing this funding option.

Overall, crowdfunding can be an attractive option for startups looking to raise capital without taking on debt or giving up equity.

By understanding the various types of platforms available and investing time in creating a well-planned campaign, entrepreneurs may find success in raising funds while building a community around their business idea.

Grants and Accelerator Programs

Grants and accelerator programs offer alternative funding options for entrepreneurs seeking financial support and mentorship to grow their business. Grants are non-repayable funds given by organizations or government agencies to individuals or businesses that meet certain criteria, such as being in a certain industry or having a specific mission.

While grants can provide substantial financial support, they often come with strict guidelines on how the money can be used and require extensive documentation.

Accelerator programs, on the other hand, provide not only funding but also mentorship and valuable resources to help startups grow quickly. These programs usually have a set timeframe (often around 3-6 months) during which participants receive intensive training, access to investors and networking opportunities, and guidance from experienced mentors.

In exchange for these benefits, accelerators typically take equity in the startup. Both grants and accelerator programs have potential advantages for startups seeking funding beyond traditional loans or crowdfunding platforms.

Loan Repayment and Terms

Understanding the terms and repayment requirements of a loan is crucial for entrepreneurs seeking funding. Before signing on to any loan agreement, it is important to review the terms and conditions carefully, including interest rates, fees, payment schedules, and penalties for late or missed payments. Entrepreneurs should also familiarize themselves with different types of loans available to them such as secured vs unsecured loans; short-term vs long-term loans.

To help entrepreneurs navigate through different loan options, we have compiled a table outlining some common types of loans along with their repayment terms and requirements.

The table below presents information on five popular types of loans: SBA Loans (Small Business Administration), Term Loans, Lines of Credit, Equipment Financing and Invoice Financing.

By reviewing this table, entrepreneurs can better understand which type of loan may be best suited for their business needs and budget constraints.

By understanding these different types of loans and their respective repayment terms and requirements, entrepreneurs can make informed decisions about which option works best for their startup business. It is important to remember that borrowing money always carries risks so it’s essential that entrepreneurs do their due diligence before signing any agreements.

Interest Rates for Startup business loans

The determination of interest rates for financing a startup business can be influenced by various factors. One of the most significant factors is the creditworthiness of the borrower, which includes their credit score and financial history. Lenders typically offer lower interest rates to borrowers with good credit scores because they are considered less risky and more likely to repay their loans on time.

Another factor that affects interest rates for startup business loans is the loan amount. Generally, larger loan amounts may attract higher interest rates as lenders perceive them as riskier investments.

Additionally, longer repayment periods often result in higher interest rates due to increased risks associated with prolonged exposure to market conditions. Therefore, it’s essential for entrepreneurs to carefully evaluate their business needs and determine an appropriate loan amount and repayment term that aligns with their financial goals while minimizing costs associated with high-interest rates.

Loan Amounts

Loan amounts can impact the interest rates offered for financing a new venture, as larger amounts may be perceived as riskier investments by lenders. Startups typically require significant capital to get off the ground, and financing options range from microloans to multimillion-dollar deals. The loan amount will depend on several factors, including the type of business, its stage of development, revenue potential, and creditworthiness.

The following table provides an overview of common startup loan amounts available to entrepreneurs:

Loan Type | Loan Amount Range

- Microloan | $500 – $50,000 |

- SBA 7(a) | Up to $5 million |

- Equipment Financing | Up to $5 million |

- Venture Capital Funding | Varies but usually over $1 million |

It is important for startups to carefully consider their financial needs and borrowing capacity before applying for a loan.

While larger loans may allow for more significant growth opportunities, they also come with higher risks and potentially higher interest rates.

Entrepreneurs should work with lenders who understand their industry and offer flexible repayment terms that align with their cash flow projections. By carefully assessing their financial needs and choosing the right lender, startups can secure funding that will help them achieve long-term success.

Startup business loans Loan Fees and Closing Costs

Startup business loans may involve additional costs such as loan fees and closing costs, which entrepreneurs should carefully consider before applying for financing.

Loan fees are charges assessed by the lender to cover administrative expenses related to processing a loan application. These fees can vary widely depending on the lender and the type of loan being considered. Some lenders may charge an origination fee, which is a percentage of the total loan amount, while others may charge an application fee or underwriting fee.

Closing costs are another expense that entrepreneurs should be aware of when taking out a startup business loan. These costs can include legal fees, appraisal fees, and title search fees among others. The total cost of closing will ultimately depend on factors such as the size of the loan and the complexity of the transaction.

While these additional expenses can add up quickly, they are often necessary in order to secure financing for a new business venture. As such, it is important for entrepreneurs to carefully review all associated costs before making any decisions about acquiring startup funding through loans or other financial instruments.

Repayment Schedule

After understanding the fees and closing costs involved in obtaining a startup business loan, it is essential to plan for the repayment schedule.

Repayment schedules are agreements between borrowers and lenders that outline how much money borrowers will pay back, when they will pay it back, and how often. Generally, repayment schedules can last from one year up to ten years or more depending on the lender’s requirements.

Entrepreneurs should consider their business revenue projections before deciding on a repayment schedule. The revenue projections help entrepreneurs determine their ability to repay their loans while keeping up with other expenses such as rent, payroll, and inventory.

It is also important to be realistic about revenue projections because overestimating income could lead to difficulties in repaying the loan on time. Furthermore, entrepreneurs should read through all terms of the agreement carefully before signing up for any loan so they can avoid penalties for missed payments or other breaches of contract.

Overall, planning ahead by considering different repayment schedules based on projected income can be helpful in avoiding any potential financial challenges down the road.

Loan Default and Consequences

Failure to make loan payments on time can result in serious consequences, including damage to credit scores and legal action taken against the borrower.

When a borrower defaults on a loan, it means they have failed to make payments as agreed upon in the loan contract. This can happen for various reasons such as financial difficulties or simply forgetting to pay.

Regardless of the reason behind defaulting, it is important to understand the consequences that come with it.

One of the most significant impacts of defaulting on a loan is damage to credit scores. Late or missed payments are recorded by credit bureaus and lower credit scores, making it difficult for borrowers to secure future loans or lines of credit.

Additionally, lenders may take legal action against borrowers who default on their loans. This can include wage garnishment or seizure of assets such as property or vehicles used as collateral for the loan.

Therefore, borrowers should carefully consider their ability to repay before taking out a loan and seek assistance if they experience financial difficulties during repayment.

Startup business Loan Comparison Tools

Comparing available loan options can be a useful tool for entrepreneurs seeking funding for their new ventures. Fortunately, there are various online tools and platforms that can help business owners compare different types of startup loans offered by banks and alternative lenders.

These comparison tools allow entrepreneurs to easily assess the terms, fees, interest rates, repayment schedules, and eligibility requirements of each loan option side-by-side.

One such platform is Fundera, which offers a user-friendly interface that allows business owners to compare more than 20 different lenders in one place.

The platform also provides detailed information on each lender’s application process, borrower requirements, funding timeframes and more. Another popular comparison tool is Lendio which connects small businesses with multiple lenders through its online marketplace. Startups can use this platform to receive pre-qualified offers from over 75 lending partners based on their specific financing needs and creditworthiness.

Meanwhile, NerdWallet provides an extensive database of business loan providers along with ratings and reviews from past borrowers helping entrepreneurs make informed decisions about where they should apply for funding.

Overall, these comparison tools offer valuable insights into the world of startup loans allowing entrepreneurs to make the best possible decision when it comes to securing financing for their new businesses.

Choosing the Right Lender

Selecting the most appropriate lender for a startup requires careful consideration of several factors.

It is crucial to begin by evaluating the terms and conditions of various lenders. Different lenders will offer different loan terms, which may include repayment periods, interest rates, and fees. The entrepreneur must evaluate these factors against their financial needs and capabilities.

In addition to loan terms, entrepreneurs should also consider collateral requirements and funding speed when selecting a lender. Some lenders may require collateral before they approve a loan application while others do not need any security.

Moreover, startups often require quick access to funds; hence it is vital to review the funding speed offered by each potential lender.

Ultimately, choosing the right lender can make all the difference in helping your startup achieve its goals with ease.

Tips for Startup business loans Approval

One effective approach for increasing the chances of securing approval for a loan as a startup is to optimize your business plan and financial projections. Lenders are more likely to approve loans for businesses that have a solid plan in place, with well-defined goals and strategies for achieving them.

This means that you need to invest time and effort into preparing a comprehensive business plan that covers all aspects of your operations, including marketing, sales, production, finance, and management.

Your financial projections should also be realistic and based on reliable data sources. You should provide detailed information about your revenue streams, expenses, cash flow statements, balance sheets, income statements, and other key metrics that lenders use to evaluate the viability of your business.

It’s important to demonstrate how you intend to use the loan funds in order to achieve your goals and grow your business over time. By showing lenders that you have a clear roadmap for success and can effectively manage resources to achieve your objectives, you’ll increase your likelihood of getting approved for startup business loans.

Common Mistakes to Avoid

After learning some tips that can increase the odds of getting approval for a startup business loan, it is equally important to know what not to do. Common mistakes can lead to rejection or acceptance with higher interest rates and unfavorable terms. Therefore, this subtopic will discuss the common mistakes that applicants make when seeking startup business loans.

Firstly, one of the most common mistakes is applying for too much or too little funding. Applying for an amount that is too high may raise suspicion from lenders and could result in rejection. In contrast, requesting a lower amount may not be enough to cover all necessary expenses, leading to cash flow problems down the road.

Secondly, failing to have a solid business plan can also hurt an applicant’s chances of approval. Lenders need assurance that their investment is sound and profitable before they release funds. A clear business plan that outlines financial projections and strategies for growth is critical in securing a loan.

Lastly, neglecting personal credit scores can be detrimental as well. Even if the company has excellent revenue streams and cash reserves, lenders often consider personal credit history as part of their decision-making process.

To summarize, avoiding these common mistakes will help improve the likelihood of getting approved for a startup business loan with favorable rates and terms:

- – Requesting appropriate funding amounts

- Having a solid business plan

- Maintaining good personal credit scores

Success Stories and Testimonials

The success stories and testimonials of entrepreneurs who have secured funding can provide valuable insights into the effectiveness of various loan strategies and lenders. These accounts offer firsthand experiences and lessons learned from those who have navigated the process successfully.

For example, a business owner may share their experience of working with a particular lender or using a specific type of loan to fund their startup. Their feedback can help others in similar situations weigh the pros and cons before making important decisions.

Success stories also serve as inspiration for aspiring entrepreneurs who may be struggling to secure funding for their own businesses. Hearing about someone else’s journey towards success can provide encouragement and motivation to keep pushing forward despite any setbacks or obstacles encountered along the way.

Additionally, reading about successful startups that were able to turn their dreams into reality through smart financial planning can offer valuable lessons that apply to any business venture, regardless of industry or size.

Ultimately, these success stories and testimonials serve as powerful reminders that with hard work, persistence, and access to the right resources, starting a successful business is possible for anyone willing to put in the effort.

Startup business loans vs grants

Comparing the benefits and drawbacks of startup business loans and grants can help entrepreneurs make informed decisions about which financing option best aligns with their goals and values.

While both options provide funding for startups, there are significant differences in terms of repayment requirements, eligibility criteria, and the level of control that investors have over the business.

When it comes to startup business loans, entrepreneurs must repay the principal amount plus interest within a specified time frame. This means that they will have ongoing debt obligations even after the business has started generating revenue.

On the other hand, grants do not require repayment but typically come with strict eligibility criteria and reporting requirements. Additionally, grant providers may demand regular updates on how funds are being used or even intervene in decision-making processes related to the business.

Ultimately, choosing between these two options requires careful consideration of one’s financial needs and long-term goals as well as an understanding of the potential trade-offs involved.

Very Common Questions & Some Answers

- Can a startup business loan be used for personal expenses?

- Startup business loans are intended for financing business operations, not personal expenses. It is important to use the funds for their intended purpose and provide documentation of how they were used. Misusing loan funds can result in legal consequences.

- How long does it typically take to receive funding from a startup loan?

- The typical time it takes to receive funding from a startup loan varies depending on the lender, type of loan, and application process. It can range from a few days to several weeks or even months.

- Are there any penalties for prepaying a startup loan?

- Prepaying a startup loan may result in penalties, depending on the lender’s policies. It is essential to review the loan agreement carefully and inquire about any potential fees associated with early repayment. Some lenders may charge a prepayment penalty or require payment of interest until the original loan term ends.

- Can a startup loan be used to purchase an existing business?

- Yes, a startup loan can be used to purchase an existing business. However, lenders may require additional information and collateral to ensure the viability of the investment. It is important to review all loan terms and conditions before making any financial decisions.

- What happens if a borrower misses a payment on their startup loan?

- If a borrower misses a payment on their startup loan, they may incur late fees and damage to their credit score. The lender may also take legal action to recover the outstanding balance. It is important for borrowers to communicate with their lenders and explore options for repayment assistance if necessary.

2023, 2024 and beyond for startup loans:

Startup businesses are exciting ventures, but they require adequate funding to launch and grow. Finding the right startup loan can be a daunting process, but with proper preparation and research, entrepreneurs can secure the funds they need.

Understanding the different types of loans available, credit requirements, collateral options, and business plan preparation is crucial for success. Entrepreneurs should avoid common mistakes when applying for startup loans and seek advice from experts or successful business owners.

It’s also important to note that startup business loans differ from grants in terms of repayment expectations. With careful planning and persistence, entrepreneurs can secure the necessary funds to turn their dreams into reality.

Editor of Startups #nofilter