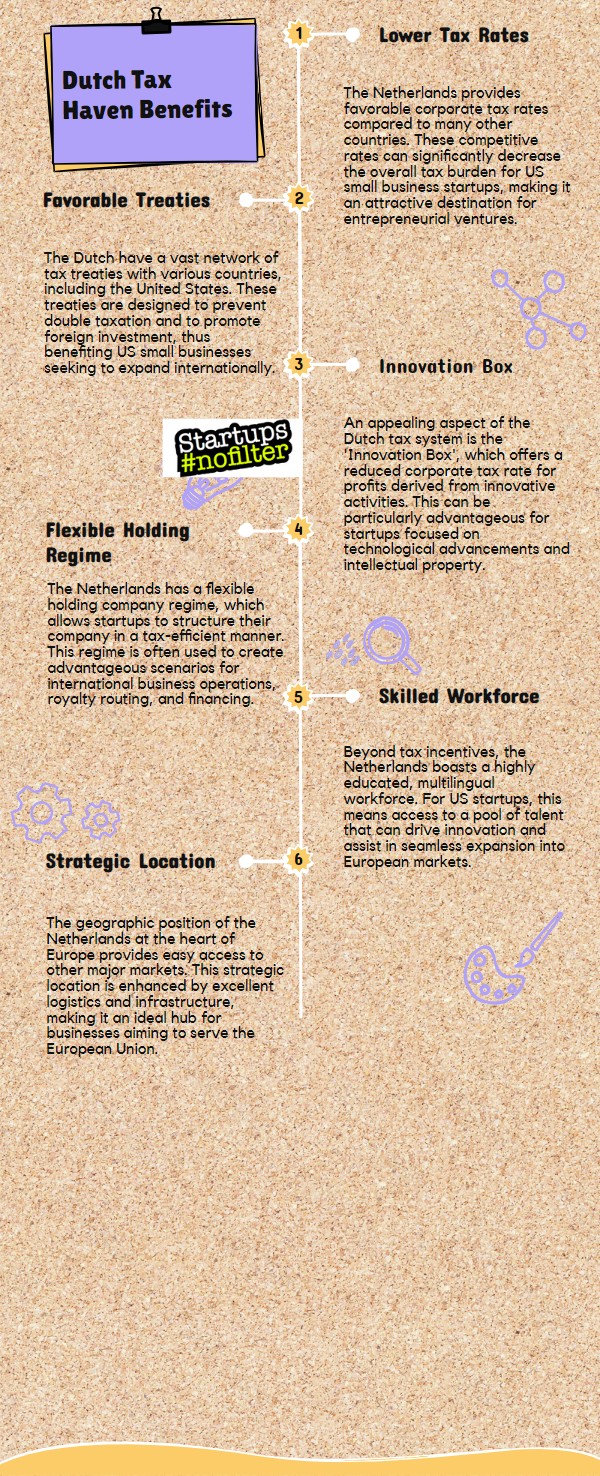

The Netherlands offers significant benefits as a tax haven for your US small business startup. You’ll appreciate their low corporate tax rates, tax exemptions, and incentives, along with a well-organized tax ruling system that provides financial clarity and stability.

Dutch tax regulations are known for being clear and easy to follow, making compliance hassle-free for new businesses. Delving deeper into Dutch tax policies could uncover even more advantages to streamline your startup’s financial path.

Understanding Tax Havens

You’ve probably heard of the term ‘tax haven‘ before, but let’s break it down to understand why the Netherlands is a hotspot for US small business startups.

It all comes down to the low corporate tax rates, attractive tax exemptions, incentives, and advanced tax rulings that help ease tax burdens. These perks allow startups to keep more of their profits, which is a big draw for choosing the Netherlands as a base.

Netherlands Beneficial Tax Policies

When it comes to the Netherlands’ tax policies, one standout feature is the corporate tax rates. They set the rate at 19% for profits under €200,000 and 25.8% for higher profits, making it an attractive choice for small business startups from the US.

Moreover, the Netherlands offers clear and advanced tax rulings that provide guidance for multinational companies. This clarity helps businesses plan their taxes effectively. The competitive tax methods in place also appeal to smaller corporations looking to establish themselves in the country.

Additionally, the Netherlands maintains a stable tax environment that attracts foreign companies seeking a reliable and transparent system. This, coupled with clear communication on tax matters, enhances tax planning for businesses operating within the country.

Role of International Tax Agreements

When it comes to international tax agreements, the Netherlands shines as a top spot for US small business startups. They offer some great tax perks that really help make the business scene competitive. These agreements mean lower tax rates, exemptions for certain types of income, and clear rules on how taxes work across borders.

Let’s break down these benefits:

- Lower Tax Rates: Thanks to these tax deals, businesses can enjoy lower tax rates, which ultimately boost their profits.

- Exemptions: Certain types of income get a pass from taxes, lightening the overall tax load for businesses.

- Stability: With set rules in place, businesses can predict how taxes will work, reducing financial guesswork.

Startups and Tax Optimization

When you think about the Netherlands’ tax system and how it can benefit US startups, it’s clear that there are some distinct advantages.

The Dutch tax setup offers competitive rates and straightforward rules, providing unique perks that can make a real difference to your startup’s finances.

Let’s take a closer look at these tax incentives in the Netherlands and how they can help streamline your small business’s tax planning.

Netherlands Attractive Tax Regime

Considering the Netherlands’ appealing tax system could be a smart move for small US startups. The country offers competitive corporate tax rates, clear tax guidelines, and a strong focus on following the rules. Here’s how it can benefit you:

- Take advantage of the competitive corporate tax rates to increase your profits.

- Benefit from advanced tax agreements tailored for international businesses.

- Understand tax laws clearly to steer clear of any issues with tax evasion.

- Stay compliant with regulations, setting it apart from other tax havens in Europe.

US Startups Tax Benefits

When it comes to navigating the Dutch tax system for your startup, you’ll find a treasure trove of benefits that can boost your bottom line.

The Netherlands offers attractive corporate tax rates and clear tax guidelines, making it a smart choice for US startups.

You can take advantage of tax perks such as exemptions, favorable regulations, and chances to optimize your tax situation.

Despite some withholding tax considerations, the Netherlands provides a welcoming environment for small businesses looking to expand internationally.

Exploring Dutch Tax Incentives

When it comes to Dutch tax incentives, the Netherlands attracts US small business startups with a competitive corporate tax rate of 19% for profits up to €200,000 and 25.8% for profits beyond that. Here’s why this matters:

- Dutch tax rulings help with optimizing taxes.

- Clear tax interpretations support smart tax planning.

- Competitive tax methods create a transparent business environment.

- US startups can benefit from enhanced growth opportunities.

These aspects position the Netherlands as an appealing destination for startups looking to establish themselves in Europe.

Comparing Netherlands With Other Tax Havens

When you compare the Netherlands to other European countries known for favorable tax conditions, you’ll notice that the Netherlands stands out for its competitive tax rates, specialized tax agreements for multinational companies, and a commitment to transparency.

The Dutch tax system offers benefits like tax exemptions that help reduce overall tax burdens. These perks, paired with straightforward tax procedures, make the Netherlands an attractive choice for budding businesses looking to save on taxes.

Establishing a Startup in the Netherlands

When it comes to starting a business abroad, setting up shop in the Netherlands can be a smart move, especially for small US companies. Here’s why:

- You’ll enjoy friendly tax policies and clear tax guidelines.

- There are appealing tax breaks available for multinational corporations.

- The country boasts a stable political and economic climate.

- Plus, there’s a withholding tax in place to prevent tax evasion from low-tax regions.

All these factors combine to make the Netherlands a top pick for launching your international startup.

Very Common Questions & Some Answers

Why Is Netherlands a Corporate Tax Haven?

You’re interested in the Netherlands because it has straightforward tax rules, beneficial corporate setups, and openness about taxes. It’s great for moving profits around, setting up holding companies, and managing intellectual property without needing complex strategies like a Dutch Sandwich.

Does the Netherlands Have a Tax Treaty With the Us?

Absolutely! The Netherlands and the US have a tax treaty in place. This treaty is super handy as it helps to prevent double taxation, clear up any tax-related issues, assist with business tax strategies, and make international transactions smoother for you.

Is the Netherlands a Good Country to Start a Business?

Definitely, the Netherlands is a fantastic place to kick off a business journey. With a vibrant startup scene, attractive incentives for entrepreneurs, and solid governmental backing, it sets the stage for success. The country’s stable economy, innovative prospects, and skilled workforce add to its appeal for new ventures.

Why Is Netherlands Good for Business?

The Netherlands is a great place for business because of its innovative atmosphere, skilled workforce, and thriving startup community. Additionally, its solid infrastructure, stable economy, and accessible market make it a hotspot for investment opportunities.

The TLDR for 2024

So, you’ve learned why the Netherlands is a popular choice as a tax haven for small business startups from the US. Its favorable tax regulations, strategic international tax agreements, and supportive environment for startups offer clear benefits.

When compared to other tax havens, the Netherlands stands out. Starting your business there could be a smart move, helping you optimize taxes and boost your profits.

Remember, making an informed choice can have a significant impact on your business’s financial future.

Editor of Startups #nofilter