Bermuda is a sweet spot for your US small business startup when it comes to taxes. They don’t tax your profits, income, dividends, or capital gains, giving you a nice break on your tax bill and helping your startup grow faster.

Thanks to exemptions under the Corporate Income Tax Act, your bottom line gets a boost. While big global companies will face a 15% corporate income tax starting in 2025, small businesses like yours are in the clear.

By taking advantage of Bermuda’s tax-friendly vibe, your startup can get a leg up in the financial game.

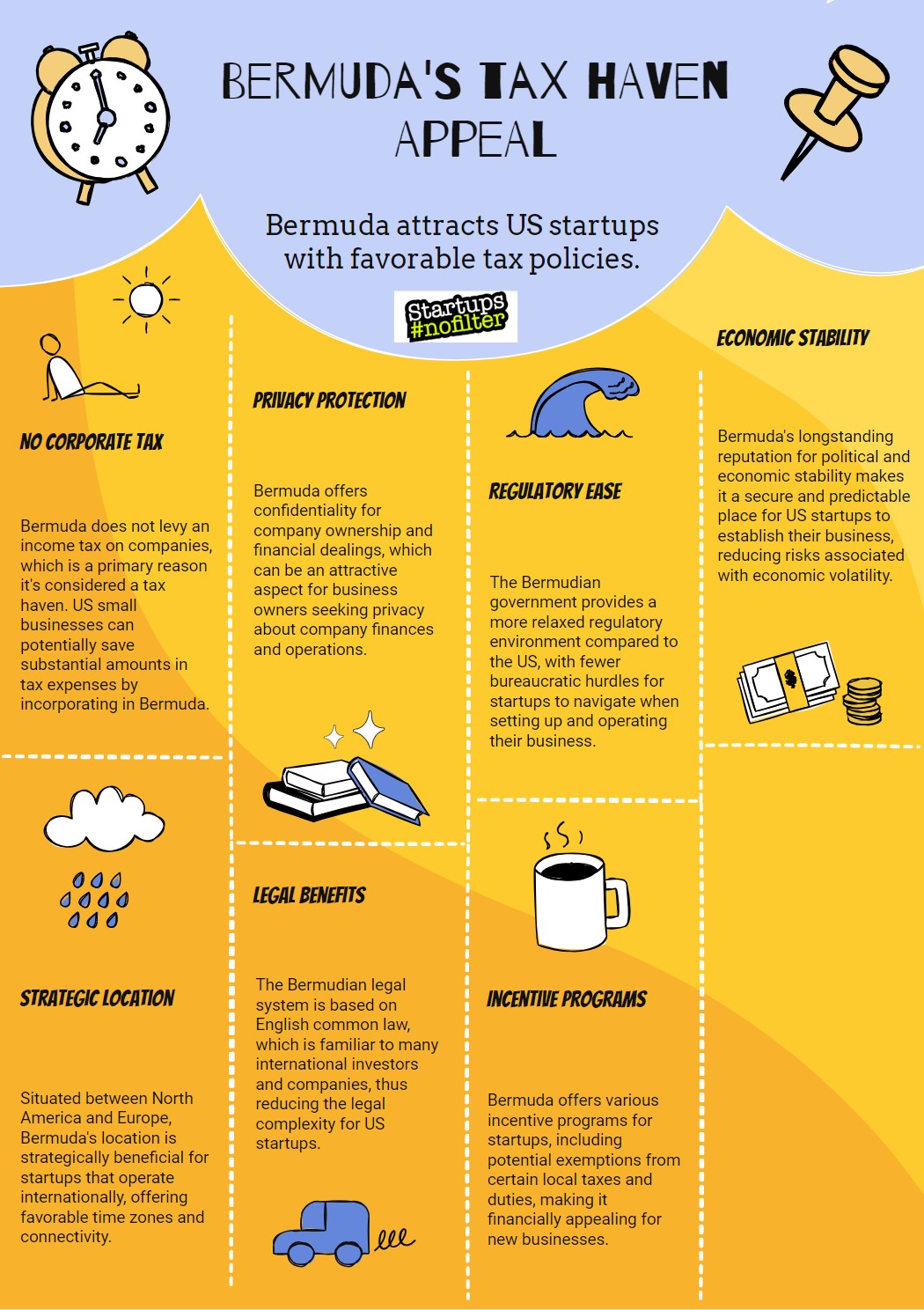

Understanding Tax Havens

Tax havens, such as Bermuda, where foreign businesses are lured in with low or no taxes. These offshore havens for US citizens, known for their financial secrecy, are popular for avoiding taxes.

Many U.S. companies, including startups, take advantage of these havens to reduce their tax payments legally. The tax benefits offered by Bermuda make it an attractive choice for small American startup businesses looking to manage their taxes efficiently.

Bermudas Tax Policies

Let’s talk about Bermuda’s tax policies.

Bermuda doesn’t impose taxes on profits, income, dividends, or capital gains, making it a popular choice for US small businesses looking to minimize tax burdens.

However, starting in 2025, multinational enterprises (MNE) with revenues exceeding $750 million will face a new 15% Corporate Income Tax.

To sweeten the deal, Bermuda offers Tax Assurance Certificates that can grant your business tax exemptions until 2035, giving you a solid tax strategy to work with.

Bermudas Attractive Tax Regime

US small business startups often find Bermuda’s tax system incredibly appealing. Here’s why:

- Businesses can keep all their profits since Bermuda doesn’t tax profits, income, dividends, or capital gains.

- Small businesses benefit from an exemption under the Corporate Income Tax Act, saving them from the 15% CIT.

- Tax Assurance Certificates shield them from potential future tax burdens.

Bermuda’s tax policies create a welcoming environment for startups seeking tax advantages.

Impact on US Startups

Bermuda’s tax policies offer US small business startups a golden opportunity to save big on taxes and enjoy exemptions that can supercharge their financial growth.

By not having to pay taxes on profits or income tax, these startups can keep more money in their pockets, leading to increased profitability and optimized financial resources.

With strategic tax planning, they can fast-track their growth and make the most of these tax advantages.

Economic Climate in Bermuda

In Bermuda, setting up your small business comes with perks like friendly tax policies and a bustling startup scene.

Here, you won’t face taxes on profits, income, dividends, or capital gains, making it a lucrative choice for your US startup.

It’s this business environment that makes Bermuda a top spot for launching your small business.

Bermudas Business-Friendly Policies

Bermuda’s policies are a boon for US small businesses, creating a tax-friendly haven where profits, income, dividends, and capital gains are all tax-free. Here’s what you need to know:

- You can operate without physical presence or mandatory meetings, allowing you to maintain your US headquarters hassle-free.

- The CIT Act 2023 establishes a modest 15% CIT for larger companies starting in 2025.

- Tax Assurance Certificates offer tax certainty all the way up to 2035, giving businesses peace of mind.

Tax Benefits in Bermuda

Bermuda offers attractive tax benefits to small US startup companies. The country does not tax profits, income, dividends, or capital gains, making it a great location for tax savings. By setting up your business in Bermuda, you can take advantage of these tax perks while maintaining your main office in the US. Additionally, Bermuda’s 15% Corporate Income Tax rate offers further opportunities for managing your taxes efficiently.

These benefits make Bermuda a compelling option for small US startups looking to optimize their tax structure and enhance their financial flexibility.

Thriving Startup Ecosystem

Venturing into Bermuda’s bustling startup scene, your small business can tap into substantial tax benefits, fine-tune tax strategies, and seize growth opportunities. Here’s how:

- Bermuda’s tax-friendly status allows for the accumulation of profits.

- The island’s corporate tax system helps minimize tax burdens.

- The favorable economic environment fosters financial expansion for startups.

Harness Bermuda’s tax advantages to strengthen your startup’s financial standing.

Bermudas Influence on U.S Startups

US small business startups are increasingly attracted to Bermuda for its enticing tax benefits.

By incorporating in Bermuda, startups can enjoy significant tax savings thanks to the country’s status as a tax haven.

This means your startup can lighten its tax load without having to uproot its operations.

Taking advantage of Bermuda’s low fees and favorable tax system allows you to maximize your startup’s financial prospects.

Success Stories of Startups in Bermuda

Thanks to Bermuda’s tax-friendly environment, many startups have thrived by taking advantage of zero corporate income tax and no capital gains tax to boost their growth. These benefits have allowed startups to reinvest more profits back into their businesses, attract entrepreneurs and investors, and easily tap into global markets.

As a result, startups in Bermuda have expanded their operations, fostered innovation, and generated employment opportunities. The tax advantages have played a crucial role in their success stories, enabling them to make significant strides in the business world.

Analyzing Bermudas Financial Reputation

When starting a new business, it’s crucial to consider Bermuda’s reputation as a tax haven. Bermuda offers significant tax benefits, including no taxes on profits, income, dividends, or capital gains. This can help businesses optimize their taxes effectively.

For instance, imagine a startup like Generic Startup A taking advantage of these tax benefits to boost its financial growth. Additionally, certain multinational enterprise groups can benefit from a 15% Corporate Income Tax rate in Bermuda, aligning with global tax initiatives. This could be advantageous for a startup like Generic Startup B looking to expand internationally.

Moreover, businesses can secure Tax Assurance Certificates in Bermuda until 2035, safeguarding them from future tax changes. This kind of assurance could be vital for a startup like Generic Startup C planning long-term financial strategies.

Tax Efficiency in Bermuda

If you’re starting a small business in the US, Bermuda’s tax benefits will catch your eye. Bermuda doesn’t tax profits, income, dividends, or capital gains, which can mean big savings for you.

Here’s why it’s a great choice:

- Opting for Bermuda can save you a bundle each year on taxes.

- You won’t need to make major changes to how you operate.

- No need to be physically present in Bermuda or attend meetings there.

This setup makes Bermuda an attractive tax haven for your startup.

- Let’s break down how you, as a US small business owner, can smoothly navigate Bermuda’s tax system.

- Your parent company reaps the benefits of no taxes on profits or dividends.

- You can set up shop easily without physically moving there.

- Get a Tax Assurance Certificate for tax exemption until 2035.

- Seek advice from tax experts like Scott D. Slater to help you tackle Bermuda’s tax rules with ease.

Future of Startups in Bermuda

Looking ahead for small business startups in Bermuda, the tax landscape offers a sweet deal with no taxes on profits, income, dividends, or capital gains. Here’s why Bermuda sets the stage for success:

- Easy company setup

- Few operational hurdles

- Affordable fees for tax-saving strategies

With these perks and tax breaks, Bermuda presents a bright future for startups, yielding substantial yearly savings and fostering business expansion.

Very Common Questions & Some Answers

Why Is Bermuda Considered a Tax Haven?

You might be interested in Bermuda as a tax haven because it doesn’t levy any taxes on profits, income, or capital gains. Setting up a company there is straightforward, which can lead to substantial savings on U.S. corporate taxes each year.

Why Do Companies Do Business in Bermuda?

Businesses flock to Bermuda for its attractive perks. With a zero corporate income tax policy and no taxes on profits, income, dividends, or capital gains, companies can save big bucks. On top of that, the process of incorporating is simple, requiring minimal operational changes.

Do US Citizens Pay Taxes in Bermuda?

If you’re a US citizen living in Bermuda, you catch a break on local taxes since Bermuda doesn’t levy personal income tax. However, Uncle Sam still expects you to pay taxes on any income you earn worldwide. This tax setup in Bermuda, without personal income tax, makes it a favorable spot for businesses to set up shop.

Does Bermuda Have a Tax Treaty With the Us?

Bermuda and the US do not have a tax treaty in place. This means that if you’re a small business owner in the US, you can strategically take advantage of Bermuda’s tax laws without any treaty complications.

The TLDR for 2024

To sum it up, Bermuda’s tax-friendly policies, stable economy, and positive impact on U.S startups make it a great choice as a tax haven. Its strong financial reputation and tax efficiency provide excellent incentives for small businesses.

However, it’s crucial to navigate the system correctly to take full advantage of these benefits. With a promising outlook for startups in Bermuda, it’s definitely worth considering for your entrepreneurial journey.

Editor of Startups #nofilter