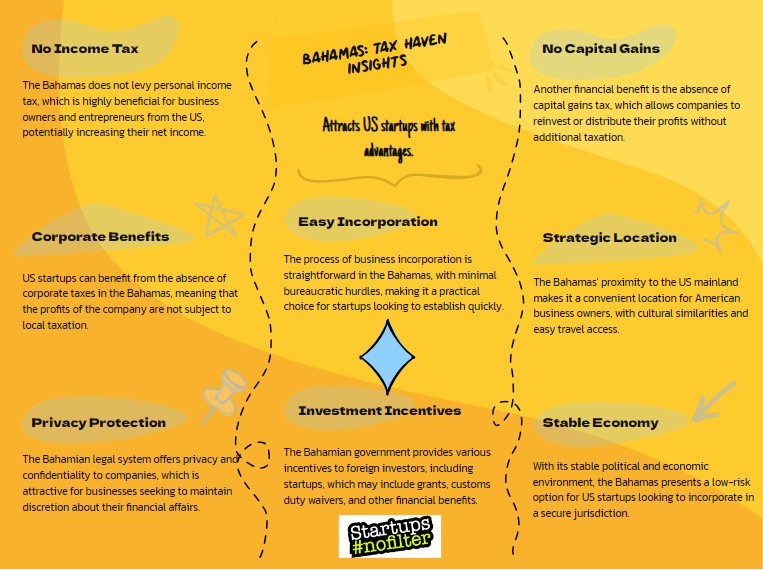

The Bahamas is a magnet for US small businesses starting up because it’s a tax haven, offering perks like no corporate or capital gains taxes. These advantages mean you can plow your profits back into your business, cutting down your expenses significantly.

The country’s strict privacy laws also make it attractive, keeping your business information under wraps and creating a safe atmosphere. Moreover, the political stability and consistent rules in the Bahamas give investors a sense of security.

Take a closer look at the unique tax benefits and robust privacy protections of the Bahamas, and you’ll see why it’s a go-to spot for startups.

Understanding Tax Havens

Let’s take a closer look at the Bahamas, a hotspot for American small businesses looking to cut down on taxes and increase profits.

This island nation is a US tax haven that offers special exemptions and favorable tax treatment, along with financial privacy and confidentiality.

Benefits of Bahamas Taxation

Picture running your startup in a place where you don’t have to worry about corporate taxes or capital gains tax. The Bahamas offers this tax-friendly setup, cutting down on your expenses significantly.

These perks make the Bahamas a top choice for your small business startup in the US.

Zero Corporate Taxes

With no corporate taxes to worry about, small business startups in the Bahamas have a major advantage. This allows them to make more money and stay ahead in the market.

They can reinvest their profits for long-term success, thanks to the absence of corporate income tax and other tax benefits.

For American startups looking for tax perks and a supportive environment to grow, this tax haven in the Bahamas is a great choice.

No Capital Gains Tax

Want to supercharge your profits without the headache of capital gains tax? The Bahamas has got you covered! For small businesses from the US, this is a game-changer – no capital gains tax to worry about.

It’s like a tax-free oasis, drawing in entrepreneurs and startups looking to keep more of their hard-earned money. The Bahamas is a haven for businesses, offering a sweet deal with tax-free profits on the table.

Low Operational Costs

Setting up your small business in the Bahamas comes with a significant perk: low operational costs. With no corporate income tax to worry about, you can keep more of your profits.

This tax-friendly setup also includes no capital gains tax, giving you a competitive edge as a US small business startup. These tax advantages can help boost your revenue and bottom line, making the Bahamas an attractive option for entrepreneurs looking to maximize their earnings.

Privacy Protections in Bahamas

Have you ever wondered why the Bahamas attracts so many small businesses?

One big reason is the strong privacy protections here. These laws keep financial records confidential and protect sensitive business details from unauthorized eyes.

With rules that prioritize privacy and a regulatory setup that values confidentiality, the Bahamas creates a safe and secure environment for startups.

Political Stability in Bahamas

One of the key draws for US small business startups eyeing the Bahamas is its stable political environment. With a track record of steady governance, consistent policies, and a reliable regulatory system, the Bahamas instills confidence in investors, fueling the growth of small businesses.

This political stability paves the way for smoother business operations, positioning the Bahamas as a favorable choice for budding startups looking for support.

Bahamas Corporate Income Tax Policies

When looking at the Bahamas as a potential location for starting your small business from the US, it’s key to grasp how corporate income taxes work there.

The Bahamas offers a zero percent tax rate, which is a major draw for foreign investors.

To make the most of this advantage, it’s important to understand the Bahamas’ tax treaties and how they can benefit your financial strategies.

Zero Percent Tax Rate

Picture running your small business startup in an environment where the corporate income tax rate is a remarkable zero percent – that’s the tax-smart reality that the Bahamas offers US entrepreneurs. The Bahamas, a well-known tax haven, presents tax benefits with its 0% tax rate, creating a business-friendly atmosphere full of tax perks for US small businesses.

| Tax Benefits | Bahamas |

|---|---|

| Corporate Income Tax | 0% |

| Tax-Friendly Setting | Yes |

| Tax Savings | Significant |

| Business-Friendly Environment | Yes |

| Ideal for US Small Business Startups | Yes |

Incentives for Foreign Investors

When it comes to the Bahamas’ corporate income tax rules, foreign investors, especially US small business startups, can enjoy some pretty sweet deals.

- The Bahamas is a popular tax haven that attracts investors from all over the world.

- Foreign investors love the fact that there’s no corporate income tax to worry about.

- Bahamas IBCs (International Business Companies) get plenty of tax breaks to take advantage of.

- US small business startups can make the most of some unique tax benefits.

- The business landscape here is very investor-friendly thanks to the favorable corporate policies in place.

Understanding Bahamas Tax Treaties

When it comes to tax treaties in the Bahamas, it’s worth noting that the lack of corporate income tax rules can be a game-changer for small businesses starting up from the US. Understanding these agreements is crucial for making the most of the tax perks available, like being exempt from certain taxes.

This unique setup lets startups hang on to more of their earnings, which can fuel their growth and reach new horizons.

Bahamas Personal Income Tax Policies

The Bahamas doesn’t impose personal income taxes, which can be a game-changer for small business startups from the US. This perk translates to more money saved, increased investment opportunities, and a stronger financial standing for entrepreneurs.

Without the burden of personal income tax, businesses can thrive and grow in the Bahamas. These tax advantages give your company a competitive edge, setting the stage for financial stability and expansion.

Capital Gains Tax in Bahamas

With no capital gains tax to worry about, small business startups from the US are finding the Bahamas to be an attractive destination. As a US entrepreneur, you can take full advantage of these tax benefits for your capital gains investments, promoting growth and progress in a favorable setting.

The tax savings available in the Bahamas provide a significant boost to the financial well-being of small businesses compared to the 20% capital gains tax rate in the US. This difference makes the Bahamas a highly appealing option for startups looking to maximize their returns and foster a conducive environment for business development.

Very Common Questions & Some Answers

Is Bahamas Tax Free for US Citizens?

Absolutely, as a US citizen, you can take advantage of the tax-free perks in the Bahamas. With incentives for investments, a stable economy, and strong financial privacy laws, the Bahamas is a top pick for offshore banking and business activities.

Does the US Have a Tax Treaty With the Bahamas?

The US and the Bahamas do not have a tax treaty in place. This lack of agreement means dealing with distinct legal consequences and potential financial considerations. It underscores the importance of grasping tax evasion tactics and navigating international tax regulations for offshore dealings.

Why Start a Company in the Bahamas?

Thinking about starting a business in the Bahamas? Well, you’re in for a treat! The Bahamas offer hassle-free company registration, a solid legal system, plenty of business prospects, financial confidentiality, offshore banking options, investment perks, real estate opportunities, economic steadiness, top-notch infrastructure, and safeguarding of intellectual property rights. It’s a promising environment for entrepreneurial ventures.

What Is the Self Employed Tax in the Bahamas?

In the Bahamas, you won’t have to worry about paying any self-employed tax. This not only gives you more financial privacy but also makes setting up your business easier and provides tax advantages. The laws and regulations here are designed to support offshore banking and offer flexibility for businesses, creating a welcoming environment for entrepreneurs.

The TLDR for 2024

The Bahamas is a go-to spot for US small businesses looking to catch a break on taxes. With its friendly tax rules and privacy safeguards, it’s a top choice. Plus, the stable political climate sweetens the deal.

Whether it’s the corporate tax setup, personal income tax benefits, or their approach to capital gains tax, startups find plenty to love about setting up shop there.

If you’re after a business environment that’s tax-friendly, the Bahamas is definitely worth considering.

Editor of Startups #nofilter