Anguilla’s appeal to US small business startups lies in its zero-tax policy covering income, corporate, capital gains, and inheritance taxes. By setting up your business here, you can significantly reduce your tax obligations, leading to improved financial health and potential growth prospects.

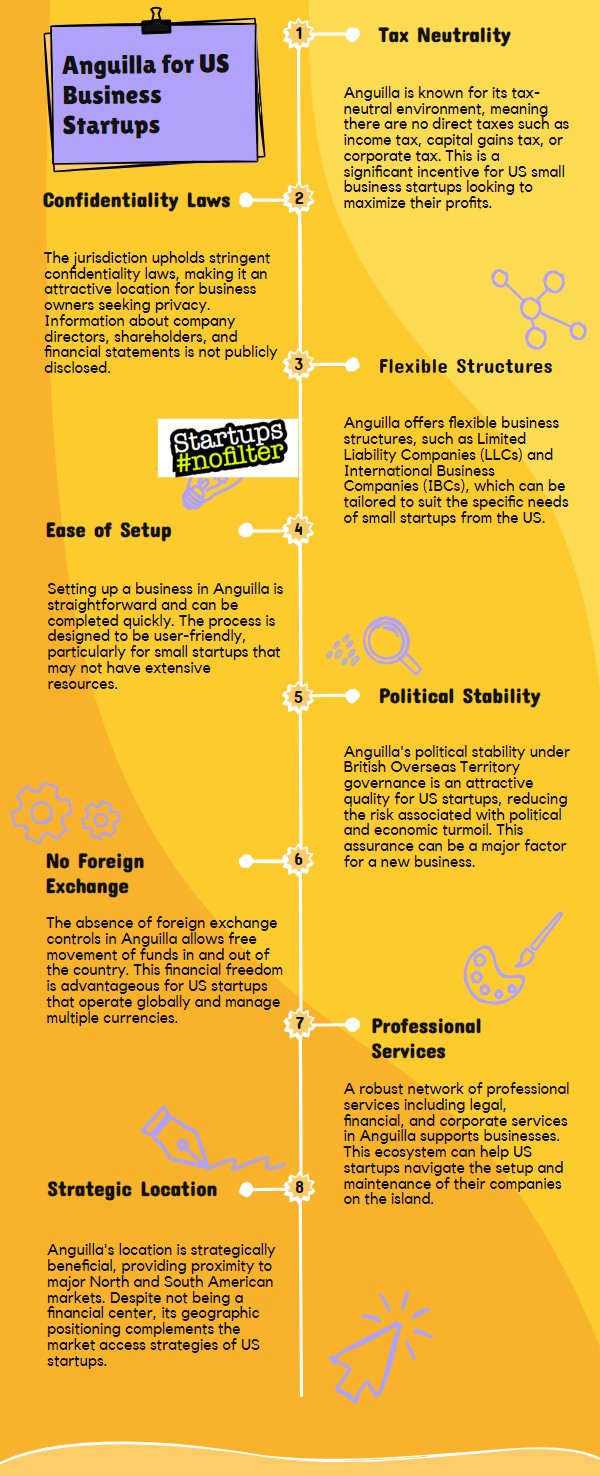

The straightforward process for establishing a business, along with robust confidentiality safeguards, adds to Anguilla’s attractiveness. Looking into residency options within Anguilla can further enhance these benefits.

Delving deeper into how tapping into the advantages of this offshore destination could positively impact the future of your startup is worth your consideration.

Understanding Tax Haven Concepts

To truly grasp how US small business startups can benefit, it’s essential to understand what a tax haven entails and how Anguilla fits this profile.

A tax haven, like Anguilla, offers businesses low or zero taxes, making it attractive for those looking to minimize their tax burdens within legal boundaries.

Anguillas Tax Policies

Let’s talk about Anguilla’s tax policies and how they can benefit small businesses from the US. In Anguilla, you’ll find tax rates that work in your favor:

- Income Tax: 0% – This means less financial strain on your business.

- Corporate Tax: 0% – It helps your business thrive without heavy tax burdens.

- Capital Gains Tax: 0% – Encourages you to invest more without worrying about taxes.

- Inheritance Tax: 0% – Simplifies your succession planning process.

These policies aim to lower your tax responsibilities, ultimately improving your business’s financial well-being.

Business Opportunities in Anguilla

When looking at Anguilla’s tax laws, it’s clear they offer great potential for startups. With no income, capital gains, or corporate tax, small businesses have a fertile environment to thrive.

These business-friendly policies make it easy to create tax-efficient structures, leading to significant savings and business growth opportunities.

Anguillas Favorable Tax Laws

In Anguilla, you’ll enjoy a tax setup that’s super beneficial for US small business startups. Here’s the deal: there’s a sweet 0% income tax rate for both residents and non-residents.

Being a British territory, Anguilla hooks you up with some major tax perks, setting up your offshore business real nice without any pesky financial audits or reports.

Plus, there’s no need to worry about capital gains, inheritance, or gift taxes, making it a top spot for your startup to thrive in a tax-friendly environment.

Startup Success in Anguilla

Anguilla isn’t just a tax haven; it’s a hotspot for startups to thrive. Here’s why:

- Anguilla boasts a 0% income and corporate tax rate, making it a tax-efficient choice.

- With options like LLCs and IBCs, setting up a business structure here is a breeze.

- Your startup’s confidentiality is safeguarded in Anguilla’s offshore environment.

This supportive ecosystem in Anguilla is tailor-made for your business venture.

When considering Anguilla’s residency program, you have three main options to choose from: Permanent Residency By Donation, By Real Estate, and Anguilla Tax Residency. Each option has its own set of requirements, including making a significant monetary donation for the By Donation route, owning property for the By Real Estate option, and spending a minimum of 45 days in Anguilla annually for Anguilla Tax Residency.

As a potential British Overseas Territories Citizen (BOTC), meeting the 45-day minimum requirement is essential.

Offshore Jurisdiction: Anguilla

When you think about setting up your US small business in Anguilla’s offshore jurisdiction, it’s essential to know about the attractive tax perks it offers.

Here, you can benefit from a 0% corporate tax rate, no capital gains tax, and no inheritance or gift tax to deal with. These advantages, along with the territory’s strong confidentiality protections and business-friendly atmosphere, make it a promising spot for launching your startup.

Anguillas Tax Benefits

Anguilla is a top choice for US small business startups looking to save on taxes, thanks to its 0% income tax rate for residents and non-residents. This British Overseas territory offers strong financial services, the option to set up an offshore company, and a focus on privacy and confidentiality.

Combined with a 0% corporate tax rate, Anguilla is a prime spot for startups aiming for tax efficiency.

Establishing Startups in Anguilla

When it comes to offshore jurisdictions, starting your startup in Anguilla can offer a wealth of tax advantages and flexible regulations. The island is dedicated to safeguarding business confidentiality and privacy, making it an attractive option.

With zero income tax and corporate tax rates, along with business structures like LLCs and IBCs that provide streamlined regulatory frameworks, Anguilla’s offshore setting ensures your startup’s prosperity and protection.

Impact of Panama Papers on Anguilla

After the release of the Panama Papers, Anguilla’s reputation took a hit, especially in the financial services realm. This led to a significant drop in its transparency ranking. The repercussions were evident in three main areas:

- The closure of Mossack Fonseca had a disruptive impact on Anguilla’s governance structure.

- Dealing with information requests became increasingly difficult following the revelations.

- The misuse of Anguillian companies was brought to light, highlighting concerns about regulatory oversight.

These events emphasized the urgent need for Anguilla to enhance its financial services practices and regulatory framework.

Tax Compliance and Accounting in Anguilla

Tax compliance and accounting in Anguilla are pretty straightforward. Here’s the lowdown: The island slaps a 13% Goods and Services Tax (GST) on imports and value-added goods.

You’ll need to keep your accounting records up to date at your registered office. Property tax is an annual affair, pegged at 0.75% of your land’s value.

Oh, and let’s not overlook stamp duty, which can range from a tiny 0.01% to a max of 5% on your contractual paperwork.

Anguillas Universal Social Levy

Let’s talk about Anguilla’s Universal Social Levy (USL) – a unique aspect of Anguilla’s tax system that charges a 3% tax on employees earning over EC$2000 per month.

- The USL, approved by Anguilla’s government, specifically focuses on income exceeding this threshold.

- It funds social programs that benefit Anguilla’s residents without burdening small businesses with heavy taxes.

- The USL significantly contributes to Anguilla’s revenue, helping maintain its status as a tax haven.

Exploring Anguillas Money Transmission Levy

Anguilla’s Money Transmission Levy is a 2% fee on funds sent off the island by licensed Money Service Businesses. It is a crucial part of the territory’s financial regulations and is enacted through the Money Transmission Act. This levy serves as a vital tool for overseeing and managing financial transactions.

For business owners operating in Anguilla, understanding the details of this levy is essential. It directly impacts your operations in this tax-friendly haven.

Very Common Questions & Some Answers

Why Is Anguilla a Tax Haven?

Anguilla’s economy flourishes thanks to its offshore regulations and commitment to confidentiality. It serves as a tax haven by refraining from imposing direct taxes, which attracts businesses seeking to reduce their tax burdens.

What Are the Tax Benefits of Anguilla?

Anguilla is a hotspot for offshore banking because it doesn’t have income, corporate, or capital gains taxes. The corporate confidentiality it offers adds a layer of protection for your wealth. With minimal tax obligations, there are plenty of investment opportunities to explore on the island.

Does Anguilla Have Capital Gains Tax?

Anguilla keeps things investor-friendly by steering clear of capital gains tax. This approach not only boosts the economy but also creates a welcoming space for investments to thrive. Small businesses, in particular, benefit from this setup as it helps them rake in more profits by trimming down their tax burdens.

Do You Pay Tax in Anguilla?

Living in Anguilla comes with a unique financial perk – no need to worry about income or corporate taxes. This benefit, along with the advantages of offshore banking, makes Anguilla an attractive choice for individuals looking to streamline their small businesses’ tax obligations.

The TLDR for 2024

In a nutshell, Anguilla’s attractive tax rules, wide-ranging business prospects, and beneficial offshore position make it a sought-after tax haven for small American startups.

Despite the Panama Papers scandal, Anguilla remains committed to following tax laws and maintaining transparent accounting practices.

By implementing measures like the Universal Social Levy and Money Transmission Levy, Anguilla creates a financially advantageous setting for your startup to flourish.

Editor of Startups #nofilter