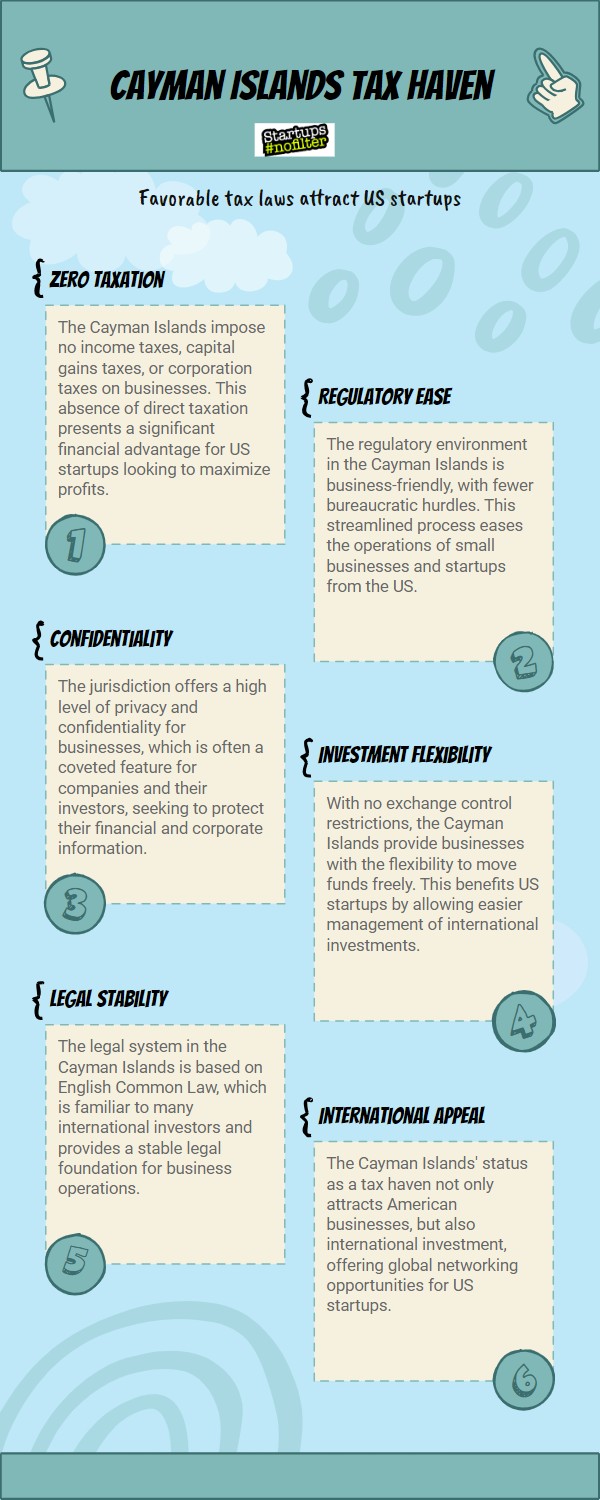

Are you a startup in the US looking for a tax-friendly option? The Cayman Islands might catch your eye with their tax haven status. They offer no corporate income tax, capital gains, or property tax, making it a smart choice to cut down on taxes and grow your business.

The Cayman Islands’ strong privacy laws safeguard your assets, and their business-friendly environment ensures a stable economy, making it an appealing location for your venture. Setting up your business there is simple, and the legal protections give you an advantage in property ownership.

If you want to learn more about the tax-efficient setup and opportunities in the Cayman Islands, there’s a wealth of information waiting for you. Don’t miss out on exploring these benefits.

Understanding Tax Havens

When you’re getting your small business off the ground, knowing about tax havens like the Cayman Islands can bring you some serious financial perks. These perks include not having to pay any income or capital gains taxes, creating an environment that’s perfect for growing your business.

The attractive tax regulations in these havens draw in many small startups aiming to cut down on their tax burdens. On top of that, you’ll benefit from strong legal safeguards and strict privacy laws, ensuring that your business stays secure and your information remains confidential.

Working Mechanism of Tax Havens

Curious about how tax havens like the Cayman Islands work?

Well, they offer sweet tax deals, like zero corporate income tax, which can be a big win for your small business.

On top of that, they throw in privacy perks and offshore banking services to safeguard your assets, dodge income taxes, and take advantage of financial loopholes.

Understanding Tax Havens

To really grasp why tax havens like the Cayman Islands are so appealing, it’s key to understand how they work. These places offer major tax advantages and privacy safeguards for businesses in ways that are quite unique. They use offshore banking and take advantage of regulatory loopholes to lure in businesses by providing unmatched tax benefits and secrecy.

| How They Operate | Key Advantages |

|---|---|

| Offshore Banking | Helps avoid taxes |

| Regulatory Arbitrage | Exploits legal gaps |

| Privacy Protection | Ensures confidentiality |

Caymans Business-Friendly Policies

By taking advantage of the business-friendly environment in the Cayman Islands, small startups in the US can benefit from zero corporate income tax, no capital gains tax, or property tax, and a relaxed approach to dividends and interest payments. This tax-neutral setting helps maximize your profits.

With a stable economy and a straightforward process for setting up your business, the Cayman Islands become an appealing choice for your startup company looking for a tax-efficient location.

Cayman Islands Tax Laws

The Cayman Islands stand out as a top choice for US small business startups, thanks to their unique tax laws. In this island paradise, there’s no corporate income tax, capital gains tax, property tax, payroll tax, or withholding tax to worry about.

This tax-friendly environment means you get to keep more of your hard-earned money, giving you room to grow and expand your business. With no major income taxes to contend with, the Cayman Islands serve as a lucrative and tax-efficient location to maximize your profits.

Non-Citizen Taxation in Cayman Islands

The tax laws in the Cayman Islands can be a real boon for small businesses from the US, but they’re even better for non-citizens. Here’s why:

- If you’re not a citizen, you won’t have to worry about income, capital gains, or property taxes.

- Companies based offshore don’t get taxed on money they make outside the Cayman Islands.

- Plus, there’s no need to hold back any tax on dividends or interest payments.

This tax-friendly setup makes money matters easier and sets the stage for a great environment for offshore businesses.

Defining Shell Companies

When expanding your business presence in the Cayman Islands, you might consider setting up shell companies. These are legal entities that exist mainly on paper without many assets or operations. They serve purposes like financial structuring, protecting assets, and planning for taxes.

In tax havens like the Cayman Islands, these shell companies offer privacy and help with strategic financial planning for business owners looking to keep a low profile.

Incorporation Benefits in Cayman Islands

Considering setting up your small business overseas? The Cayman Islands could be a smart choice with its tax-efficient setup.

You’ll find the process straightforward, with minimal requirements for directors and shareholders, all under an English common law system.

Privacy protection is a key perk here, along with the relief of avoiding hefty corporate taxes.

Streamlined Incorporation Process

Incorporating your business in the Cayman Islands is a breeze, especially for small US companies aiming to cut down on initial expenses and increase flexibility. The Cayman Islands General Registry manages the process, solidifying its reputation as a go-to tax haven for startups.

- Quick company registration in just 1-4 working days

- No need for a local director

- No mandatory minimum capital requirements

Favorable Tax Regulations

Have you thought about setting up your small business in the Cayman Islands?

This location offers zero corporate, income, capital gains, property, and withholding taxes for startups like yours. With a tax-friendly environment and a solid legal system, you can significantly reduce your tax obligations.

Business Privacy Protection

When you set up your business in the Cayman Islands, it’s not just about saving on taxes. It’s a smart move to safeguard your privacy and stay under the radar.

The Islands have strict laws to protect your business privacy, keep your financial info and ownership details safe, and let you operate with a high level of anonymity. Your sensitive data and ownership structures are secure here, making it a top choice for small business startups in the US.

Raising Investment as an Exempted Company

If you’re thinking about raising funds as an Exempted Company, the Cayman Islands is a smart choice. Its business environment is budget-friendly, legal processes are straightforward, and tax advantages are plentiful. This tax-efficient setup, paired with clear legal regulations, makes it a top pick for startups.

Take advantage of this opportunity to boost your startup’s development in a supportive, financially beneficial location.

Impact of Economic Substance Regulations

As you navigate the world of Cayman Islands tax rules, it’s crucial to understand the impact of Economic Substance Regulations.

These regulations play a significant role in shaping startup strategies and present unique challenges for compliance.

Let’s delve into how these rules affect your business landscape, helping you make informed decisions moving forward.

Understanding Economic Substance Regulations

Understanding the Economic Substance Regulations in the Cayman Islands boils down to one key point: companies must prove they’re not just dodging taxes by showing they actually do substantial business there.

In simple terms, these rules require companies to have their main operations, like decision-making, based in the Cayman Islands. The goal is to crack down on tax dodging by making sure companies have real substance in the jurisdiction.

If a company doesn’t follow these rules, they could face fines or lose out on tax benefits. So, it’s crucial for businesses to comply with the regulations to avoid any penalties.

Regulations Influence on Startups

Understanding the Economic Substance Regulations in the Cayman Islands can be quite a challenge for startups. To benefit from tax advantages, startups need to establish substantial business operations within the jurisdiction.

These regulations require startups to meet specific criteria, such as operating expenses and the number of employees. Essentially, they ensure that your startup is a legitimate business that contributes to the local economy, rather than just a means to evade taxes.

Compliance Challenges for Businesses

Navigating the ins and outs of the Cayman Islands’ Economic Substance Regulations can be quite a puzzle for businesses looking to show they’ve real economic activities happening there. The hurdles to compliance include:

- Meeting specific criteria like spending, staff numbers, and executive meetings

- Proving the legitimacy of operations to satisfy regulatory standards

- Steering clear of fines while upholding a positive reputation in the jurisdiction.

When it comes to the Cayman Islands being known as a tax haven, it can be a bit tricky to navigate due to its history of no taxes and rumors of shady financial dealings.

For startups, the appeal lies in the tax-friendly environment and protection from personal liability. However, there are valid concerns from the global financial community regarding the island’s reputation and lack of transparency.

Despite these issues, the Cayman Islands is making efforts to improve its image, which should provide some peace of mind.

Very Common Questions & Some Answers

Why Do People Set up Companies in Cayman Islands?

Setting up a company in the Cayman Islands is a popular choice for many businesses looking to take advantage of legal perks, offshore advantages, and financial privacy. With its zero-tax policy and stable economy, it’s no wonder why entrepreneurs flock to this destination for their business ventures.

Do US Citizens Pay Tax in Cayman Islands?

Hey there, if you’re a US citizen living in the Cayman Islands, you still have to pay your US taxes. Even though offshore banking might seem like a way to avoid taxes, it’s important to remember that there are legal consequences to consider. So, make sure you stay on top of your tax obligations to avoid any issues down the line.

Do Businesses Pay Tax in Cayman Islands?

Businesses in the Cayman Islands have a sweet deal when it comes to taxes. Unlike many other places, they don’t have to worry about the usual tax burdens here. This unique setup is a big draw for startups looking to keep their tax bills in check. It’s no wonder this system plays a big role in the island’s economy, attracting businesses far and wide.

Can a US Citizen Open Business in Cayman Islands?

Absolutely! If you’re a US citizen, you can definitely start a business in the Cayman Islands. There are no restrictions on ownership, but you’ll need to make sure you meet all the necessary legal requirements, get the required business licenses, and think about the banking side of things as well. It’s a great opportunity to expand your business horizons internationally!

The TLDR for 2024

So, you’ve looked into why the Cayman Islands is a popular choice for US small business startups seeking tax advantages.

With its friendly tax policies, easy property ownership, and the perks of incorporating and securing investments, it’s a hotspot for entrepreneurs.

Though the economic substance regulations play a role, the benefits outweigh the obstacles with careful planning.

Remember, it’s not just about tax savings but also about building a financially sound business model.

Editor of Startups #nofilter