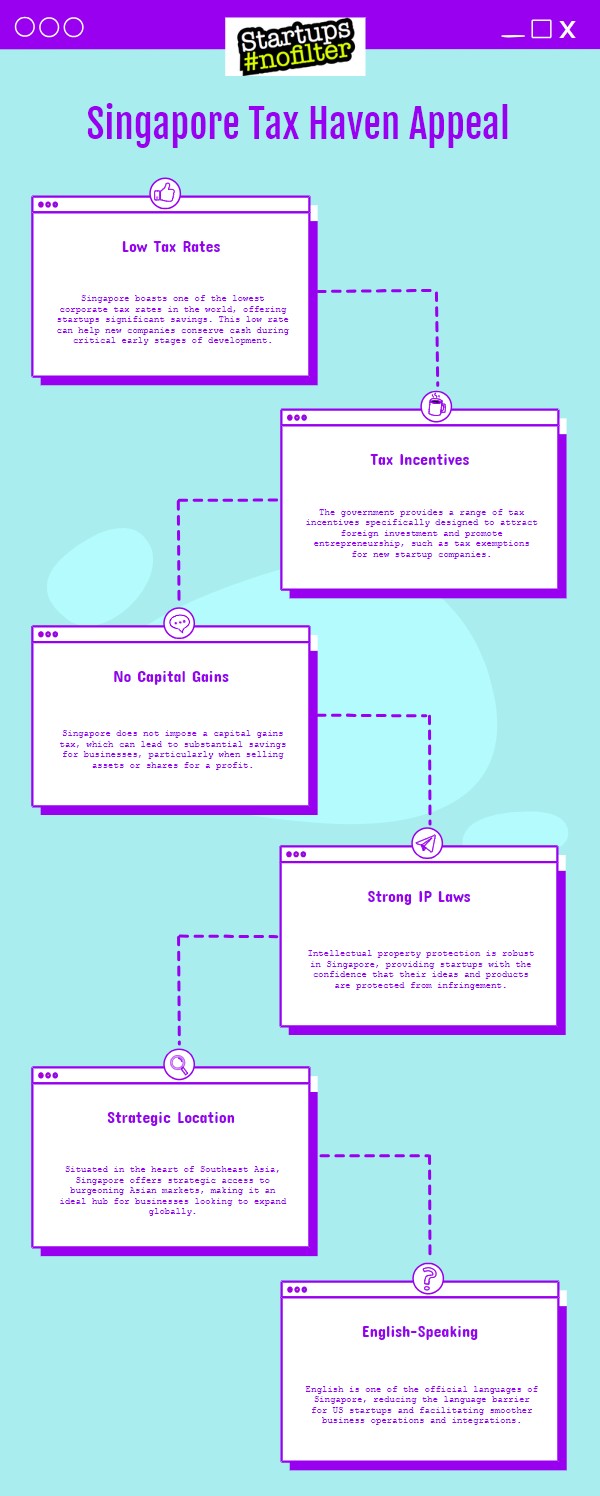

Singapore is a hot spot for US small business startups thanks to its low 17% corporate tax rate and zero capital gains tax. For startups, the first $100,000 of income is tax-free, along with a range of tax benefits, making it a top US citizen and startup tax haven choice.

The business-friendly environment and strategic location make Singapore a prime entry point to the Asia-Pacific market. Its reputation as a tax haven is well-deserved, offering a smooth path for businesses looking to thrive.

Keep exploring, and you’ll find even more reasons why setting up shop in Singapore is a smart move for your small business.

Singapores Attractive Corporate Rates

Singapore offers a flat corporate tax rate of 17%, which is much lower than what businesses face in the US. With no capital gains tax to worry about, Singapore becomes an attractive hub for American small business startups looking to make their mark.

On top of that, the array of tax incentives and exemptions available sweetens the deal even further, creating an inviting environment for startups aiming to grow and thrive.

Unique Tax Breaks for Startups

Today, we’re delving into Singapore’s special tax perks tailored for startups. Get ready to grasp Singapore’s appealing tax policies, the tax exemptions startups can enjoy, and how corporate tax rates come into play.

This info might just help your startup save a significant amount of cash in the long haul.

Singapores Attractive Tax Policies

If you’re starting a new business, Singapore has some pretty sweet tax perks that could give your finances a nice boost. This business-friendly hub offers tax exemptions that can really help your bottom line.

For instance, start-up companies enjoy a 0% tax rate on the first $100,000 of income. Even after that, with a partial tax exemption on the next $100,000, Singapore’s corporate tax rate can be as low as 4.25%, giving you some solid tax savings.

Startups Tax Exemption Benefits

When it comes to tax benefits for startups, Singapore’s Start-Up Tax Exemption (SUTE) scheme stands out for its financial perks. New businesses can enjoy a full exemption from taxes on the first $100,000 of income for three years. Following that, there is a 75% tax break on the next $100,000, setting the stage for growth and progress.

| Taxable Income | Tax Rate | Benefits for Startups |

|---|---|---|

| First $100,000 | 0% | Full tax exemption |

| Next $100,000 | 75% | Partial tax exemption |

| Next $200,000 | 50% | Partial tax exemption |

Understanding Corporate Tax Rates

Let’s take a look at Singapore’s corporate tax rates, especially the special tax breaks available for startups. One notable advantage is the 0% tax rate on the initial $100,000 of earnings for the first 3 years.

In Singapore, the standard corporate tax rate is 17% for earnings exceeding $2 million. Startups meeting certain criteria can benefit from exemptions and tax incentives. To access these advantages, companies often opt for offshore incorporation.

It’s important to note that these tax benefits are regulated by the Inland Revenue Authority of Singapore (IRAS), ensuring compliance and oversight.

Singapore Vs USA Tax Haven Status: Business Environment

Comparing the business scenes in Singapore and the USA reveals that Singapore’s lower corporate taxes, efficient government processes, and prime location offer valuable perks for small businesses looking to kickstart their ventures.

With its reputation as a tax-friendly hub and enticing tax schemes, Singapore provides an advantageous setting for easy entry into the diverse Asia-Pacific market.

Conversely, the USA’s regulatory landscape can present hurdles, making Singapore a more appealing option for many entrepreneurs.

Understanding Offshore Company Formation

Now, let’s talk about setting up an offshore company. This step is crucial because it allows you to take advantage of Singapore’s favorable tax policies for your startup.

Understanding the legal ins and outs of this process will help you navigate smoothly and confidently through this new business territory.

Offshore Incorporation Benefits

When it comes to setting up an offshore company, small businesses can reap substantial tax benefits, especially in Singapore with its enticing 17% corporate tax rate for earnings exceeding $2 million. Here’s why this can be advantageous:

- New businesses can enjoy a tax break on the first $100,000 of income for three years.

- The Inland Revenue Authority of Singapore oversees tax exemptions, which can facilitate business expansion.

- Singapore offers tax incentives specifically designed to support the establishment of small businesses.

Singapores Business-friendly Taxation

Expanding on the perks of setting up a company offshore, Singapore stands out for its tax-friendly approach, boasting a corporate tax rate of 17%.

This setup offers great advantages for American small businesses branching out into international markets. Singapore’s tax system includes exemptions on the initial $100,000 of income for three years, leading to substantial tax savings.

These benefits solidify Singapore’s reputation as a top choice for businesses looking to optimize their tax situation.

When setting up an offshore company in Singapore, it’s essential to grasp the intricate legal frameworks. To make sure you’re on the right track:

- You must appoint a local director to comply with regulations.

- Follow specific criteria outlined in Singapore’s legal frameworks.

- Register with ACRA, a vital step in forming your offshore company.

Benefits of Singapores Tax Agreements

Singapore has a vast web of double tax agreements with over 80 countries, bringing a host of benefits to small business startups. These agreements offer perks like lower tax rates, exemptions, and relief. They also provide withholding tax exemptions and special concessions.

Startups can enjoy tax breaks on specific types of income, while offshore funds meeting certain criteria can also get exemptions on profits and gains. These advantages make Singapore a highly attractive destination for startups looking to thrive.

Privacy and Flexibility for Corporations

When it comes to privacy and flexibility, your corporation can benefit greatly from Singapore’s rules on keeping things confidential and having the freedom to operate as you see fit. Here’s why:

- Financial Privacy: Your corporation’s financial information is kept private and secure.

- Operational Freedom: You aren’t required to reveal all your operational plans or share your capital distribution strategies.

- Regulatory Ease: Singapore’s regulations are designed to give shareholders and directors more freedom, creating a business-friendly environment for your corporation.

Very Common Questions & Some Answers

Does Singapore Have Tax Treaty With Us?

Yes, Singapore and the US have a tax treaty in place. This treaty is pretty handy for you because it stops you from getting taxed twice on the same income, lowers withholding tax rates, and makes it easier to do business across borders. It’s a big part of what makes Singapore a great place for business.

How Are US Citizens Taxed in Singapore?

Hey there, if you’re a US citizen living in Singapore, how you’re taxed depends on where you call home and where your money comes from. The good news is you could snag some tax breaks on income earned outside Singapore and take advantage of tax treaties to steer clear of getting taxed twice.

Are Taxes Higher in the US or Singapore?

In the US, you’ll find higher taxes compared to Singapore. Singapore offers lower corporate taxes, attractive incentives, and favorable fiscal policies, making it a hotspot for US small businesses looking to kickstart their ventures.

Do Foreign Companies Pay Tax in Singapore?

Yes, foreign companies in Singapore pay taxes on the income they make within the country. Singapore’s tax system offers perks like exemptions and incentives that boost financial advantages for international trade and global business operations.

The TLDR for 2024

So, here’s the deal – Singapore is a top spot for US small business startups thanks to its low corporate taxes, special tax perks for startups, and business-friendly atmosphere.

Setting up shop offshore and taking advantage of favorable tax agreements can really give your business a boost. Plus, Singapore offers privacy and adaptability that can be game-changers for your company.

It’s clear that Singapore is a smart choice for any small business looking to thrive.

Editor of Startups #nofilter