If you’re a startup based in the U.S., Hong Kong could be a great choice for tax benefits. The city offers low corporate tax rates ranging from 8% to 16% and follows a territorial tax system, meaning it only taxes income earned within its borders.

Hong Kong also values financial privacy and does not impose capital gains tax. With its position as the world’s second freest economy, it provides a stable and attractive setting for your business and is the perfect tax haven for US startups.

Understanding and utilizing Hong Kong’s unique tax advantages can greatly benefit your startup financially. Explore further to harness the full potential of Hong Kong’s tax perks.

Understanding Tax Havens

If you’re thinking about starting a small business, knowing about tax havens like Hong Kong can be a game-changer.

Hong Kong offers low corporate tax rates, ranging from 8% to 16%, which can give your startup a nice financial boost.

Their tax system only taxes income made within Hong Kong’s borders, making it super appealing for US startups looking to make the most of their profits and streamline their taxes efficiently.

Hong Kongs Attractive Tax Structure

Looking closely at Hong Kong’s tax setup, it’s clear why it’s a hotspot for American small businesses starting up.

With corporate taxes ranging from 8% to 16% and a territorial tax system in place, there are big savings to be had.

Add to that the absence of capital gains tax, and you’ve got yourself a pretty sweet deal.

Of course, Hong Kong’s reputation for financial confidentiality is a whole other story worth delving into.

Privacy and Secrecy in Hong Kong

Hong Kong stands out as a financial hotspot due to its strong focus on privacy and confidentiality. The strict laws safeguarding personal information and the limited public disclosure requirements for businesses and their owners make it an appealing choice for investors.

Despite facing criticism and being blacklisted by the EU, Hong Kong’s dedication to privacy has attracted many US small business startups looking for a secure financial environment.

Hong Kongs Confidentiality Laws

Hong Kong isn’t just famous for its vibrant city life; it also stands out as the fourth-ranked jurisdiction on the Financial Secrecy Index. This ranking highlights its strong dedication to keeping financial matters confidential and private.

Hong Kong’s laws prioritize financial secrecy and privacy, making it a key player in the global wealth management arena.

Business Privacy Advantages

When it comes to business privacy, Hong Kong has a lot to offer. It’s known for keeping financial matters confidential and ranks high on the Financial Secrecy Index. Being a tax haven adds to its appeal, providing a safe space for asset owners.

The legal system in Hong Kong strongly supports financial secrecy, making it a popular choice for those seeking privacy advantages. With limited public disclosure requirements for businesses and owners, Hong Kong stands out as a top destination for privacy-conscious individuals.

Hong Kong as an Economic Stable Environment

Situated in the heart of Asia, Hong Kong shines as a stable and prosperous economic hub for global businesses. Here’s what sets it apart:

- Ranked as the world’s second freest economy

- Boasting a unique tax and legal system

- Serving as a pivotal port for international trade

- Home to a robust international financial market

- Maintaining low taxes and resilience in the face of challenges

These factors collectively make Hong Kong an ideal spot for launching your startup.

Comparing US LLC and Hong Kong Company

When comparing US LLCs to Hong Kong companies, it’s crucial to consider the notable variations in taxation, expenses, privacy, and potential savings.

Hong Kong’s tax system, which focuses on local income only, stands out for its tax advantages. In contrast, US LLCs are subject to global taxation.

Additionally, Hong Kong offers enhanced asset protection, increased confidentiality, and reduced setup and maintenance costs, leading to significant cost savings for businesses.

Banking Options for Hong Kong Companies

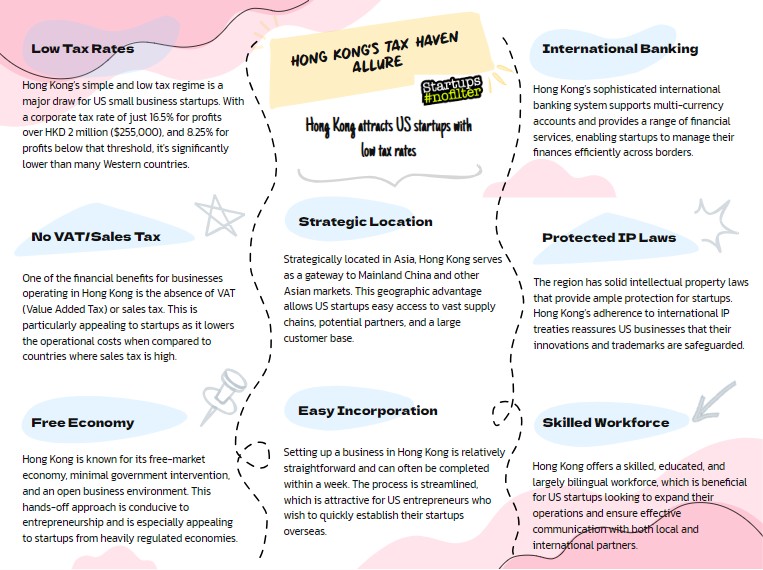

Starting a small business in Hong Kong opens up a world of banking options for you, from local banks to global giants. You can choose from various local and international banks, enjoy the convenience of multi-currency accounts, access efficient and modern banking services, explore tailored financial products for startups, and benefit from smooth global transfers without any capital restrictions.

Whether you prefer the familiarity of a local bank or the reach of an international institution, Hong Kong offers a diverse range of banking solutions to support your business needs.

Investment Opportunities in Hong Kong

When considering doing business in Hong Kong, you’ll find a wide range of investment opportunities. The territory’s tax policies are attractive, making it a smart choice for small US businesses looking to start up.

With a growing startup scene, your venture has a great chance to thrive and succeed in this dynamic environment.

Hong Kongs Business Environment

Hong Kong offers a sweet deal for small American businesses eyeing tax breaks and investment chances with its corporate tax rate sitting at just 16.5%. Here’s why Hong Kong shines as a top pick:

- You’ll love the low corporate tax rate.

- It follows a territorial tax system.

- Its prime spot as a gateway to China is a strategic advantage.

- The legal system is robust, and the financial sector is transparent.

- Count on efficient financial services, top-notch infrastructure, and global connectivity to fuel your business growth.

Attractive Taxation Policies

When it comes to Hong Kong’s tax system, you’ll be pleased to know that the corporate tax rate stands at a reasonable 16.5%. This makes Hong Kong a top choice for businesses looking to invest.

What’s even more enticing is that offshore companies can enjoy a tax rate of 0% if they run their operations completely offshore.

With manageable compliance costs and favorable policies, Hong Kong’s tax setup is a magnet for businesses that can operate from anywhere.

Expanding Startup Ecosystem

Hong Kong’s startup scene is buzzing with opportunities for investors. With easy access to venture capital, angel investors, and a strong tradition of supporting small businesses, it’s a fertile ground for entrepreneurial ventures.

The strategic location makes it a gateway to Asian economies, coupled with a regulatory environment that encourages innovation through government incentives. This combination has positioned Hong Kong as a favorable tax destination for small enterprises looking to thrive.

Challenges and Drawbacks of Tax Havens

When you think about places like Hong Kong known for being tax havens, it’s crucial to consider the potential challenges that could impact your startup.

Accusations of dodging taxes, shifts in regulations, and threats to your reputation are major concerns. Increased attention from authorities and difficulties in accessing banking services also loom large.

Despite the tempting tax advantages, these complications could have a real impact on your business, so it’s wise to carefully weigh the pros and cons.

Very Common Questions & Some Answers

Why Is Hong Kong Considered a Tax Haven?

Hong Kong stands out as a tax haven primarily because of its low corporate taxes, absence of capital gains taxes, and numerous tax agreements. Its appeal lies in features like offshore banking services, transparent business practices, and strong financial confidentiality. These factors make Hong Kong an attractive destination for American small business owners looking to establish their startups.

Why Do People Open a Company in Hong Kong?

If you’re thinking about starting a company in Hong Kong, you’re in for some great benefits. Hong Kong offers a fantastic environment for business growth with its easy incorporation process, strong business infrastructure, and reliable legal system. These factors make it a top choice for startups looking to thrive.

What Is the Tax Rate for Small Businesses in Hong Kong?

If you run a small business in Hong Kong, you’ll be looking at a 16.5% tax on any profits made within the region. However, if your business operates exclusively offshore, you could benefit from a 0% tax rate, thanks to Hong Kong’s business-friendly approach. This means you can potentially save on taxes by structuring your business accordingly.

Is Hong Kong Tax Free for Foreigners?

Absolutely! If you’re an expat in Hong Kong running an offshore company, you won’t have to worry about taxes. By keeping all your business activities offshore and meeting residency criteria, you can maintain a cool 0% tax rate. It’s a sweet deal for foreigners in Hong Kong!

The TLDR for 2024

So, you’ve learned why Hong Kong stands out as a popular tax haven for small American startups. Its attractive tax system, privacy protections, stable economy, and investment potential make it a compelling choice despite the challenges.

When weighing your company’s needs, take a close look at Hong Kong’s banking options and compare them with setting up a US LLC. Remember, delving into tax havens requires thoughtful planning and consideration.

Editor of Startups #nofilter